Turkish Treasury and Finance Minister Mehmet Simsek, who heads the country’s economic team and has faced criticism from several pro-government outlets over the tight monetary policy pursued over the past two years to combat high inflation, pushed back by emphasizing that price stability is the cornerstone of long-term, sustainable growth.

“The permanent solution to access finance is to succeed in disinflation,” Simsek said, responding indirectly to the growing criticism that tight monetary conditions are stifling economic activity due to limited access to commercial loans and the negative impact on exports caused by a stronger Turkish lira.

“Efforts to discredit the program not only create confusion but also risk delaying Türkiye’s economic stabilization and social welfare. This program is not merely a set of economic measures—it is the main tool for building a stronger, more predictable, and fairer future for our country,” Simsek remarked.

“We have made significant progress toward price stability because we know that without it, we cannot achieve the kind of competitive, sustainable, and high-quality production our industrialists aspire to,” Simsek said in an interview with the business-focused news outlet Dunya. "Today, we can say that the most difficult period is behind us."

The Turkish Economic Board, established in 2023 under Simsek's leadership, has been implementing a comprehensive program aimed at ensuring price stability while maintaining economic growth.

According to the government’s Medium-Term Program, the primary objective is to bring inflation down to single digits by 2027.

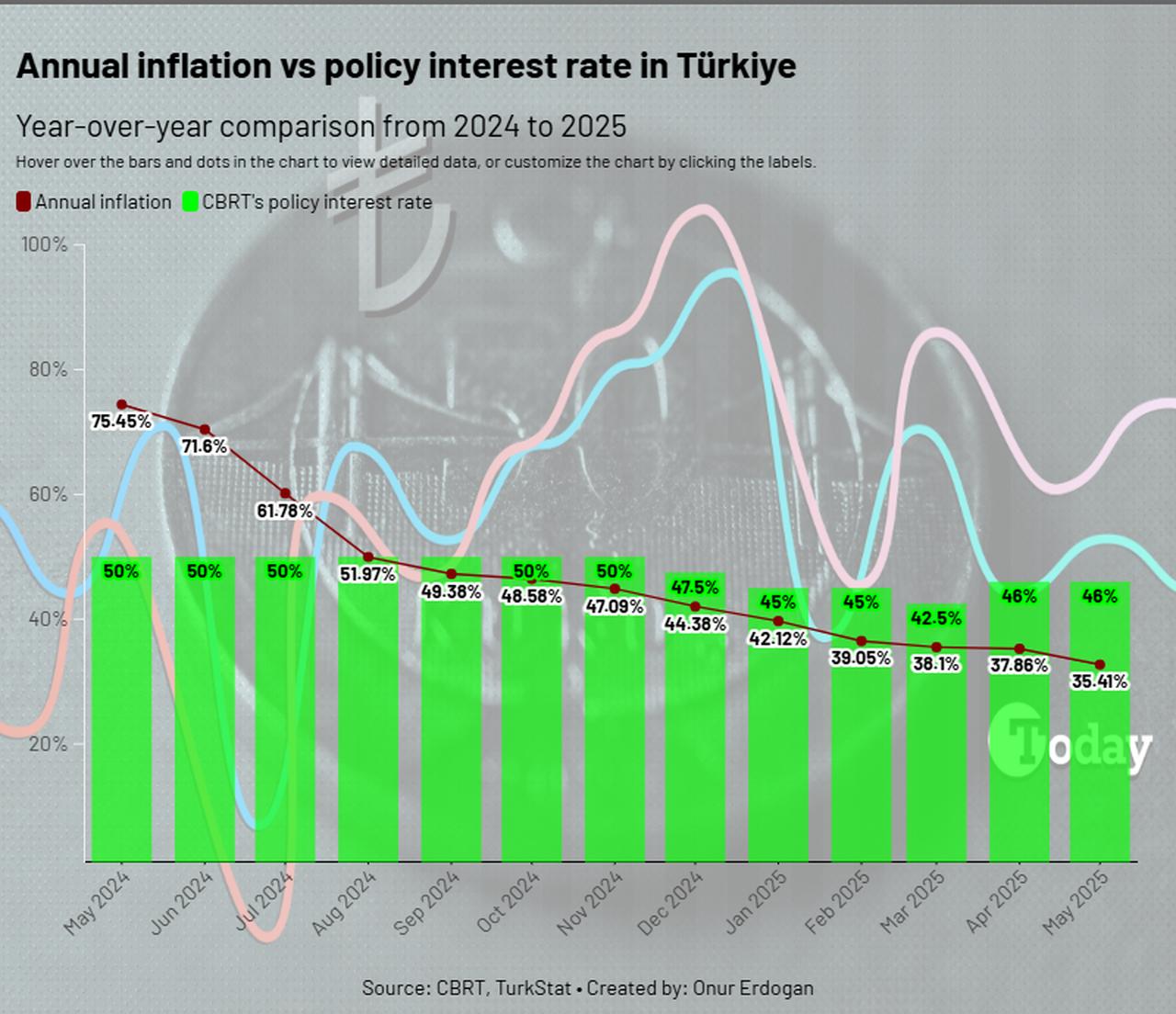

To achieve this goal, the Turkish central bank adopted a tight monetary policy framework, raising interest rates as high as 50% in March 2024 and maintaining a restrictive stance to curb inflationary pressures.

