Türkiye's Treasury and Finance Minister Mehmet Simsek says the country is moving steadily toward macroeconomic stability, though short-term challenges for the real sector persist.

“Even the simplest treatment comes with pain,” Simsek remarked during a live broadcast on Thursday, urging businesses to stay the course as tight monetary and fiscal measures begin to bear fruit.

While acknowledging sector-specific struggles, Simsek defended the tight stance. “The only way to ensure access to affordable financing in the long run is by reducing inflation,” he said. “By 2026, the real sector’s access to finance will improve, and uncertainty will decline.”

“We are providing strong support to the real sector. Around ₺2 trillion ($50.85 billion) — roughly the size of the budget deficit — is being allocated for this purpose,” he added.

Explaining the sources of business hardship, he said that some of it is linked to where these sectors stand in the global value chain, some to the international environment, and some to side effects of the program. He cited weak growth in the EU and structural shifts in global trade, adding that Türkiye's largest trade partner is not growing, and when that happens, it becomes necessary to capture a larger share of the market to increase exports.

He also referenced China’s rapid global expansion, noting that China’s share in global exports rose from 0.8% in 1980 to over 20% today, while its share in global manufacturing exceeds 30%. He added that countries like the U.S. and Japan lost ground.

Simsek emphasized ongoing financial support for exporters, small businesses, and farmers. “Last year, we issued $49 billion in low-interest export credits. About 83% of that went to SMEs. That’s 18,000 companies,” he said. “The state covers 50% of the interest paid by small businesses and 70% of what farmers pay. Exporters also benefit from subsidized rates.”

He noted that credit is provided through the Central Bank and Eximbank, with guarantees from the Treasury. “You need to find funding before you offer incentives,” he remarked.

Simsek said the government’s main goal is to bring inflation to single digits on a permanent basis. “The program is delivering results broadly as I had anticipated. The primary objective is to bring inflation down permanently to single digits,” he noted. “Inflation is coming down and will continue to do so.”

