The International Monetary Fund (IMF) results show that the gross domestic product of Türkiye is forecast to expand by 3.0% in 2025 and 3.3% in 2026. The revised estimates represent increases of 0.3 and 0.1 percentage points, respectively, compared with the April 2025 estimates.

Türkiye’s economic growth is projected to surpass that of its peers in the emerging and developing markets of Europe, where the regional average for 2025 is 1.8%.

IMF noted that the depreciation of the US dollar, along with improved global financial conditions, is providing additional monetary policy space for emerging markets. In the case of Türkiye—currently experiencing high inflation—this trend could reduce external pressures on interest rate policy and support financial stability.

Following military tensions between Iran and Israel in June, oil prices temporarily surged due to rising risk premiums, despite no physical disruption to supply. The IMF warns that a renewed escalation in the region could increase Türkiye’s energy import costs and place additional pressure on its inflation and external balances.

Natural gas prices have remained high due to the Russian boycott following the war in Ukraine. With LNG reserves in the EU declining and member states still reliant on imported gas, Türkiye could become an attractive market for gas exports.

The IMF revised the global trade volume upward by 0.9% for 2025, but lowered the 2026 forecast by 0.6% due to trade policy uncertainty in the country. Given Türkiye’s strong trade ties with the European Union, and despite risks of a slowdown in the following year, this trend could further boost Türkiye’s growth.

Economic growth in the Middle East and Central Asia is projected to reach 3.4% in 2025. The regional recovery may benefit Türkiye’s exports and deepen its economic partnerships, particularly with Gulf countries.

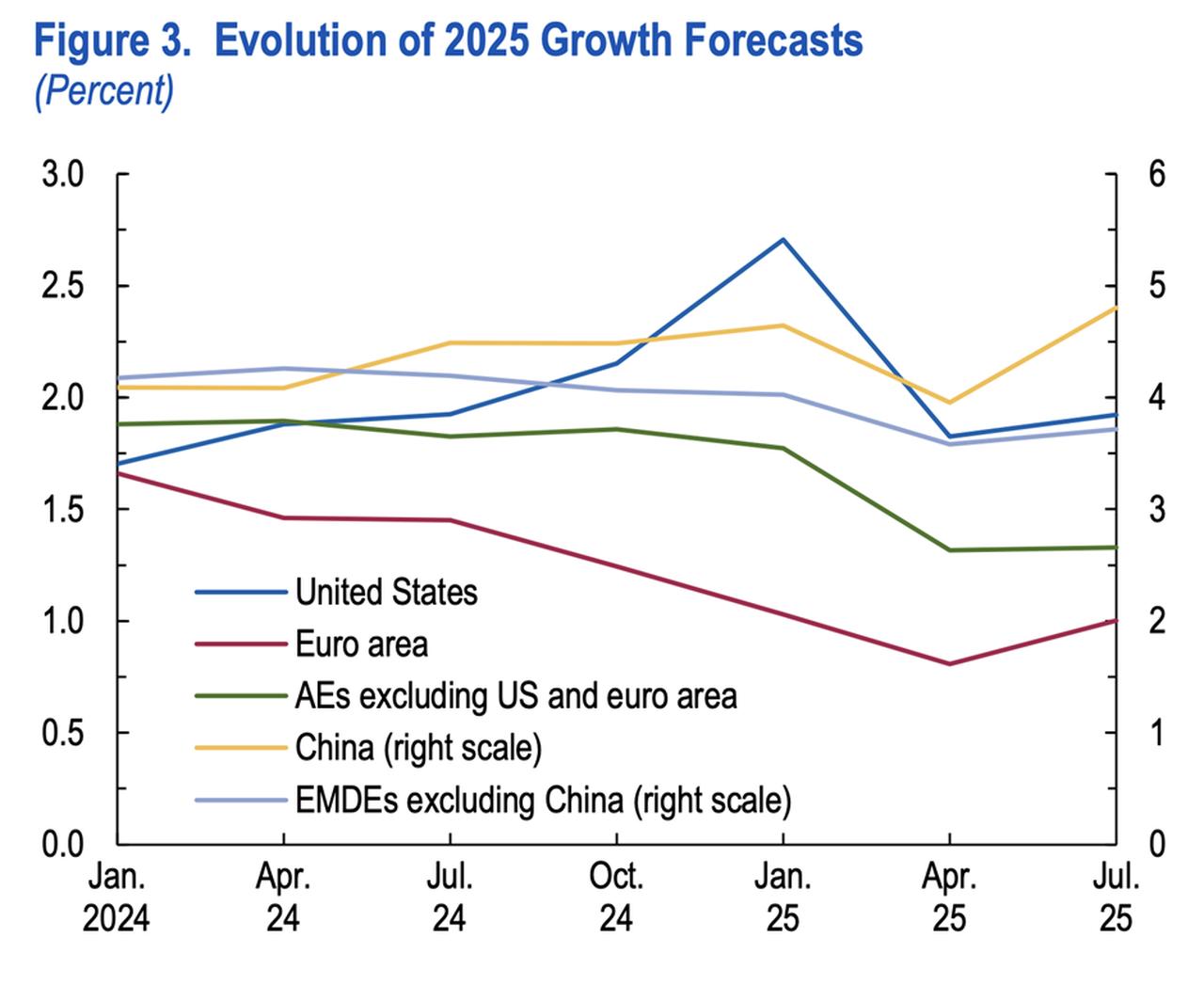

The expected growth rate of the United States is projected to be 1.8% by the end of the year, which is 0.1 percentage point higher than the April 2025 estimate. Growth in the Eurozone will reach 1.0% in 2025 and 1.2% in 2026, driven primarily by robust pharmaceutical sales in Ireland, although Ireland accounts for less than 5% of Eurozone GDP.

Advanced economies are projected to decline slightly to 1.6% in 2025, before rising to 2.1% in 2026. Emerging markets and developing economies will remain resilient, growing 4.1% in 2025 and 4.0% in 2026. China is expected to see a 0.8 percentage point gain, reaching 4.8% growth in 2025, supported by strong first-quarter performance and declining US tariffs.

The Middle East and Central Asia are projected to grow by 3.4% in 2025 and 3.5% in 2026. Emerging and developing Europe, however, will remain weak, growing 1.8% in 2025, and rising to 2.2% in 2026.