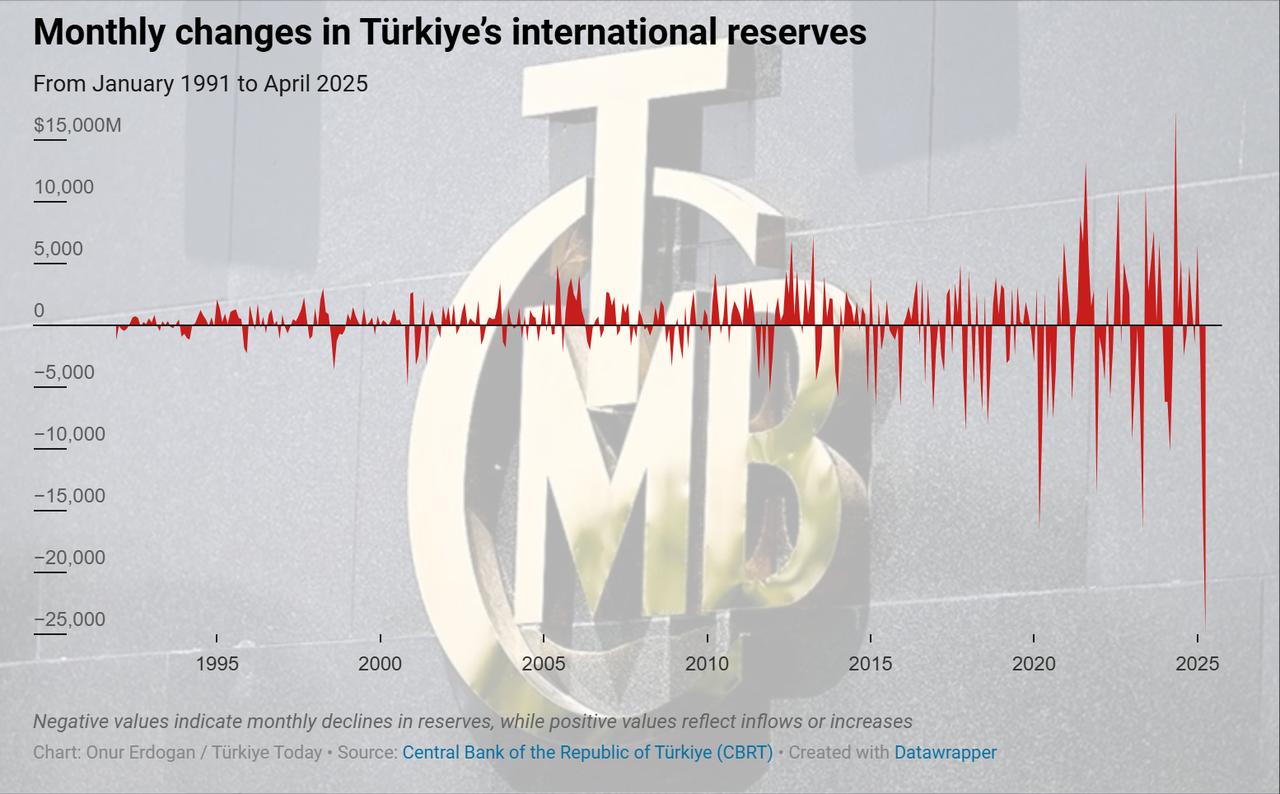

Türkiye's central bank registered the largest monthly reserve loss in its recorded history in April, with a decline of $25 billion.

This steep drop came during a period of heightened political tension and global market volatility that sharply impacted investor sentiment toward Turkish assets.

The sharp drop came amid widespread financial instability triggered by the arrest and removal of then-Istanbul Mayor Ekrem Imamoglu in March, following a corruption investigation.

The political fallout shook investor confidence and accelerated capital outflows, further straining Türkiye’s reserve position throughout March and April.

