Türkiye’s disinflation trend extended to the 13th month in June, declining to 35.05%, but it also marked the 68th consecutive month of double-digit inflation.

In other words, persistent inflation has continued to cast a shadow over the Turkish economy for nearly six years, remaining entrenched in categories that have historically seen little fluctuation—even amid tight monetary policies introduced since 2023, with policy rates reaching as high as 50%.

This challenging base has led to an over 86% loss in the value of the Turkish lira as of June, meaning it now takes nearly 7 times more lira to purchase the same goods as in November 2019.

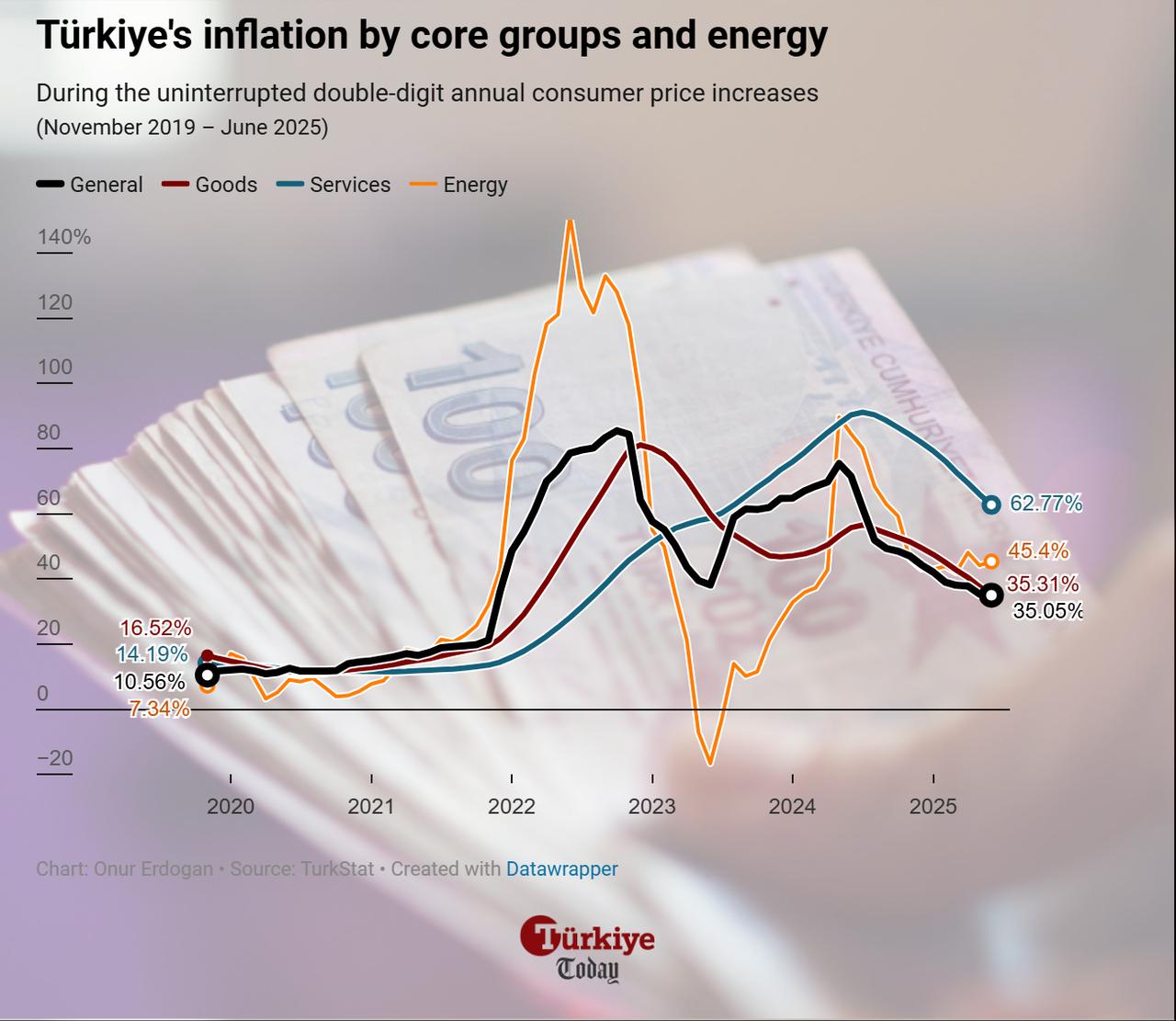

