Spot gold prices touched a new all-time high on Tuesday after Monday’s surge above $3,900, reaching $3,977.45, as expectations of further Federal Reserve rate cuts continue to drive demand amid growing uncertainties.

The world’s oldest safe-haven asset has extended its year-to-date gains to more than 51%, already making 2025 the most profitable year since 1979. The rally, which began in August, accelerated after the Fed’s rate cut in September and signals of further easing, while last week’s U.S. government shutdown added to demand.

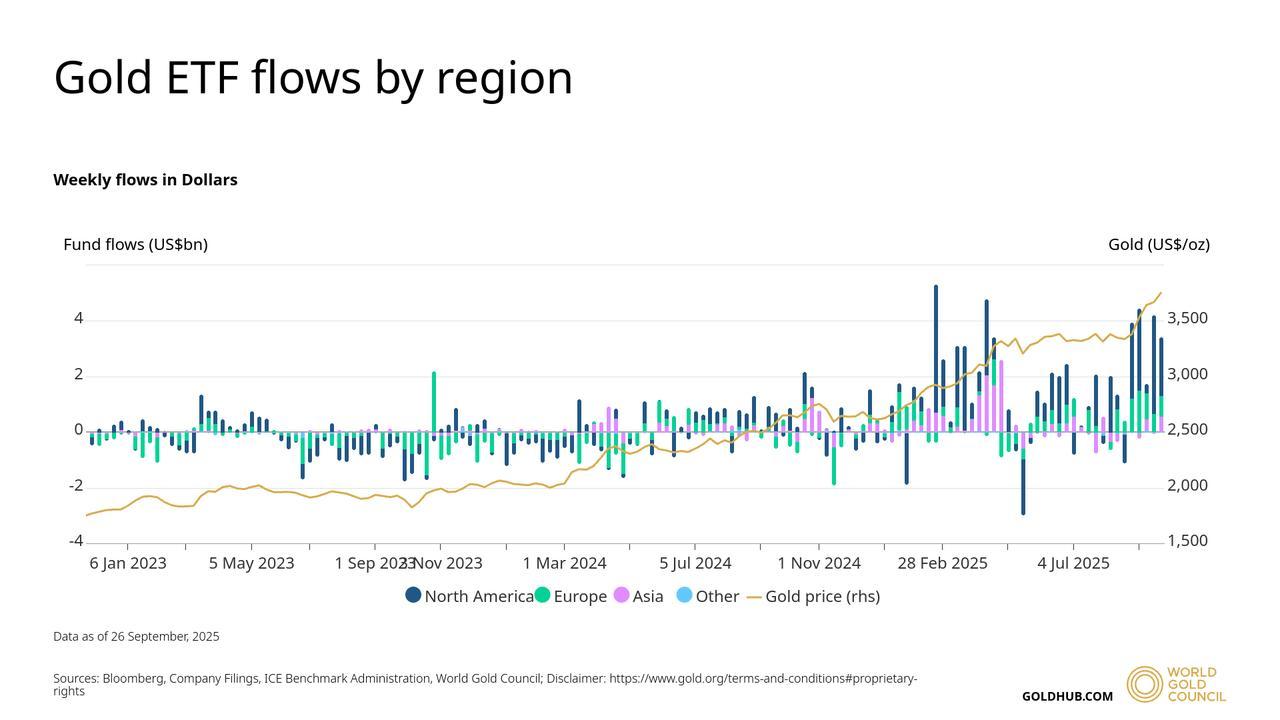

Following Monday’s breach of the $3,900 level, U.S. investment bank Goldman Sachs raised its December 2026 price forecast for gold to $4,900 per ounce, up from $4,300. In a note to clients, the bank cited strong inflows into gold-backed exchange-traded funds (ETFs) in Western markets and sustained demand from central banks as the primary drivers of the upward revision.

According to data from the World Gold Council, ETF inflows saw $13.6 billion in September, marking the highest monthly figure on record. Analysts at Goldman said that the inflows have now fully caught up with their rates-implied estimate, suggesting that the recent surge is not an overshoot.

"We see the risks to our upgraded gold price forecast as still skewed to the upside on net, because private sector diversification into the relatively small gold market may boost ETF holdings above our rates-implied estimate," the bank explained.

Goldman also projected continued demand from central banks, particularly in emerging markets, where reserve diversification has become a structural trend. The bank expects central bank purchases to average 80 metric tons in 2025 and 70 tons in 2026.

"Emerging market central banks are likely to continue the structural diversification of their reserves into gold," Goldman noted.

In addition, the bank highlighted expectations of further U.S. monetary easing as a supportive factor for the metal. Western ETF holdings are expected to rise as the Federal Reserve is anticipated to lower its benchmark funds rate by 100 basis points by mid-2026, providing an additional boost to investment demand.

