Global gold prices surged to fresh highs on Tuesday, driven by a weaker U.S. dollar and expectations of a Fed rate cut in September, with markets placing full odds on the move.

Spot gold rose 0.5% to $3,657 in Asian trading, while December U.S. gold futures gained 0.4% to $3,690.

The U.S. Dollar Index continued its decline, falling to 97.35 and extending its year-to-date drop to 10%.

Markets are now turning their attention to upcoming U.S. producer and consumer price data, due Wednesday and Thursday, for further signals on the Fed’s policy path.

In July, headline inflation held steady at 2.7%, remaining above the Fed’s 2% target.

Consecutive weak employment figures have reinforced investor conviction, with traders currently assigning a 100% probability to a rate cut at the Federal Open Market Committee (FOMC) meeting on Sept. 17, according to CME Group's Fed Watch tool.

The Fed has kept its benchmark interest rate unchanged since last December, holding it in the 4.25%–4.5% range, citing inflationary pressures.

Meanwhile, the European Central Bank (ECB) is expected to keep its key rates unchanged at its meeting on Thursday.

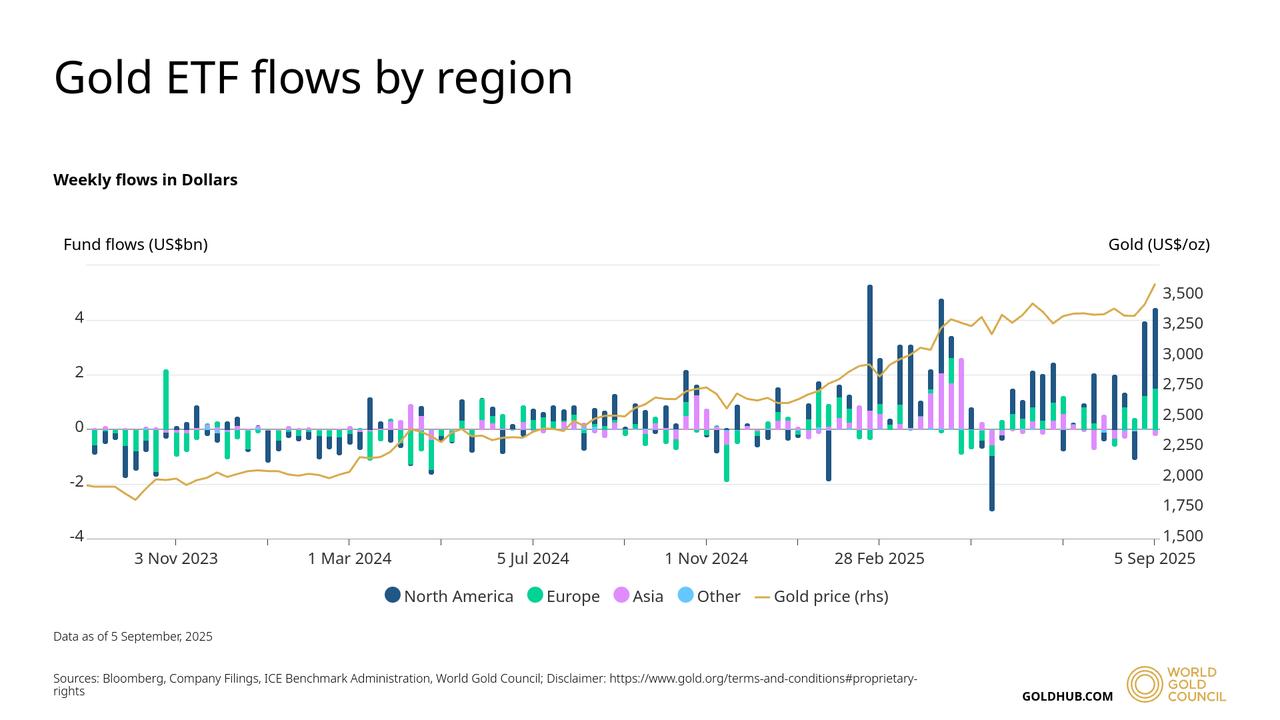

Exchange-traded funds (ETFs), which allow investors to buy and hold gold electronically without entering physical markets, have also fueled demand.

According to the World Gold Council, net inflows into gold ETFs reached $4.2 billion during the week ending Sept. 5. This marks the largest weekly inflow since March, when prices first surpassed $3,500 amid heightened U.S.-China trade tensions.

Gold has gained 38% so far in 2025, extending the 27% increase recorded in 2024. Analysts attribute the rise to a combination of a weaker dollar, strong central bank purchases, looser monetary policy, and persistent global uncertainties.

The metal’s long-term trajectory shows how quickly investor sentiment has shifted. International gold prices first broke through the $2,000 per ounce mark in August 2020, during the peak of the COVID-19 pandemic, and crossed the $3,000 mark in March 2025.

After surpassing $3,500 earlier this month, gold has now moved past $3,600 in just over a week.