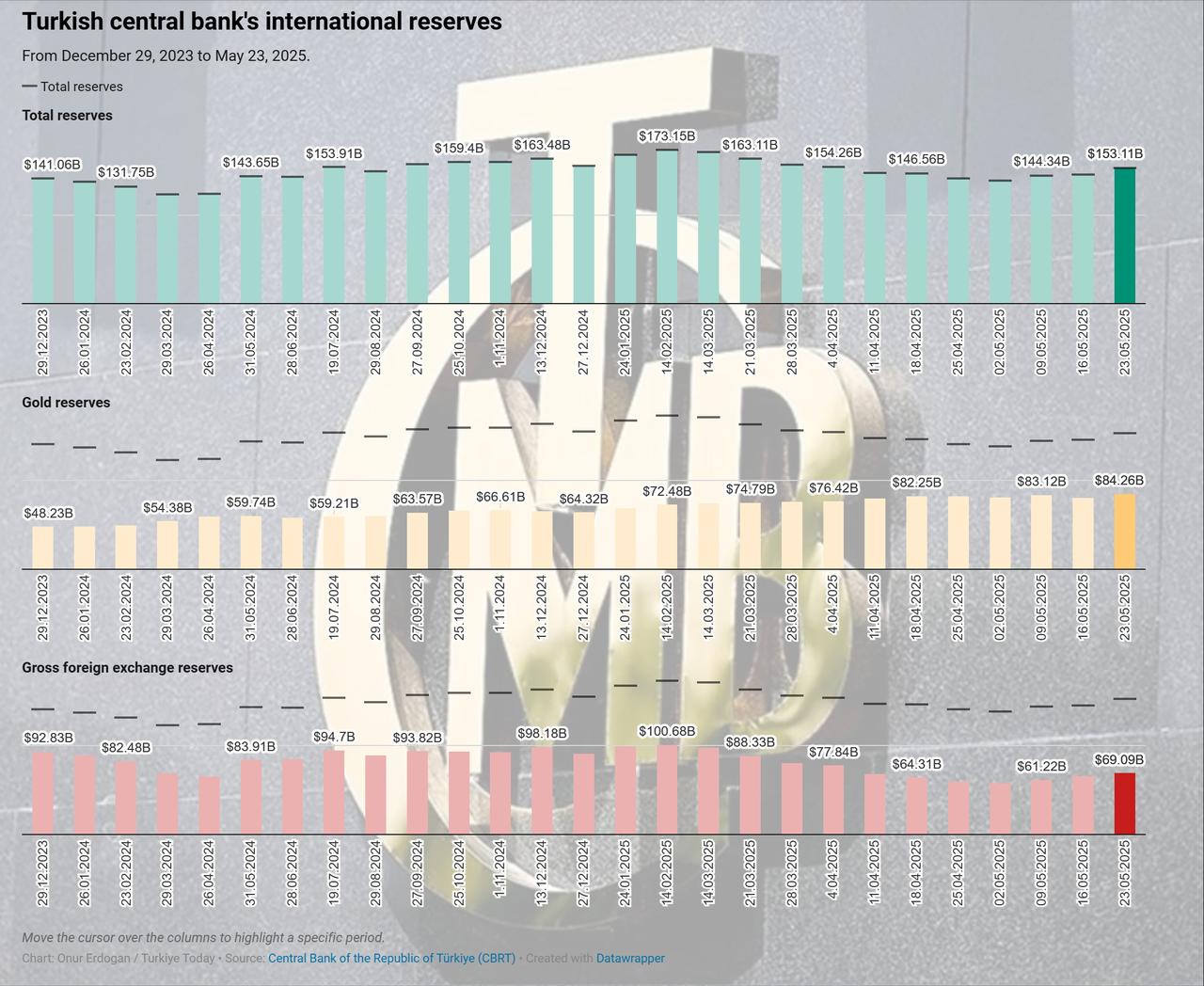

Türkiye’s central bank reserves rose sharply to $153.1 billion in the week ending May 23, bolstered by gains in both foreign currency and gold holdings. The data comes as Goldman Sachs cautions that Türkiye’s recent exchange rate strategy may have made its once-lucrative carry trade more vulnerable.

According to data released by the Central Bank of the Republic of Türkiye (CBRT), total reserves increased by $7.45 billion compared to the previous week, representing one of the most substantial weekly increases this year.

The rise was supported by a $3.69 billion gain in gross foreign exchange reserves, which reached $69.1 billion, and a $3.76 billion boost in gold reserves, which climbed to $84.02 billion.

Net international reserves also saw a notable improvement, rising by nearly $8 billion to $47.97 billion from $39.99 billion a week earlier.

Despite the improvement in reserve levels, analysts at Goldman Sachs warned that the central bank's recent policies may be discouraging foreign capital inflows, particularly those linked to carry trade strategies, where investors borrow in low-interest currencies to invest in higher-yielding assets.

In a research note, Goldman economists Clemens Grafe and Basak Edizgil said that the central bank appears to have allowed the Turkish lira to depreciate more rapidly against the U.S. dollar. They argue that this move could be intended to ease exporter concerns over an overvalued currency and to curb volatile capital inflows.

They added that the central bank may have chosen not to focus on reserve accumulation through carry trade-linked foreign inflows. "The recent depreciation may partly reflect a deliberate policy to keep such capital out," the report noted.

Goldman Sachs expects the central bank to abandon its current foreign exchange policy once it begins a new rate-cut cycle, likely no later than July. The bank described the ongoing approach as an effort to preemptively weaken the lira to avoid significant real appreciation.

Meanwhile, Goldman Sachs highlighted that, although net foreign exchange reserves have declined compared to recent months, they remain significantly healthier than in 2023 when measured appropriately. The bank emphasized that Turkish private sector confidence in saving in Turkish lira remains intact, which continues to support the reserve position.

The report noted that most of the recent reserve losses since March were largely the result of foreign capital outflows. However, Goldman sees limited risk of further declines, citing a smaller current account deficit and already-reduced foreign investor exposure. It also projects that domestic banks will likely remain overfunded, placing continued upward pressure on reserves.

On the other hand, while reserves rose, the week also saw changes in domestic deposit behavior. Residents increased their foreign exchange deposits by nearly $1.5 billion, reaching $193.1 billion. This included a sharp rise in individual deposits, while corporate holdings declined.

On the international front, non-resident investors were net buyers of Turkish government and corporate debt, purchasing $148.4 million in government securities and $191.6 million in nongovernmental sector instruments.

However, their overall equity exposure declined, with the value of foreign-held stocks falling by $706.8 million to $28.71 billion—signaling continued caution toward Turkish equities despite selective interest in fixed-income assets.

The Turkish central bank has been implementing a tight monetary policy since mid-2023 to restore price stability following a surge in inflation, which peaked at 75.5% in May 2024. As of April, inflation had eased to 37.86%. In a surprise move, the central bank raised its policy rate by 350 basis points to 46%, ending a three-month rate-cut cycle.