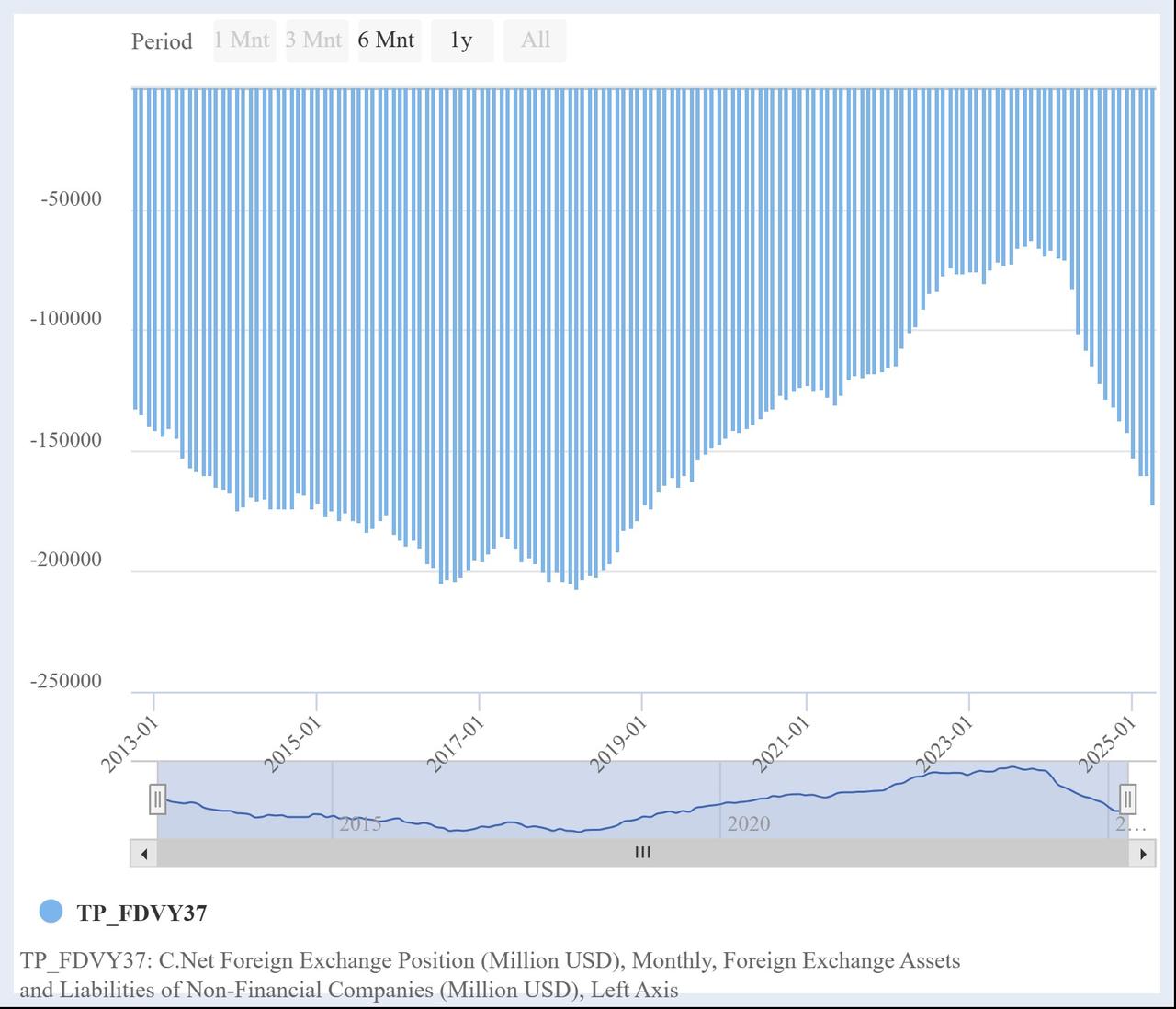

The foreign exchange deficit of non-financial companies in Türkiye surged to $171.8 billion in April, reaching its highest level since February 2019, according to newly released data from the Central Bank of the Republic of Türkiye (CBRT).

The widening gap came as liabilities increased at a much faster pace than assets.

According to the Turkish central bank's report on the Foreign Exchange Assets and Liabilities of Non-Financial Companies, foreign exchange assets dropped by $491 million from the previous month to $165.6 billion, while liabilities jumped by $11.3 billion to $337.4 billion.

The data revealed that the asset decline was mainly driven by a $2.4 billion fall in derivative assets and a $1.1 billion drop in export receivables.

However, this decline was partly offset by a $2.3 billion increase in deposits held at domestic banks, a $662 million rise in direct capital investments abroad, and a $43 million gain in securities holdings.

On the liability side, the month saw significant increases across all categories. Loans obtained from domestic sources rose by $6.4 billion, while external loans increased by $4 billion. Import payables were up by $856 million, and derivative liabilities grew by $10 million.

An analysis of maturity structures pointed to a clear shift toward longer-term borrowing.

At the same time, short-term loans from domestic sources declined by $569 million, while long-term domestic loans climbed by nearly $7 billion.

Similarly, external short-term loans rose by $2.3 billion, and long-term external borrowing expanded by $2.6 billion over the month.