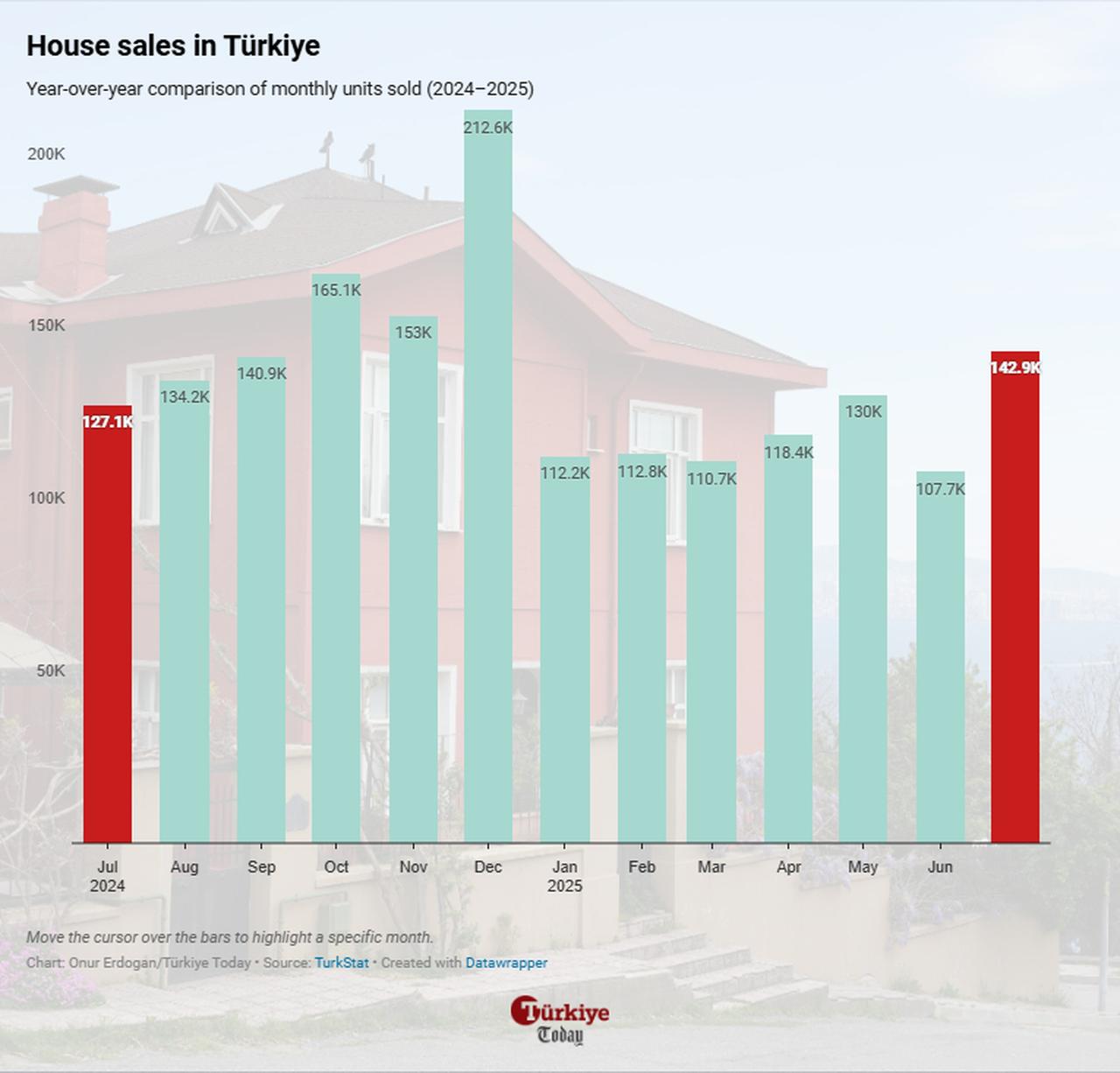

Residential property prices in Türkiye rose by 27.8% in July compared with the same month last year, while strong demand in the housing market extended its growing trend with a 12.4% growth year-over-year to 142,858 units sold.

Total sales grew 24.2% year-on-year during the January–July period, reaching 834,751 transactions, according to the Turkish Statistical Institute's (TurkStat) figures.

The average sale price for residential property across the country reached ₺4.4 million ($107,880) with an average square meter price of ₺33,832 ($818.76), real estate data platform Endeksa’s July 2025 Housing Value Report showed.

The average investment return period for housing, known locally as the payback time or amortization period, was calculated at 13 years.

However, inflation-adjusted figures showed a 4.9% decline, pointing to the key reason behind the surging demand as house prices seem undervalued amid tight monetary conditions.

Among Türkiye’s four largest cities, Ankara recorded the highest price increase, with residential property values up 37.9% year-on-year in nominal terms, and 2.7% higher after adjusting for inflation. The average price per square meter in the capital reached ₺30,060, bringing the average home price to ₺3.9 million.

In Istanbul, home prices rose 27.8% nominally but fell 4.8% in real terms. The city’s average square meter price climbed to ₺51,447, while the average home price stood at ₺5.9 million.

Izmir also recorded a 27.8% nominal increase, but inflation-adjusted figures revealed a 4.8% decline. The average home price there reached ₺5.6 million. Antalya saw a 24.4% nominal increase, yet real prices dropped by 7.4%, with an average home costing ₺4.9 million.

Rent across Türkiye rose 32.8% year-on-year in July and 2.2% from the previous month. However, inflation-adjusted data showed a 1.1% decline compared with last year, while remaining flat month-on-month. The average monthly rent was calculated at ₺23,402, with an average square meter rent of ₺225 ($5.52).

The Turkish central bank will publish July's Residential Property Price Index (RPPI) on August 18, which represents the official figure of developments in the Turkish housing market. In the previous month, the bank said that house prices rose 32.8% year-over-year, with Ankara leading the boom at 42.1%.

In July, the strongest surge came from mortgage-backed sales, which jumped 93.2% compared with the same period last year. Mortgage transactions accounted for 14.6% of all home sales, up from 9.4% in 2024.

Second-hand house sales continued to grow, as it represented 98,874 units, accounting for a 69.2% share of total sales.

Endeksa’s co-founder and general manager, Gorkem Ogut, noted that lower interest rates and new financing campaigns encouraged buyers to return to credit-based purchases. Second-hand property sales grew faster than new homes, reflecting price advantages and broader location options, he added.

While domestic demand strengthened, sales to foreign nationals continued to drop. Home purchases by foreigners fell 18.6% year-on-year in July to 1,913 units, accounting for just 1.3% of total sales.

In the January–July period, foreign sales declined 12.1% compared with last year, totaling 11,267 units. Russian nationals purchased the largest share in July with 315 homes, followed by Iranian buyers with 152 and German buyers with 135.