According to the latest official figures, the annual inflation rate has been declining since May 2024’s peak of 75.5%, with core inflation—excluding unprocessed food, energy, alcoholic beverages, tobacco, and gold—standing at 34.62%.

These figures were welcomed by market participants, as they came in better than expected. The median estimate in a Bloomberg survey of economists was 35.3%, which fueled interest rate cut expectations for the Turkish central bank’s July meeting.

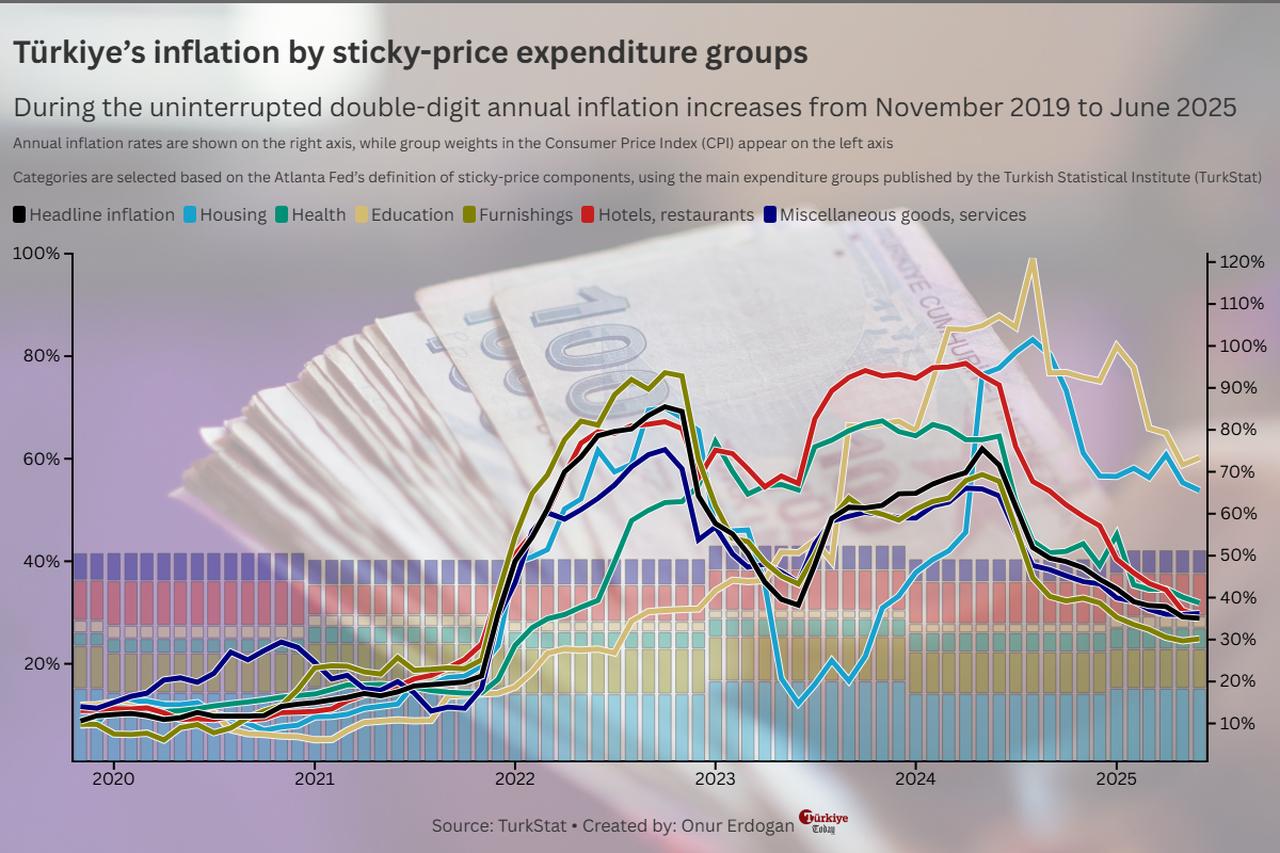

Nevertheless, June’s data confirmed that services inflation remains elevated—particularly in housing, education, and health.

