Türkiye’s currency has emerged as a focal point in the renewed popularity of carry trade strategies among emerging market investors, as expectations of U.S. Federal Reserve rate cuts weaken the dollar.

The carry trade — borrowing in low-yielding currencies to invest in higher-yielding ones — has gained momentum in recent weeks, lifting demand for the Turkish lira alongside other high-yielding currencies such as the Brazilian real and South African rand.

Bloomberg reported that asset managers, including Neuberger Berman and Aberdeen Group, are increasing exposure to high-yield markets. While the trade delivered double-digit returns earlier this year, it slowed in July as the U.S. dollar index strengthened.

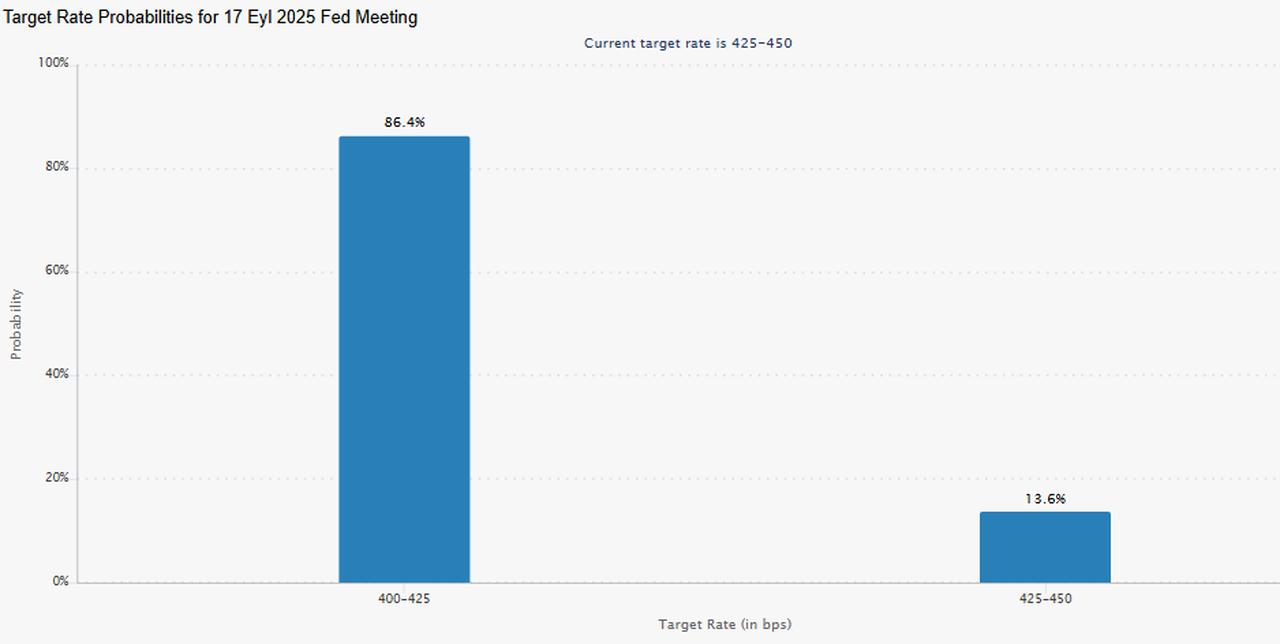

Weaker-than-expected U.S. employment data has since reignited bets that the Fed will reduce borrowing costs to prevent a recession, driving fresh inflows into emerging markets. CME Group's FedWatch Tool, which tracks the probabilities of the U.S. Federal Reserve’s interest rate decisions, shows an 86.4% chance of a 25-basis-point cut in September.

According to Bloomberg’s calculations, the cumulative U.S. dollar-funded real return basket includes long positions in currencies of emerging markets, including the Turkish lira, and stayed above 10% in August, rebounding after slipping below that threshold in July.

With losses in the U.S. Dollar Index exceeding 10%, a potential Federal Reserve rate cut would further lower the cost of borrowing U.S. dollars, making high-yield emerging market currencies more attractive for carry trade strategies.

Gorky Urquieta, co-head of emerging market debt at Neuberger Berman, said the likelihood of a major U.S. dollar rebound is limited, adding that growth conditions remain relatively stable. He noted opportunities in Türkiye, South Africa, Brazil, and other emerging economies.

After three years of outflows, emerging market assets have seen sustained inflows, as global funds dedicated to emerging market debt attracted capital for the fourth consecutive month, reaching $1.7 billion in the week ending August 6, Bank of America reported.

Despite continuing to deliver positive real returns for investors, the Turkish lira has come under renewed selling pressure in the domestic market.

In July, the Central Bank of the Republic of Türkiye (CBRT) lowered its policy rate by 300 basis points to 43%, following a brief period of monetary tightening. The rate cut immediately weighed on the currency, sending it to a record low of 41.9184 against the U.S. dollar in intraday trading.

However, as of August 11, the exchange rate currently hovers around 40.6966, reflecting an over 15% deterioration year-to-date.

U.S. investment bank Morgan Stanley advised investors to exercise caution, pointing to the lira’s faster pace of depreciation and increasingly crowded positions in carry trade strategies. The bank warned that such conditions could amplify volatility if global risk appetite changes or if domestic monetary policy diverges sharply from expectations.

In May, the CBRT sought to reinforce its monetary policy stance by raising reserve requirement ratios on banks’ short-term lira borrowing from abroad. The adjustment was intended to curb reliance on cheaper offshore funding, which can dilute the effectiveness of domestic interest rate settings.

By making foreign-sourced short-term lira loans more costly for banks, the measure aimed to channel funding activity toward the domestic market and improve the transmission of policy changes to credit conditions.

Economists and market analysts estimate carry trade inflows to Türkiye at around $25 billion to $30 billion, as cumulative carry trade volume involving the Turkish lira peaked at $31.4 billion in February, according to business-focused Bloomberg HT.