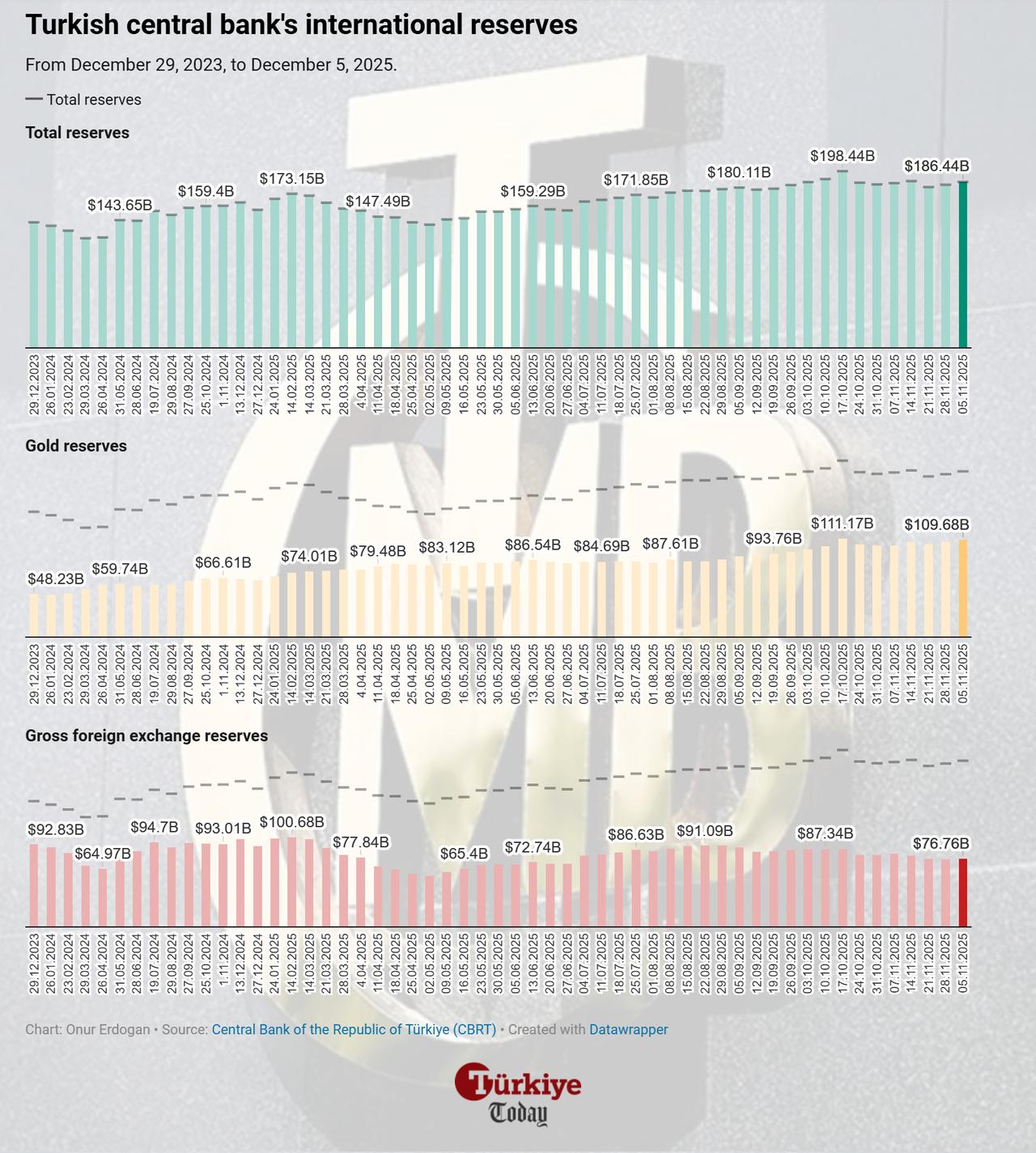

The Central Bank of the Republic of Türkiye (CBRT) increased its total reserves to $186.44 billion in the week ending December 5, with a $3.2 billion increase from the previous week.

The growth was driven by simultaneous increases in both foreign exchange and gold holdings, as gross foreign currency reserves rose by $1.15 billion to $76.76 billion, while gold reserves—supported by rising spot prices—advanced by $2.05 billion to $109.68 billion.

Net international reserves excluding swaps, widely watched as a gauge of underlying reserve strength, rose from $57.7 billion to $62 billion.

Foreign portfolio investors added $154.3 million in Turkish equities during the reporting week while reducing their exposure to government domestic debt securities, known as GDSs, by $23.7 million. In addition, non-resident investors purchased $108.4 million worth of securities issued by sectors outside the general government.

Total foreign-held equity positions rose from $31.47 billion to $31.96 billion. Their GDS holdings also grew slightly to $17.48 billion, while other security holdings stood at $654.3 million.

Total deposits held within Türkiye’s banking sector declined by approximately ₺441 billion ($10.34 billion) in the week ending December 5, settling at ₺26.81 trillion ($629.11 billion).

Foreign currency deposits stood at $249.42 billion, with $212.07 billion held by domestic residents. This represented a week-on-week decrease of $2.04 billion in foreign currency accounts held by residents.

At the same time, domestic consumer credit rose by 0.3%, bringing the total value of household loans to ₺5.43 trillion ($127.41 billion).