These categories are among the most heavily weighted in the consumer price index and are also key components of sticky inflation, as their prices tend to resist declining even when economic conditions improve due to structural and long-term pricing factors.

Annual consumer price increases in these categories were recorded at 65.54% for housing, 38.70% for health, and 73.33% for education.

Other expenditure groups that are typically less volatile—such as furnishings and household equipment, miscellaneous goods and services, and hotels and restaurants—also remained high at 30.19%, 36.21%, and 35.59%, respectively.

Of these, furnishings was the only category that remained below the headline inflation rate in June.

During this period of persistent double-digit inflation:

In its latest Price Developments Report covering June’s inflation figures, the Turkish central bank also noted these dynamics, emphasizing that energy and services inflation remain elevated.

“Monthly inflation gained strength in the services group, with the standout subitems being transportation services that rose due to the religious holiday and fuel prices, as well as education services and rents. In the core goods group, monthly inflation continued to weaken. In durable consumption goods where exchange rate pass-through is high, items other than white goods posted a relatively limited increase,” the central bank said.

Along with sticky inflation driven by services, energy also continues to play a significant role—both directly and indirectly affecting all expenditure groups—as the central bank emphasized in the same report.

“Recent geopolitical developments had their impact on the energy group. Accordingly, the group’s monthly price increase was mainly driven by fuel prices that strengthened following global events as well as by municipal water prices,” the central bank said.

Türkiye’s energy inflation rose to 45.4% in June from 44.1% in May, while core goods and services groups continued to decline, reaching 35.3% and 62.7%, respectively.

Türkiye, as an energy-dependent country that meets 67.8% of its energy needs through imports, recorded a deficit of over $49 billion in 2024 due to $65 billion in total energy imports, according to the central bank.