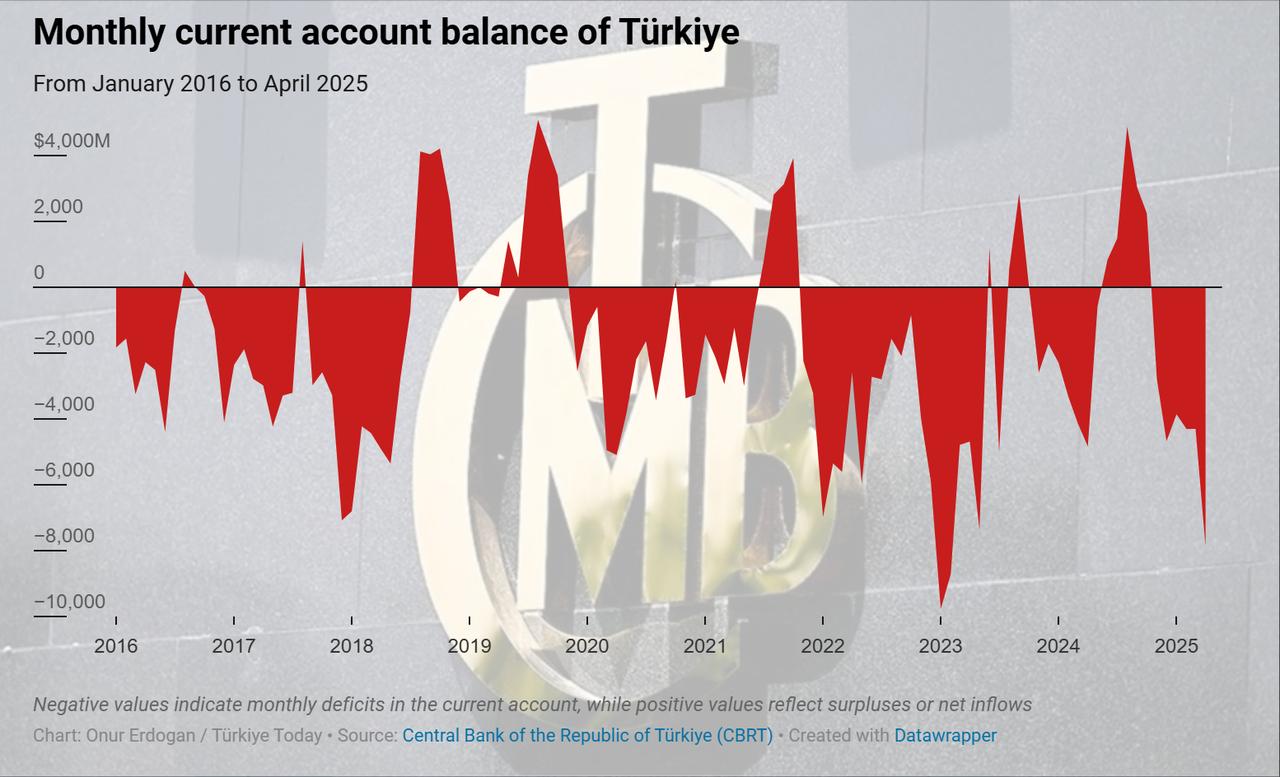

According to the Turkish central bank's balance of payments statistics for April, this loss in reserves was also reflected in Türkiye’s current account deficit, which widened to $7.86 billion, surpassing economists’ expectations of a $7.5 billion shortfall, according to a Bloomberg survey. This marked the highest monthly current account deficit since February 2023.

The deficit, excluding gold and energy, stood at $1.94 billion, while the trade deficit—calculated under the balance of payments framework—reached $9.89 billion for the month.

On a 12-month rolling basis, the current account gap was $15.8 billion, and the trade deficit under the same methodology widened to $60.4 billion.

The services balance continued to offset part of this pressure, generating a $62 billion surplus. Meanwhile, the primary income balance registered a $17.3 billion deficit, while the secondary income balance showed a more modest $188 million shortfall.

In terms of financing, net foreign direct investment contributed $4.3 billion, while portfolio inflows totaled $0.8 billion. Loan inflows added $25 billion, supported by $3.8 billion from trade credits. However, these inflows were offset by $17.1 billion in outflows from net cash and deposit positions, deepening the pressure on reserves.

To curb heightened demand for foreign currency and stabilize the lira, the Turkish central bank reportedly sold around $60 billion in reserves during the March-April period.

These interventions aimed to reassure markets and dampen inflation expectations, as the country’s economic authorities continued efforts to manage persistent price pressures.