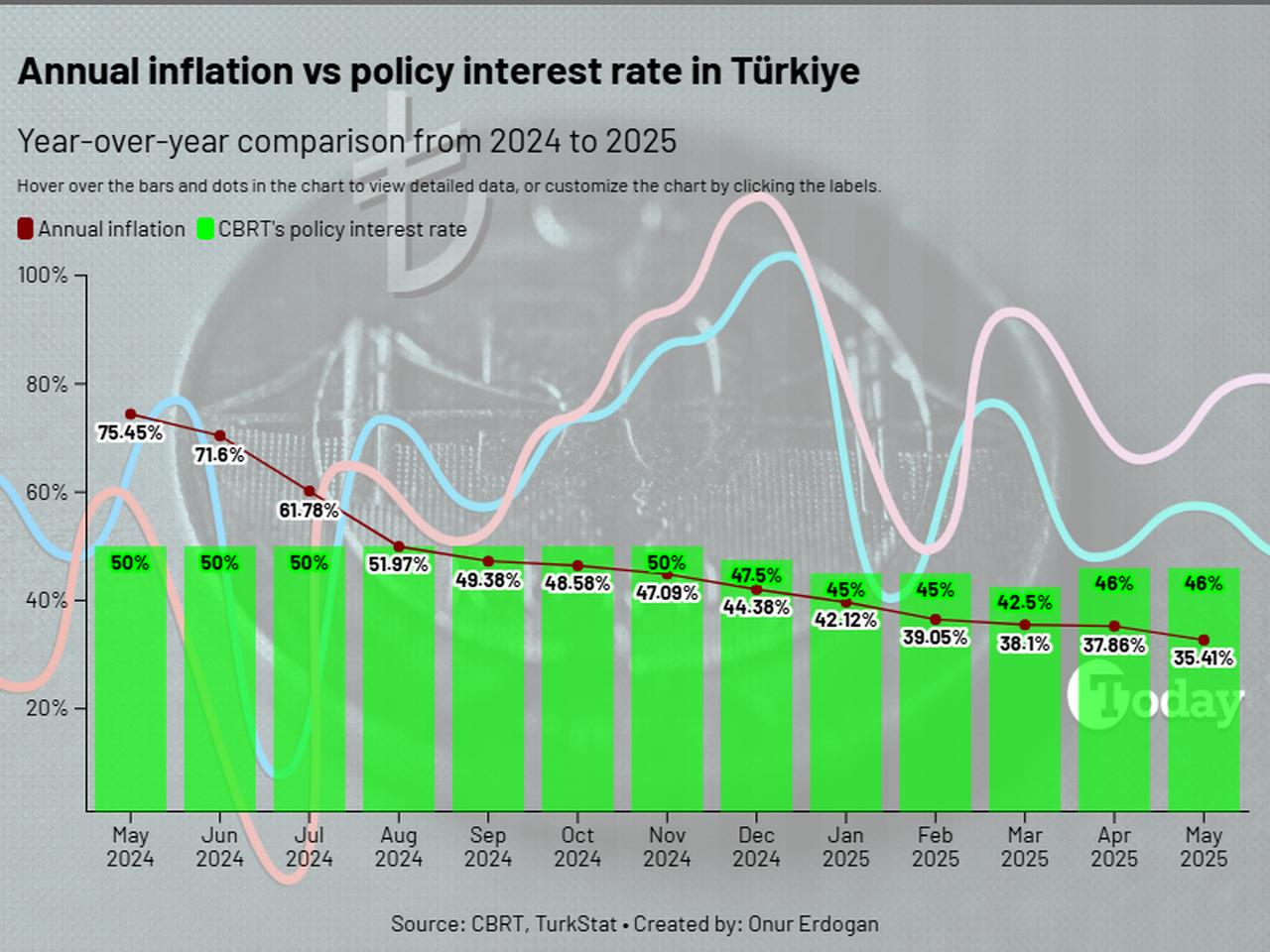

Türkiye’s annual inflation has eased to 35.4% in May 2025 from a peak of over 75% in 2024 May, following a sharp tightening in monetary policy. The Central Bank of the Republic of Türkiye currently holds its benchmark interest rate at 46% — a level maintained to anchor expectations and rein in domestic demand.

Simsek pointed to a significant drop in goods inflation over the past year, stating that “goods inflation fell by 28.7% as of May, and core goods came down to 20%.” However, he acknowledged that services inflation remains elevated, largely due to rents. “If we leave rent aside, services inflation fell from 97% to 43%,” he said.

Simsek emphasized improvements in external balances, noting: “We have also made progress on the current account and the budget deficit. The current account deficit as a share of GDP is now below 1%.”

He highlighted the fall in Türkiye’s credit risk premium since May 2023, saying, “There has been a 410 basis-point drop in Türkiye’s risk premium. In comparison, emerging markets averaged a 40 basis-point drop. Türkiye outperformed by a factor of ten.”

Simsek also addressed concerns over foreign exchange reserves. “We have no concerns about reserve adequacy,” he said, adding that gross reserves, which had declined to below $140 billion, have rebounded significantly. Türkiye’s reserve adequacy ratio, which had dropped to 0.7 in May 2023, has returned to 0.97 — in line with the country’s long-term average.

According to Simsek, international capital has begun flowing back into Türkiye as confidence in the economic program improves. “We introduced required reserves for short-term FX borrowing to limit speculative inflows,” he explained. “We raised the requirement to 18% for maturities up to one month and to 14% for up to three months. We don’t need hot money.”

In May, Türkiye's central bank raised reserve requirements to 18% for lira-denominated funds with maturities of up to one month, and to 14% for those maturing within three months.

Simsek also mentioned the decline in Türkiye’s FX-protected deposit scheme, known as KKM. “KKM peaked in August 2023 at around $144 billion. Today, it has fallen below $15 billion. We achieved this without disrupting markets, and we will likely end the program soon,” he stated.

Simsek reaffirmed Türkiye’s long-term attractiveness to international investors, citing the country’s modern infrastructure, skilled workforce, and consistent economic growth — averaging around 5.5% over the past two decades. “Türkiye remains attractive to international capital. No global firm can afford to overlook this country,” he said. “Our infrastructure is excellent, we have a highly educated population, and we’re not missing global trends.”

Although Türkiye faces periodic volatility, Simsek argued that investments should be viewed with a long-term perspective. “I believe investment will continue to rise. These reforms will unlock major opportunities,” he said.

TWEET: Türkiye’s Finance Minister Mehmet Simsek says the disinflation process is on track and urges the real sector to stay patient, noting that tight policies are starting to stabilize the economy