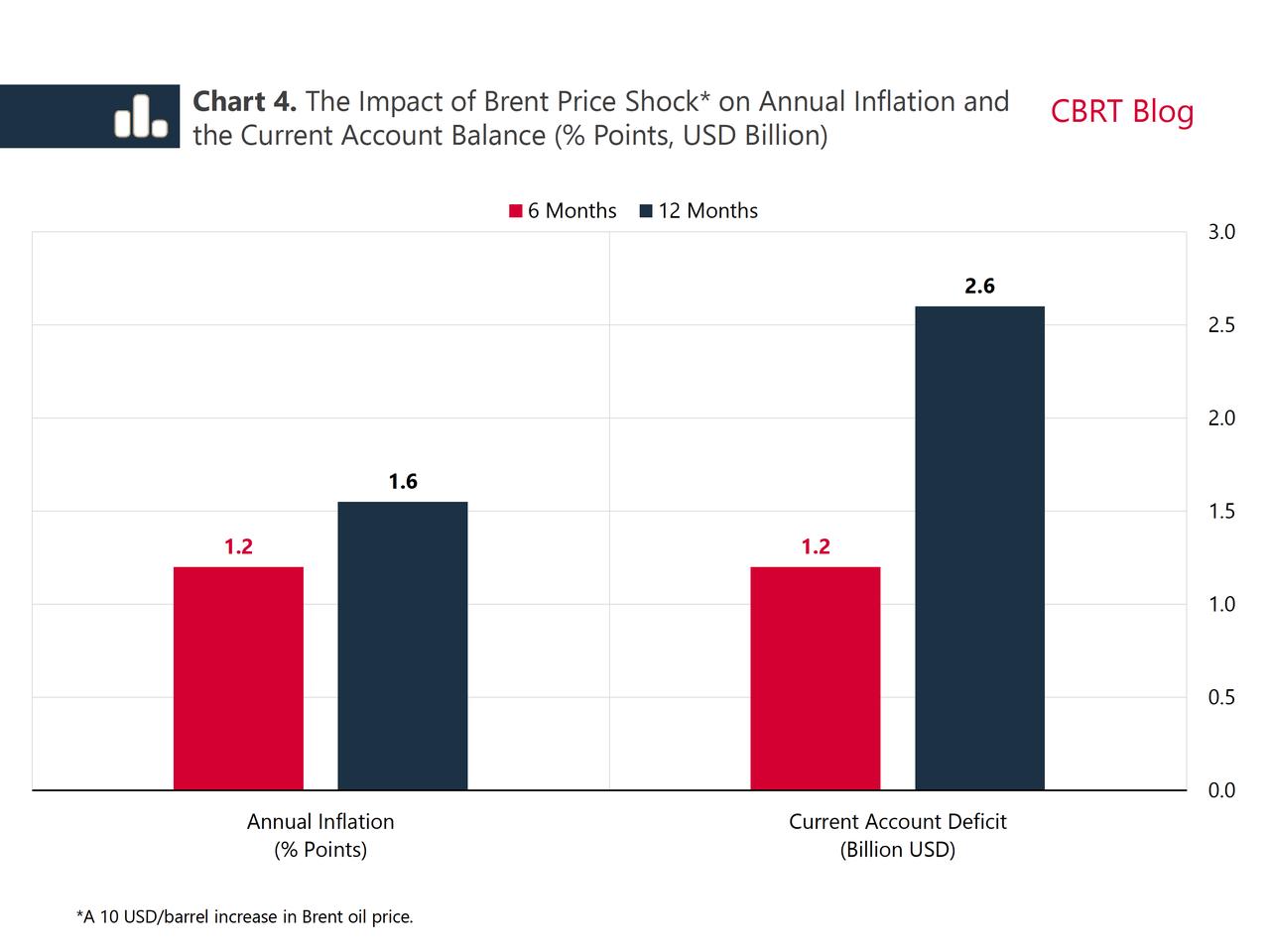

In June, oil prices surpassed $80 per barrel due to global supply fears stemming from the 12-day conflict between Israel and Iran but later retreated to around $60 following a cease-fire.

According to a new study by economists at the Central Bank of the Republic of Türkiye (CBRT), a $10 increase per barrel in crude oil prices is expected to drive headline inflation up by 1.2 percentage points at year-end and 1.6 percentage points over a 12-month horizon, while widening the current account deficit by $1.2 billion and 2.6%, respectively.

The Turkish central bank’s most recent inflation report, released in May, maintained its year-end inflation forecast at 24% and estimated the average oil price for 2025 at $65.8 per barrel.

