The European Central Bank (ECB) cut its key deposit rate by 25 basis points to 2% on Thursday, marking its 8th interest rate reduction since June of last year. The move, widely expected by markets, comes as inflation moderates and trade tensions with the United States cast a shadow over the eurozone’s economic outlook.

With eurozone inflation reaching 1.9% in May—just below the ECB’s 2% target—the central bank revised its inflation forecast downward and dropped previous language suggesting inflation was “on track,” instead saying it had reached the target. This change, paired with a more cautious tone, fuels speculation that the ECB may pause its rate-cutting cycle.

ECB President Christine Lagarde described the bank’s current stance as being in a “good place” to manage global economic uncertainty. She refrained from confirming whether cuts would be paused at the July meeting but stated, “We are in a good position to navigate the uncertain conditions that will be coming up,” adding, “I think we are getting to the end of a monetary policy cycle.”

The ECB's decision coincides with escalating trade tensions between the United States and Europe. U.S. President Donald Trump has imposed a series of tariffs on EU goods, including a recent move to double tariffs on aluminium and steel from 25% to 50%. The EU already faces a 10% “baseline” tariff, along with sector-specific duties.

Trump’s tariff policy, aimed at reshoring U.S. manufacturing, has introduced new risks for European exporters and consumer prices. The ECB warned that a “severe” trade war could cost the eurozone one percentage point of economic growth between 2025 and 2027.

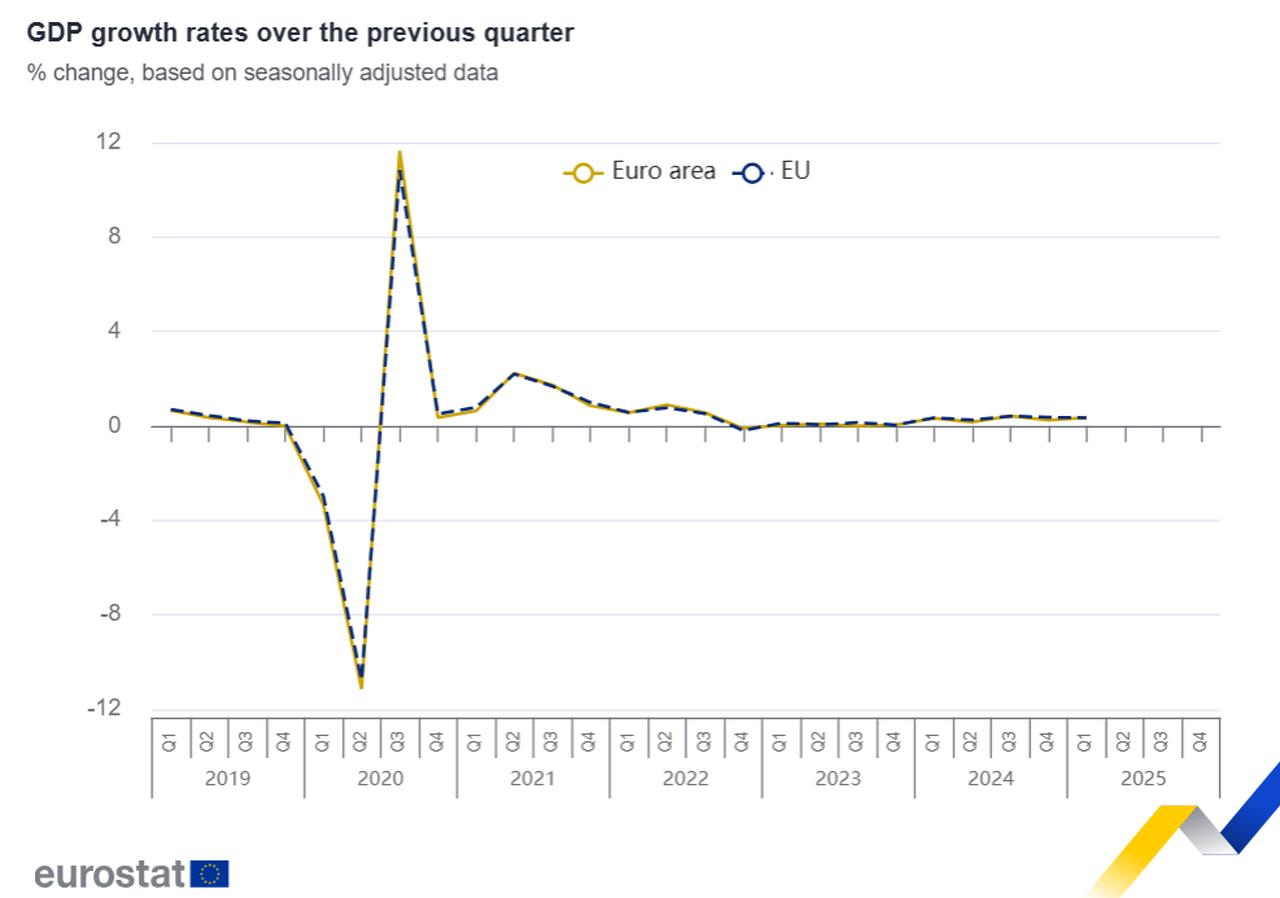

Despite global headwinds, the ECB maintained its growth forecast for 2025 at 0.9% and cited early signs of resilience in the eurozone economy. Lagarde also noted the potential for economic stimulus from upcoming infrastructure and defense spending, particularly in Germany.

While lower inflation and tepid growth have supported the ECB’s easing cycle, factors such as a stronger euro, redirected low-cost goods from tariff-hit China, and potentially lower energy prices continue to complicate the outlook.

Following speculation that she might leave her post early to lead the World Economic Forum (WEF), Lagarde pledged to complete her term as ECB president. Speaking at the press conference following the rate decision, she said, “I am fully determined to carry out my mission and complete my mandate.”

The Financial Times recently reported that WEF founder Klaus Schwab had discussed shortening his term to hand over leadership to Lagarde. The WEF is best known for its annual meetings in Davos, Switzerland.

Lagarde has previously left a position before the end of her term, stepping down as managing director of the International Monetary Fund in 2019 to take up her current role in Frankfurt.