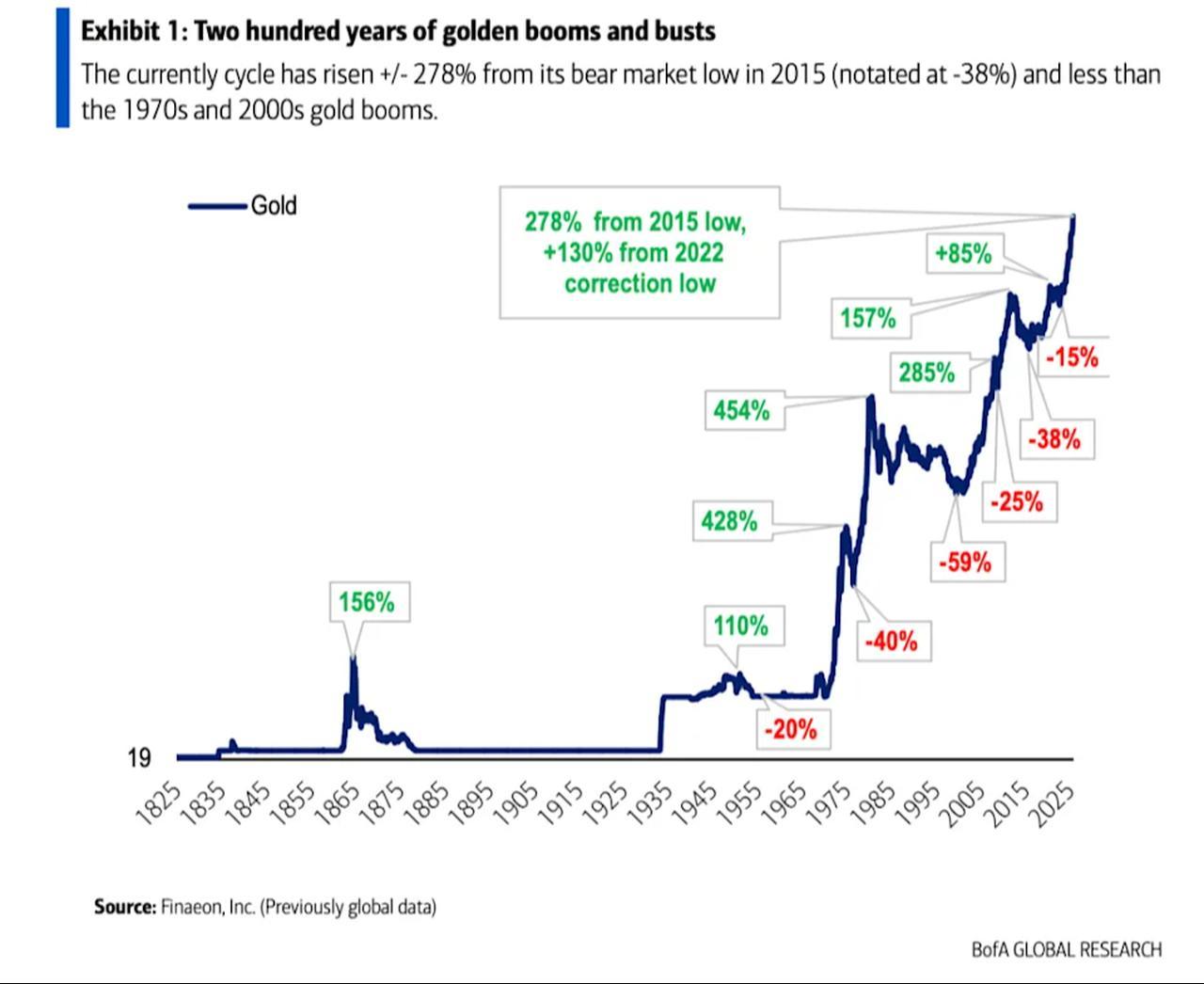

Not all analysts share the bullish outlook for gold’s trajectory, as another U.S. investment bank, Bank of America's (BofA) research report advised investors to remain cautious, warning that the risk of a correction is growing.

Technical strategist Paul Ciana argued that while economic stress and geopolitical tensions have funneled safe-haven flows into gold, the current rally is showing signs of strain.

"The risk of correction is elevated," Ciana wrote in a note to clients, stressing that the rally increasingly reflects momentum-driven buying rather than solid fundamentals. He pointed to technical signals across multiple time frames that suggest "uptrend exhaustion," including stretched charts, waning divergence, and overbought conditions.

According to his analysis, gold is trading about 20% above its 200-day simple moving average, a level that has historically preceded pullbacks. "A relevant peak may be close," he said, noting that major highs in August 2020, August 2011, March 2008, and May 2006 all occurred when prices were roughly 25% above the same moving average.

Ciana also emphasized that speculative positioning has swelled in recent weeks, increasing the risk of a sharp reversal if sentiment shifts or if monetary policy surprises the market. "Markets could see a correction if any of the supportive factors weaken or reverse," he cautioned.

The current rally also fits into a longer history of booms and corrections in the gold market. After bottoming in 2015, gold rose about 85% into 2020, then fell roughly 15% into 2022 before climbing another 130%. Analysts note that while the present upswing is smaller than the booms of the 1970s and 2000s, these cycles often included interim corrections before further gains.

Ciana underlined that possibility, explaining that patterns from earlier decades suggest a correction may be part of the current cycle rather than its end. "There is a rhyme with several midway corrections in 2020–22, 2007–08, and 1975–76," he wrote, while adding that further upside over the next two years remains possible if macroeconomic pressures continue to sustain demand for safe-haven assets like gold.