U.S.-based investment bank Citi issued a buy recommendation for the Turkish lira on Wednesday, ahead of the Turkish central bank’s Monetary Policy Committee meeting on Thursday, where a policy rate cut of at least 250 basis points is widely anticipated.

In a strategy note, Citi emphasized its positioning through a three-month forward short position on the U.S. dollar against the Turkish lira. The bank also reclassified the lira as “overweight” in its model portfolio, reflecting increased confidence in Türkiye’s macroeconomic outlook.

Citi noted that Türkiye's central bank has not only halted its previous trend of reserve depletion but has also resumed accumulating foreign exchange reserves. “The central bank has not only stopped the reserve drain but has also started rebuilding reserves, which we view as a striking development. This is also reflected in the growing tendency to hold local currency deposits,” the note stated.

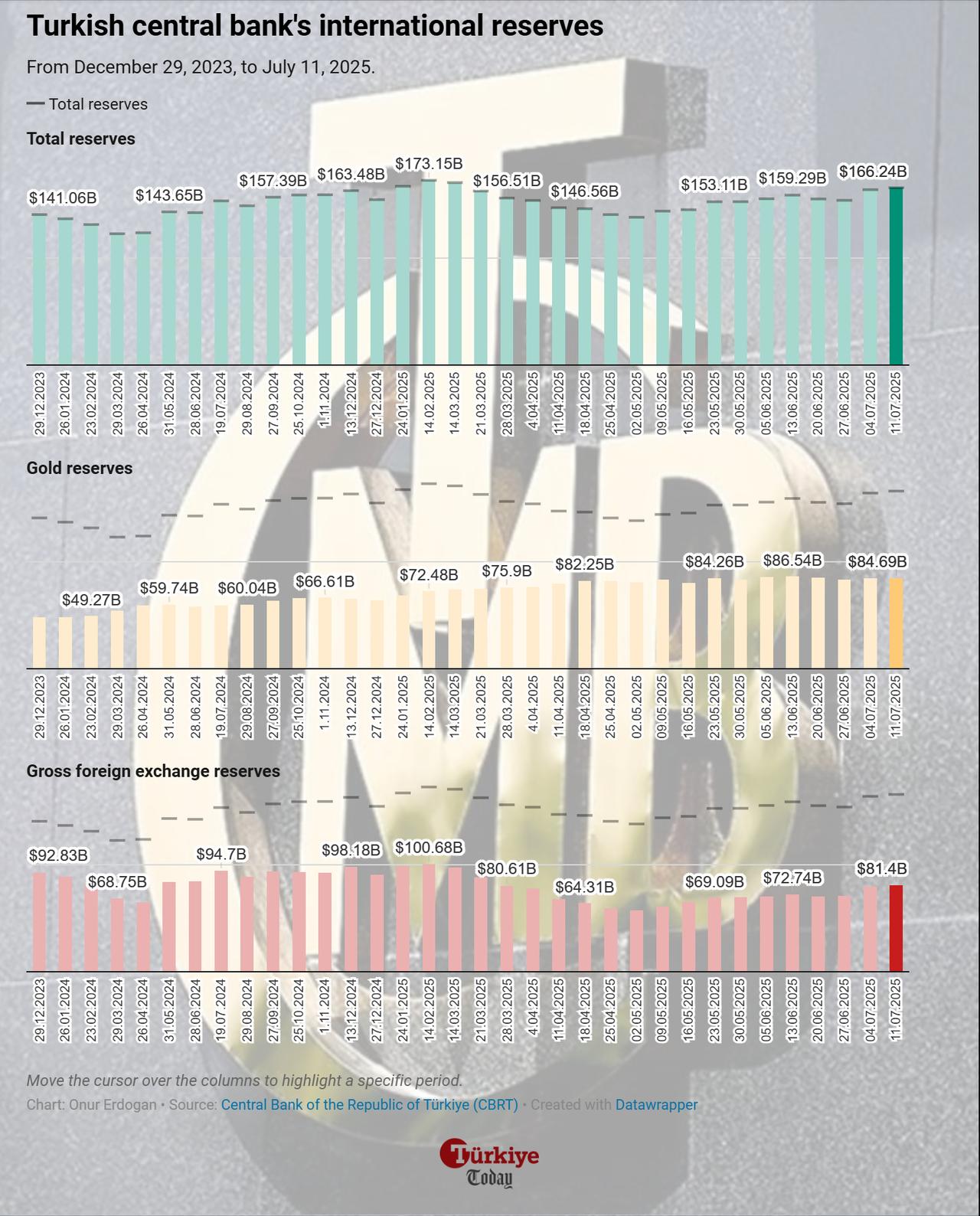

The central bank posted a record-high reserve loss in April, exceeding $25 billion, as it intervened in currency markets to stabilize the lira amid financial volatility. By May 2, total reserves had fallen below $140 billion, while net reserves excluding currency swaps stood at $13.8 billion.

However, the latest data indicates a recovery, with total reserves rising to $166.2 billion in the week ending July 11 and net reserves excluding currency swaps increasing by $5.5 billion to reach $41 billion during the same period.

In addition to Türkiye, Citi’s note also issued positive guidance for Poland’s 10-year local bonds and Egypt’s three-month treasury bills. The strategy indicates a broader tilt toward emerging market assets with improved fiscal dynamics.

In a prior note from November 2024, Omar Hafeez, Citi’s head of North Africa, the Levant, and Central Asia, had warned that despite the shift to orthodox monetary policies, large-scale portfolio inflows into Türkiye remained subdued due to the perceived relative strength of the lira.

As of 1:40 p.m. GMT on July 23, the U.S. dollar was trading at 40.4539 against the Turkish lira. The euro stood at 47.4739, while the British pound was at 54.8045.