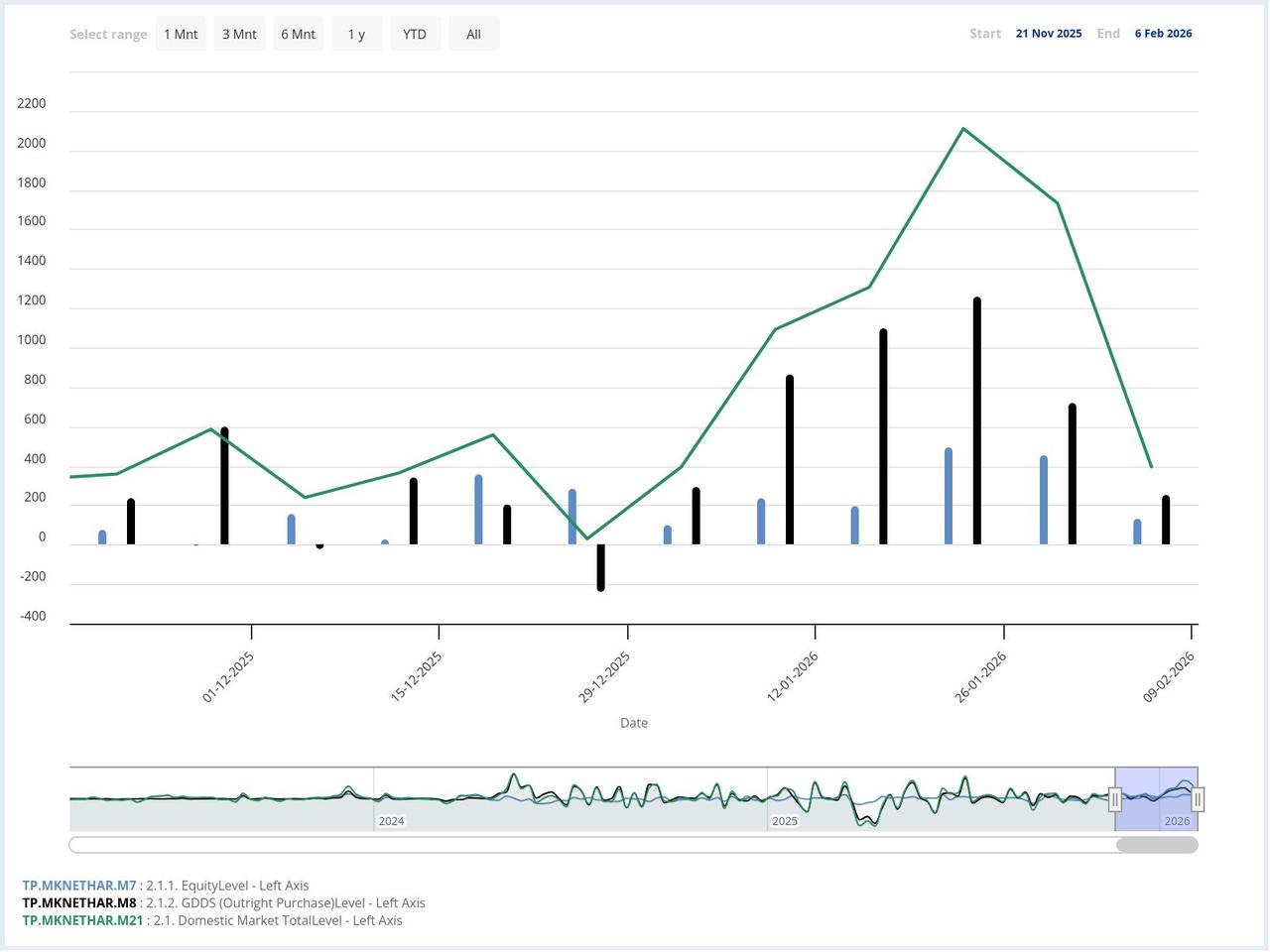

Foreign investors extended their stock buying streak in Turkish equities to a 10th straight week, purchasing $134.3 million worth of shares in the week ending Feb. 6, according to official weekly market figures.

Investors based abroad also added $255.6 million in government bonds and $4.8 million in non-general government sector assets during the same period.

Meanwhile, central bank figures showed that Türkiye’s total international reserves fell by $10.676 billion week-on-week to $207.482 billion as of Feb. 6.

Gross foreign exchange reserves decreased by $5.53 billion to $78.87 billion. Gold reserves declined by $5.14 billion, moving down to $128.61 billion.

Net reserves dropped from $93.4 billion to $91.3 billion. Net reserves excluding swaps — which exclude temporary swap funding — decreased from $82.6 billion to $77.7 billion.

Total deposits in Türkiye’s banking sector fell by 1.1% in the week ending Feb. 6, decreasing by ₺308.45 billion to ₺28.87 trillion ($661.40 billion).

Foreign currency deposits reached $272.069 billion, of which $233.488 billion belonged to domestic residents. Resident foreign currency deposits declined by $114 million over the week.

Consumer loans extended by banks to residents increased by 0.4%, reaching ₺5.86 trillion.