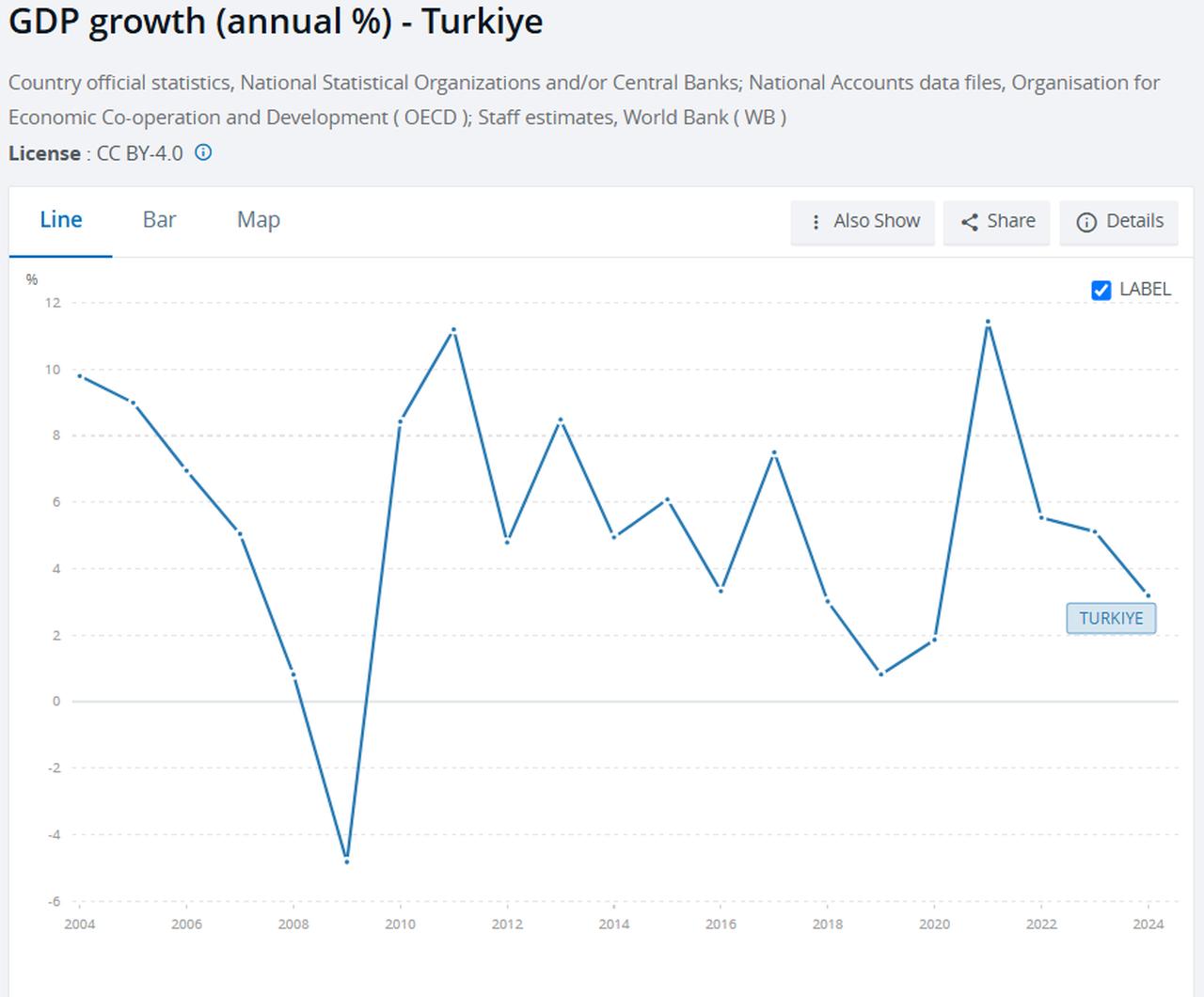

Türkiye has been implementing a disinflation program since 2023 to combat soaring inflation, which peaked at 85.5% in October 2022, maintaining a tight monetary policy with interest rates above 40% since then.

Before 2023, the economic administration followed heterodox policies, abandoning orthodox approaches. It emphasized production, growth, and easy access to financing for businesses.

During that time, the Turkish economy maintained growth for 19 consecutive quarters, most recently 2% in Q1 2025, with the unemployment rate at 8.2%.

According to Turkish economist Mahfi Egilmez, this long-term outlook would be considered a crisis in many developed economies, but in Türkiye, it is not, as policymakers typically prioritize growth and employment.

“Such a rate of inflation would be considered a crisis in developed economies. However, in Türkiye, it is not seen as a crisis,” Egilmez wrote in a blog post in November 2024.

“In Türkiye, a situation is considered a crisis only when growth turns into contraction—because that’s when layoffs begin and unemployment rises.”

This perspective, according to Egilmez, leads to a tolerance of prolonged inflation, as the government seeks to avoid short-term economic shocks that could trigger sudden contractions.

