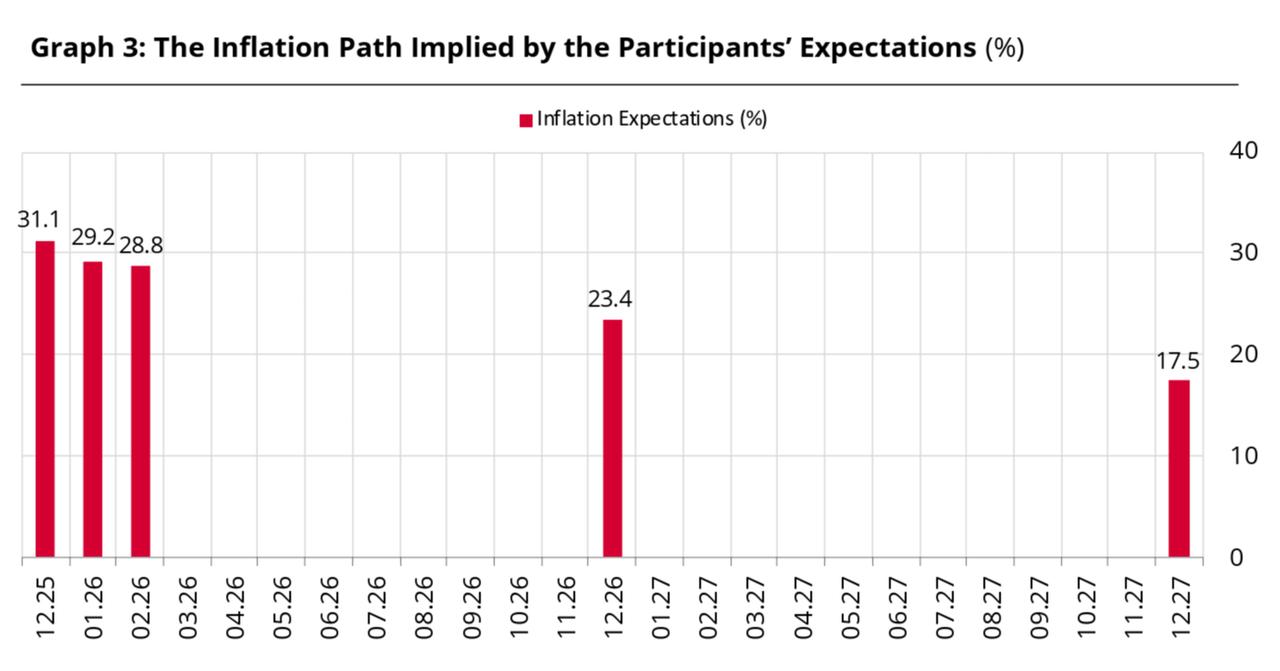

The Turkish market lowered its December inflation forecast to 1.08% from 1.16%, implying a year-end headline inflation of around 31.17% for 2025, down from the previous estimate of 32.2%, the Central Bank of the Republic of Türkiye’s (CBRT) latest survey showed.

According to the December Survey of Market Participants, the policy rate forecast for the next Monetary Policy Committee (MPC) meeting in January was 37%, implying a 100-basis-point cut.

The survey saw a modest decline in medium-term inflation expectations, with the 12-month projection falling to 23.35% from 23.49% and the 24-month estimate easing to 17.45% from 17.69%.

For the second Monetary Policy Committee meeting of 2026 in March, participants expect the policy rate to be cut to 35.55%, which would mean a reduction of around 150 basis points. The 12-month policy rate forecast also fell to 28.15%.

Türkiye's inflation eased to 31.07% in November, with monthly inflation at 0.87%, the lowest since mid-2023, as the central bank continued its easing cycle on Thursday by delivering a 150-basis-point cut in the final Monetary Policy Committee meeting of 2025, bringing the policy rate to 38%.

Participants also revised their year-end USD/TRY forecast down to 43.0587 from 43.4245, while the 12-month ahead exchange rate expectation rose to 51.0809 from 50.6169. As of Friday’s close, the rate stands at 42.6787.

The year-end current account deficit forecast for 2025 rose to $21.3 billion from $20.9 billion in the previous survey period, while the projection for the following year increased to $25.2 billion from $24.3 billion.

Türkiye's current account deficit slightly declined to around $20 billion in October and now accounts for 1.32% of gross domestic product (GDP).

The survey also indicated that GDP growth expectations rose to 3.5% for 2025 and 3.9% for the following year. In the third quarter of 2025, Türkiye’s GDP growth slowed to 3.7% year-over-year, down from 4.9% in the previous quarter.