Global markets surged further a day after the tariff truce between the U.S. and China, as most Asian stocks opened the Tuesday session with major gains, reflecting growing optimism across markets that the world’s two largest economies may opt out of a trade war.

Japan's benchmark Nikkei 225 was up more than 1% along with Taipei, while Shanghai, Sydney, Singapore, Seoul, Wellington, and Manila also posted solid gains. However, Hong Kong dropped more than 1%, following a 3% surge the day before.

The price of gold per ounce, which fell 1.7% on Monday to close at $3,235 amid expectations that trade tensions would ease, gained 0.6% in the new trading day and was trading at $3,254.

Brent crude, which rose 1.6% Monday on expectations of increased global trade activity and a possible revival in manufacturing, was trading at $64.6 per barrel as of 06:23 a.m., down 0.3%.

Equity markets across the world rallied Monday as the U.S. and China clinched a deal to slash most of their eye-watering tit-for-tat levies and hold talks to end a standoff that has stoked recession fears.

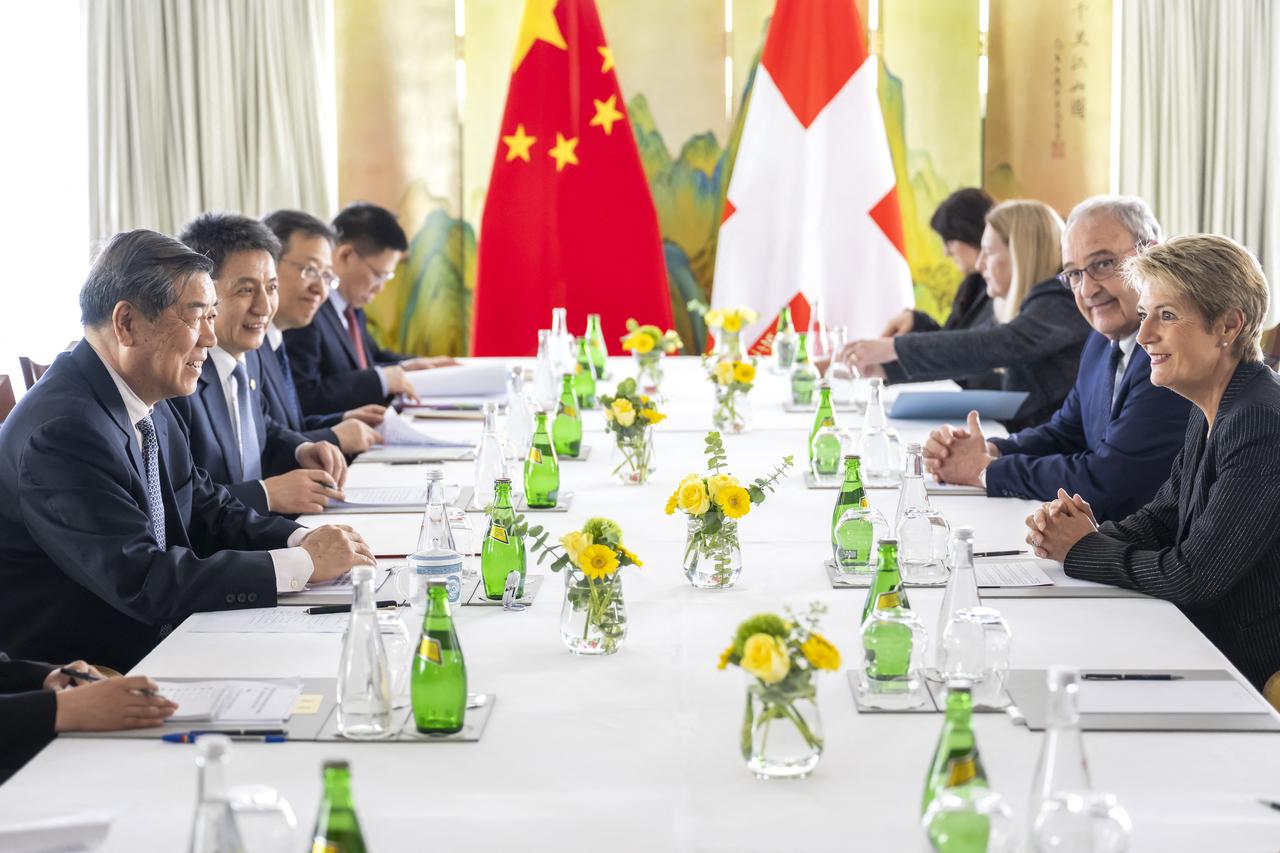

Top-level negotiators said after two days of talks in Geneva over the weekend that the United States would reduce its 145% duties on China to 30% for 90 days, while Beijing would cut its retaliatory measures to 10% from 125%.

The U.S. president described the move as a "total reset" and said talks with counterpart Xi Jinping could soon follow, while U.S. Treasury Secretary Scott Bessent told CNBC he expected officials would meet again in the coming weeks to reach "a more fulsome agreement".

Following the announcement, on the New York Stock Exchange, the S&P 500 index, which tracks the performance of 500 large-cap U.S. companies, rose 3.26%, while the Dow Jones Industrial Average, a price-weighted index of 30 major U.S. corporations, gained 2.81%.

The Nasdaq Composite, heavily weighted toward technology and growth stocks, surged 4.35% on Monday. Meanwhile, the VIX Index—commonly known as the “fear index” for its measure of expected volatility in the S&P 500—fell 17% to 18.2, returning to levels last seen before U.S. President Donald Trump’s announcement of reciprocal tariffs on April 2.

Following the announcement of the deal, shares of companies heavily reliant on Chinese imports within their supply chains, along with chipmakers, drew attention with notable gains. Amazon shares rose by over 8%, Dell by nearly 8%, Best Buy by 6.6%, and Apple by 6.3%. Chipmaker Nvidia also saw its shares rise by 5.4%.

In U.S. bond markets, investor appetite for riskier assets led to a wave of selling. The yield on 10-year U.S. Treasuries rose by seven basis points to 4.46%. The dollar index, which strengthened following the tariff cut and conciliatory messages from both sides, rose 1.3% Monday to close at 101.7, though it declined slightly by 0.1% in early Tuesday trading to 101.6.

Meanwhile, Türkiye’s benchmark stock index, the BIST 100, ended Monday at 9,747.07 points, marking a 3.8% rise from the previous close. The index began the week at 9,611.21 and advanced by 356.56 points compared to Friday’s session.