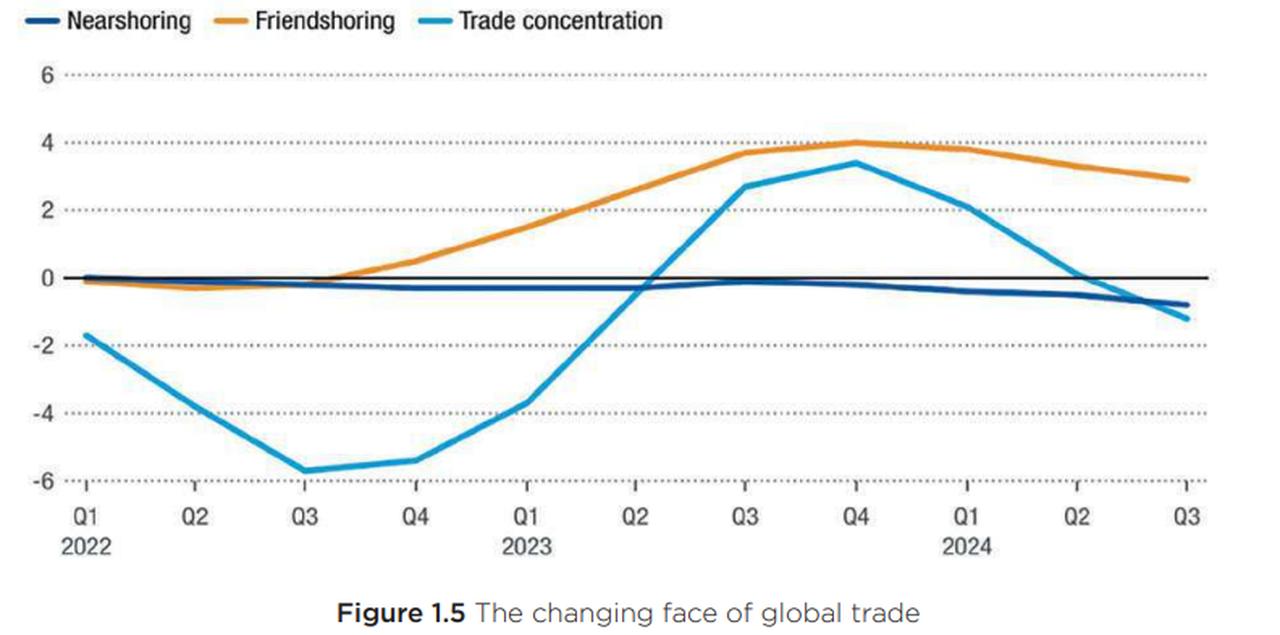

The global shift toward “friend-shoring” slowed in early 2024 after rapid growth since mid-2022, prompting Türkiye to strengthen key trade ties and diversify supply routes, the country’s port operators’ association said.

According to the Port Operators Association of Türkiye (TURKLIM), friend-shoring—strengthening partnerships with nations holding similar geopolitical positions—gained speed from the second half of 2022, stabilized in late 2023, and then eased in 2024.

The slowdown coincided with a continued drop in “near-shoring”—trade among geographically close partners—as countries prioritized economically advantageous arrangements over proximity or political alignment.

The report’s analysis notes measurable changes in bilateral trade patterns. Russia’s trade dependency on China dropped from around 10% in 2023 to 3.7% in 2024, reflecting a partial normalization in flows disrupted by the Ukraine conflict.

Overall trade concentration has also lessened, with supply chains dispersing across a broader range of partners rather than focusing on a small set of aligned or neighboring states.

For Türkiye, this shift in global trade dynamics reinforces the need to maintain strong ties with top export markets while remaining flexible to adjust to new trade corridors, the report noted.

In 2024, Türkiye’s top export markets were Germany, the United States, and the United Kingdom, while China rose to first place among import sources, ahead of Russia and Germany.

Sea transport remained the main channel for Türkiye’s trade, carrying 56% of exports and 55% of imports by value, amounting to a total seaborne trade volume of $336.8 billion in 2024.

The report noted that Türkiye’s maritime strategies are aimed at maintaining these core partnerships while adapting cargo flows to new, economically viable routes.

The report outlined three main priorities for the sector: strengthening hinterland connectivity—particularly rail links—to ease congestion and improve multimodal integration; expanding port areas to handle peak-season demand and accommodate new cargo equipment; and advancing the green transition through renewable energy adoption, electrification of port machinery, and efficiency upgrades.

The report also stressed cybersecurity as a critical operational challenge, noting that increased automation and digital integration make ports more vulnerable to cyberattacks. Safety protocols—including vessel stability monitoring and compliance with international codes—remain core to maintaining reliability.

Meanwhile, global seaborne trade volume grew by 2.3% in 2024 to 12.63 billion tonnes.

Dry bulk cargo exceeded 5.7 billion tonnes, followed by crude oil and products at 3 billion tonnes, containerized cargo at 1.9 billion tonnes, other cargo types at 1.4 billion tonnes, and gas shipments at 570 million tonnes.

Globally, container shipping saw the highest capacity growth in 2024 at 7.7%, while crude oil and products were the only segment to contract.

The total world fleet reached 2.4 billion deadweight tonnes (DWT), with dry bulk carriers making up 42.7% of capacity. Container vessels grew from 305.8 million DWT to 329.5 million DWT.