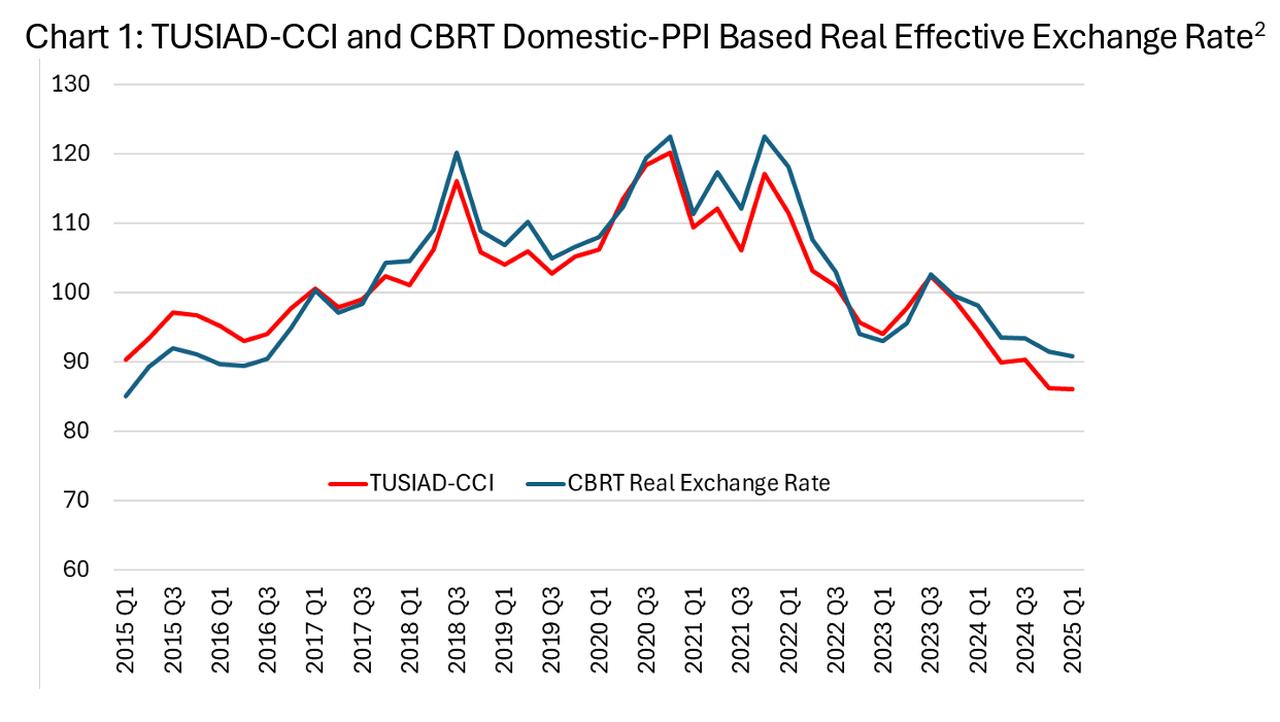

However, the Turkish Industry and Business Association’s (TUSIAD) "Cost-Based Competitiveness Index," which compares Türkiye’s domestic production costs with those of key competitor countries, shows that prolonged inflation is the main factor behind the deterioration of the Turkish economy’s competitiveness—falling to its lowest level in the past decade—further deepening the challenges.

“Depreciation may offer temporary relief, but without structural reforms and inflation control, exporters remain at a disadvantage,” asserted Hakan Kara, former chief economist of the Central Bank of the Republic of Türkiye (CBRT) and academic advisor to the index.

Meanwhile, the Turkish central bank is seemingly preparing to resume interest rate cuts at the next Monetary Policy Committee (MPC) meeting on July 24 to provide relief to the spending-restrained economy.

Estimates for the potential rate cut range between 250 and 350 basis points from the current policy rate of 46%, which was set at the April meeting.

Türkiye’s five-year CDS premium—showing default risk—fell to 280 from 375 in April, while two-year treasury yields for bonds maturing on Feb. 10, 2027, dropped to 37.3% from 44.8%, indicating improved investor confidence and supporting the central bank’s case for rate cuts, as lower values reflect reduced risk and borrowing costs.