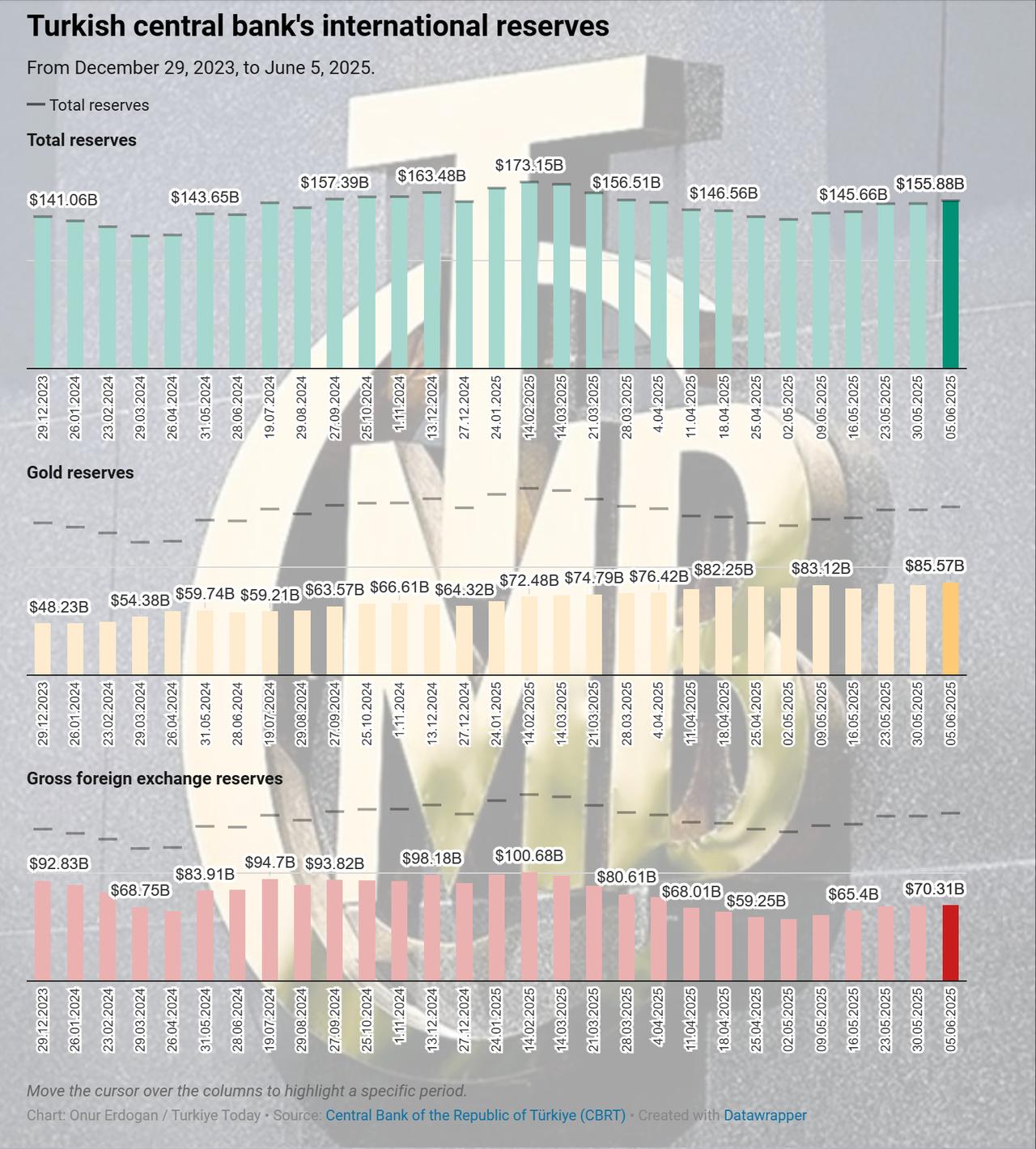

As a result, total international reserves dropped to $140 billion by May, while net reserves fell below the $20 billion threshold—a level widely considered to be critically low.

Net reserves refer to total reserve assets after subtracting liabilities such as swap agreements and short-term obligations. They are often used as a key gauge of a country’s ability to weather external shocks.

At the same time, a global market downturn in April further compounded the strain. Following U.S. President Donald Trump’s announcement of reciprocal tariffs on major trade partners—including the EU and China—investors pulled back from emerging markets.

This shift toward safe-haven assets led to additional capital outflows, with Türkiye’s bond and equity markets reportedly losing nearly $20 billion during the period.

However, following the initial shock, Türkiye’s reserve position began to recover in tandem with easing political tensions. The turnaround gained momentum after the central bank unexpectedly raised the policy rate to 46% in April, helping to restore investor confidence.

In addition, the central bank tightened liquidity by shifting to the overnight lending rate as the main funding tool while reducing repo auctions, aiming to contain the depreciation of the Turkish lira.

By early June, total international reserves climbed to $155.9 billion, while net reserves rebounded to $52.2 billion, marking a partial reversal of the earlier losses.