Inflation in the eurozone declined in May to 1.9%, its lowest level in eight months, falling below the European Central Bank’s (ECB) official 2% target and further reinforcing expectations for another interest rate cut at this week’s policy meeting.

According to Eurostat, annual consumer price growth in the 20-member currency bloc slowed to 1.9% in May, down from 2.2% in April. The figure came in lower than predicted by analysts surveyed by FactSet and marked the first time inflation fell below the ECB’s 2% target since September 2023.

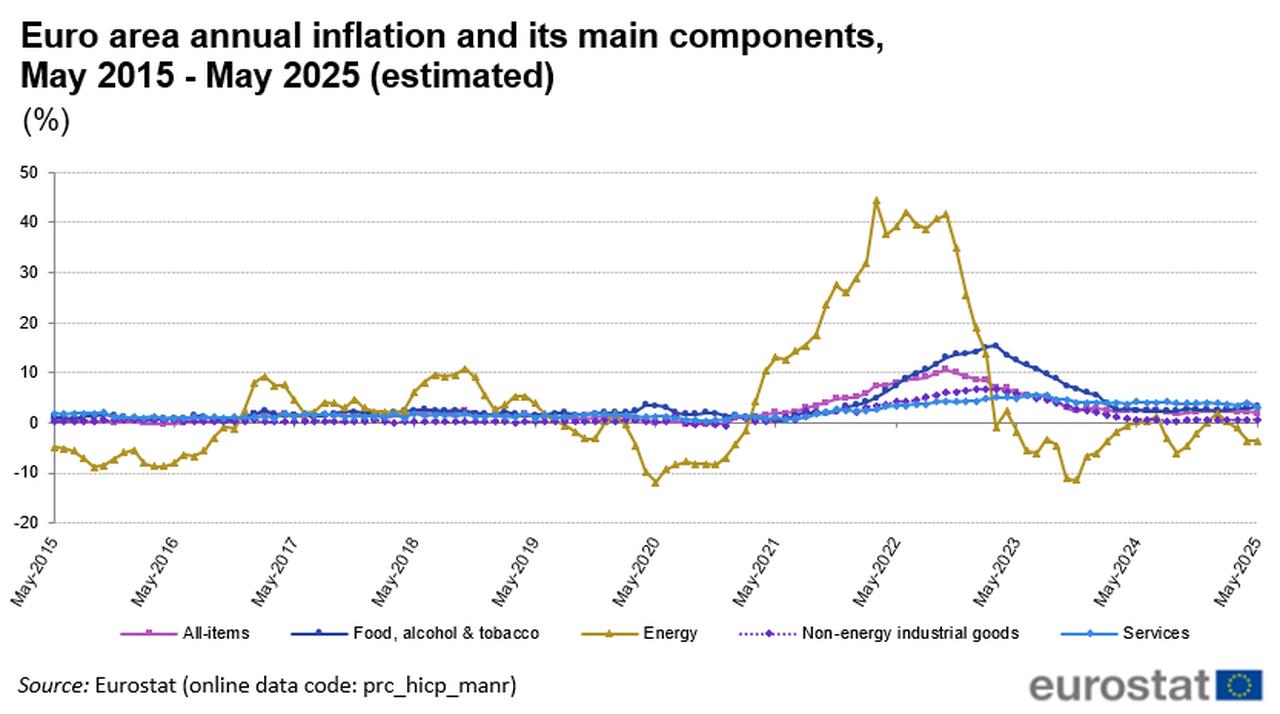

Core inflation, which excludes volatile items such as energy, food, alcohol, and tobacco and is closely watched by the ECB, also dropped more than expected. It eased to 2.3% in May from 2.7% in April, suggesting underlying price pressures continue to moderate. One of the key contributors to the decline was a slowdown in service-sector prices, which fell to an annual increase of 3.2% from 4% in the previous month.

Germany, the eurozone’s largest economy, recorded a 2.1% inflation rate in May, while France saw a sharper slowdown to just 0.6%. Energy prices remained in deflationary territory, with a negative annual rate of 3.6%, unchanged from April. However, food-price inflation picked up slightly to 3.3%, from 3% in the previous month.

The European Central Bank is widely expected to deliver a 25 basis point rate cut at its monetary policy meeting on Thursday, which would mark its seventh consecutive reduction.

Despite modest growth of 0.3% in the first quarter of 2025, the eurozone economy continues to face headwinds from external trade tensions. The outlook remains clouded by the United States’ unpredictable trade measures, led by President Donald Trump.

While a proposed 50% tariff on European Union goods has been delayed until July 9 pending further negotiations, several duties are still in place. These include a 10% general levy on EU exports and existing 25% tariffs on steel, aluminium, and automobiles. Trump now plans to raise duties on steel and aluminium to 50%, adding further uncertainty to transatlantic trade relations.