The European Central Bank (ECB) held interest rates steady on Thursday, ending a series of consecutive cuts that had been in place since September 2024 and kept the benchmark deposit rate unchanged at 2%.

In a statement following the meeting of the policymakers, the bank referred to intensifying global uncertainties, most particularly due to U.S. President Donald Trump's protectionist policies.

The decline in inflation in the Eurozone from the double-digit peaks reached at the end of 2022 led to a rapid drop in borrowing costs for businesses and households in the region. This development paved the way for interest rate cuts by the European Central Bank.

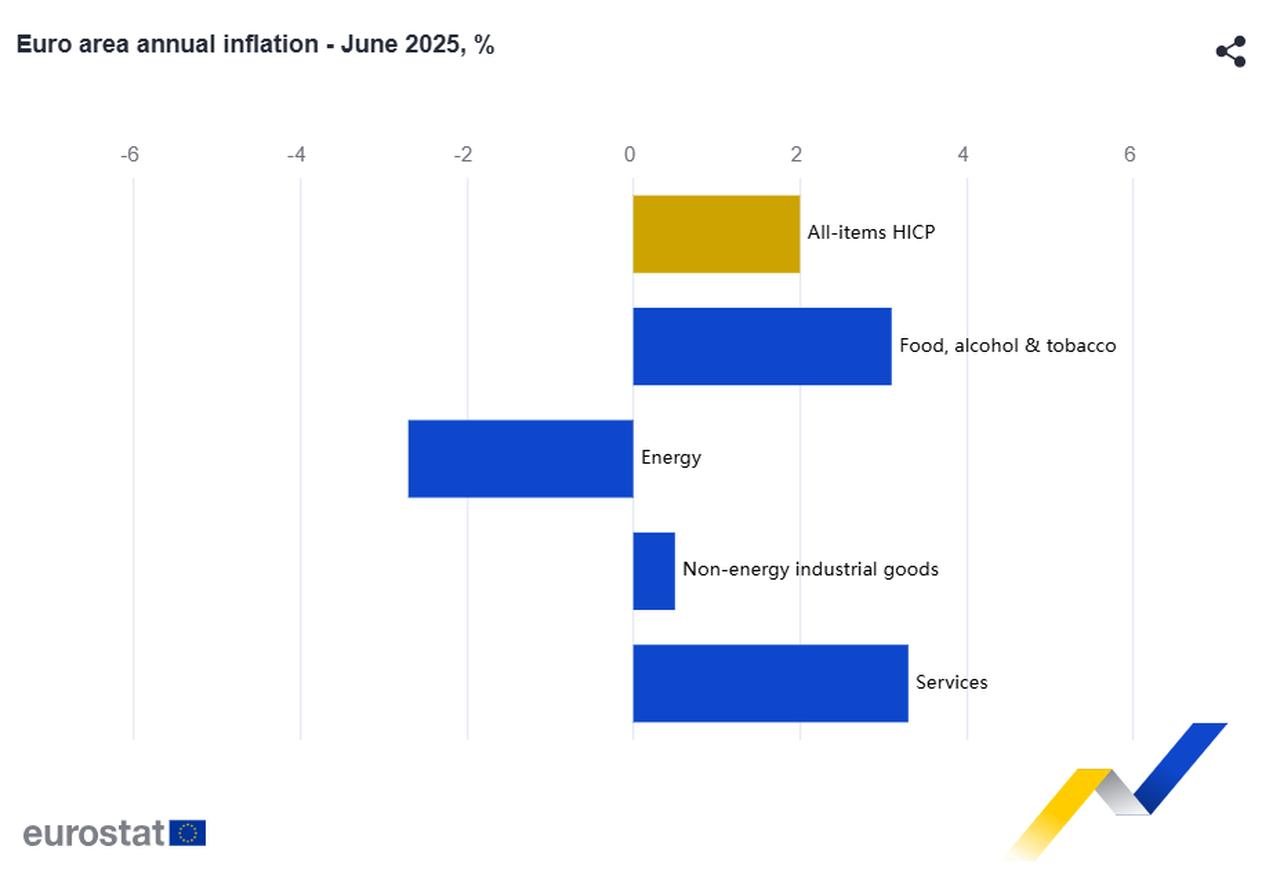

In June, consumer prices in the Eurozone rose by 2% year-over-year, reaching a level fully in line with the ECB's inflation target. While the easing of price pressures has made it easier for the ECB to lower its policy rates, concerns about the region's economic outlook have begun to grow.

The European Central Bank highlighted that the environment was “exceptionally uncertain,” particularly due to ongoing trade tensions.

U.S. President Donald Trump had set August 1 as the deadline for imposing a 30% tariff on products imported from the European Union. However, significant progress has been made in negotiations between the parties.

A European Commission spokesperson said on Thursday that a trade agreement with the U.S. was “close.” Before the statement, European diplomats reported that the U.S. had proposed a general 15% tariff.

According to UniCredit's analysis, the ECB will wait for the outcome of a potential trade agreement and seek “greater clarity” on developments before taking its next step.

Dirk Schumacher, chief economist at German public bank KfW, said that the latest economic and inflation data show that the European Central Bank (ECB) does not need to make any urgent policy changes. Schumacher commented, “Neither the economic data nor the latest data on price dynamics require an urgent response from the ECB.”

In June, inflation in the Eurozone reached the ECB's target of 2%. Positive economic indicators, including an increase in factory production, signaled that the region's economy was showing signs of recovery.

However, according to Berenberg analyst Felix Schmidt, potential political developments in the U.S. could open the door to new risks. Schmidt said that if Donald Trump returns to office and imposes harsh tariffs, the ECB will want to “keep some powder dry for emergencies.”

Schmidt warned, “An escalation of trade disputes could have serious negative effects on the Eurozone economy. This could force the ECB to make additional interest rate cuts.”

Amid growing uncertainty over tariffs, the euro's strengthening against the dollar is also noteworthy. The euro has gained approximately 14% against the dollar since the beginning of the year. This situation is explained by investors moving away from US assets in response to Trump's aggressive policies and criticism of the U.S. Federal Reserve. This volatility in the exchange rate could prompt the ECB to adopt a more cautious stance in its monetary policy.

The strengthening of the euro is making imports cheaper, which could put further downward pressure on inflation in the region. The European Central Bank (ECB) expects inflation to fall to 1.6% in 2026 and return to its target level in 2027.

According to ING Bank analyst Carsten Brzeski, while the July meeting was generally calm, concerns about the euro's rise may be questioned more by policymakers. Brzeski said, “Concerns about currency movements may not be reflected in official statements, but they may pave the way for a more dovish tone.”