Following a limited easing cycle—prompted by declining inflation figures—the Turkish central bank cut interest rates by 250 basis points in each of its December, January, and February meetings, bringing the policy rate down from 50% to 42.5%.

However, in an unexpected move at its April meeting, the central bank raised the rate by 350 basis points to 46% to contain renewed inflationary pressures and restore investor confidence.

This decision reignited backlash from industrialists and some pro-government media outlets, most notably Yeni Safak, which accused the economic board of damaging the Turkish economy.

The Turkish central bank’s move was quickly reflected in annual inflation figures, with the rate falling to 35.4% in May, beating market expectations and marking its lowest level since November 2021. This represents a 40-point decline over the past year.

Goods inflation dropped to 28.7%, the lowest in three and a half years, while services inflation fell to 51.2%, a 35-month low.

“This is a 40-point decline in inflation over the past year. Especially in the services sector, this is a critical development, as it indicates the breaking of price inertia,” Simsek said, underscoring the effectiveness of the monetary policy.

“Price stability is the precondition for a sound economy," he added. Without it, we cannot ensure investment, employment, or production. It is also essential for protecting purchasing power and ensuring predictable market conditions.”

He added that the decline in inflation is helping the real sector access long-term, affordable financing, which will reinforce investment and employment and, in turn, support economic momentum.

Nevertheless, limited access to liquidity reflected a partial slowdown in the Turkish economy, which grew by 2% in the first quarter of 2025, down from 3.0% in the previous quarter.

Besides, among the 532 companies publicly listed on Borsa Istanbul, 265 reported losses, meaning that 50.3% of the firms ended the first quarter in the red.

Simsek acknowledged a likely slowdown in the second quarter due to global uncertainty and financial tightening but emphasized that Türkiye remains committed to economic growth.

“Let me stress this clearly—we are not compromising on growth while pursuing disinflation,” he said.

He cited historical evidence to argue that controlling inflation supports long-term growth: “Between 2003 and 2012, inflation fell to an average of 9.3%, and growth rose to 5.7%. But when inflation rose again to 25.1% on average during 2013–2024, growth dropped to 5.1%. This proves that sustainable high growth depends on price stability. We aim to replicate the success of the 2003–2012 period.”

Simsek also highlighted key components of the program, including structural reforms and achieving a sustainable budget balance.

He noted that Türkiye’s efforts to formalize the economy and enhance tax compliance are delivering results, with over 5 million tax declarations filed in 2025—a 24% increase from the previous year.

Nearly 473,000 individuals submitted declarations for the first time. Simsek stressed that the aim is to encourage voluntary compliance rather than impose penalties.

He also pointed out the successful phase-out of the FX-protected deposit scheme, which had imposed a significant burden on the budget. The scheme’s volume was reduced from ₺3.4 trillion (equivalent to $86.69 billion as of June 10) in August 2023 to ₺576.2 billion without disrupting market stability, he underscored.

Simsek also noted that Türkiye’s strengthened policy framework has boosted investor confidence, raising external debt rollover rates to 163% for banks and 135% for the private sector.

Over the next three years, $41 billion in project finance is expected to support green transformation, digital infrastructure, and urban resilience.

Despite tight monetary conditions, fiscal support for SMEs and exporters remains in place. In 2024, $49 billion in export financing was provided to 18,000 firms—83% of them SMEs—with a target of $52 billion set for 2025, Simsek indicated.

New guarantee schemes and eased collateral requirements are designed to improve credit access, particularly for manufacturing SMEs.

Addressing regional development, Simsek said that the reduction in domestic security risks following the disbandment of the terrorist organization PKK allows national resources to be redirected toward Türkiye’s eastern and southeastern regions.

Meanwhile, the current account deficit has narrowed significantly, from $55 billion in May 2023 to $12.6 billion as of March 2025. Excluding gold, Türkiye has recorded a current account surplus since July 2024, with the annual deficit expected to remain below 2% of gross domestic product (GDP).

Looking ahead, Simsek projected that 2026 will bring greater purchasing power for households, improved credit access, enhanced business predictability, and more visible reform results.

He said the year would mark a turning point, with deeper confidence and broader economic opportunity.

“This is not just a technical program,” Simsek concluded. “It is Türkiye’s collective roadmap to a more predictable, competitive, and fair economic future.”