Gold prices surged above $4,000 per ounce for the first time on Wednesday. The rally was driven by strong demand for exchange-traded funds amid global uncertainty, geopolitical risks, and expectations of further Federal Reserve rate cuts.

According to the World Gold Council, global ETF inflows reached a record $26 billion in the third quarter of 2025.

The spot price climbed as high as $4,038.57 per ounce, extending a rally that has lifted gold over 53% since the start of the year.

Other safe-haven assets also gained, with silver touching $48.92 per ounce, nearing its record high set in April 2011, while platinum rose to $1,678.60 and palladium to $1,406.53.

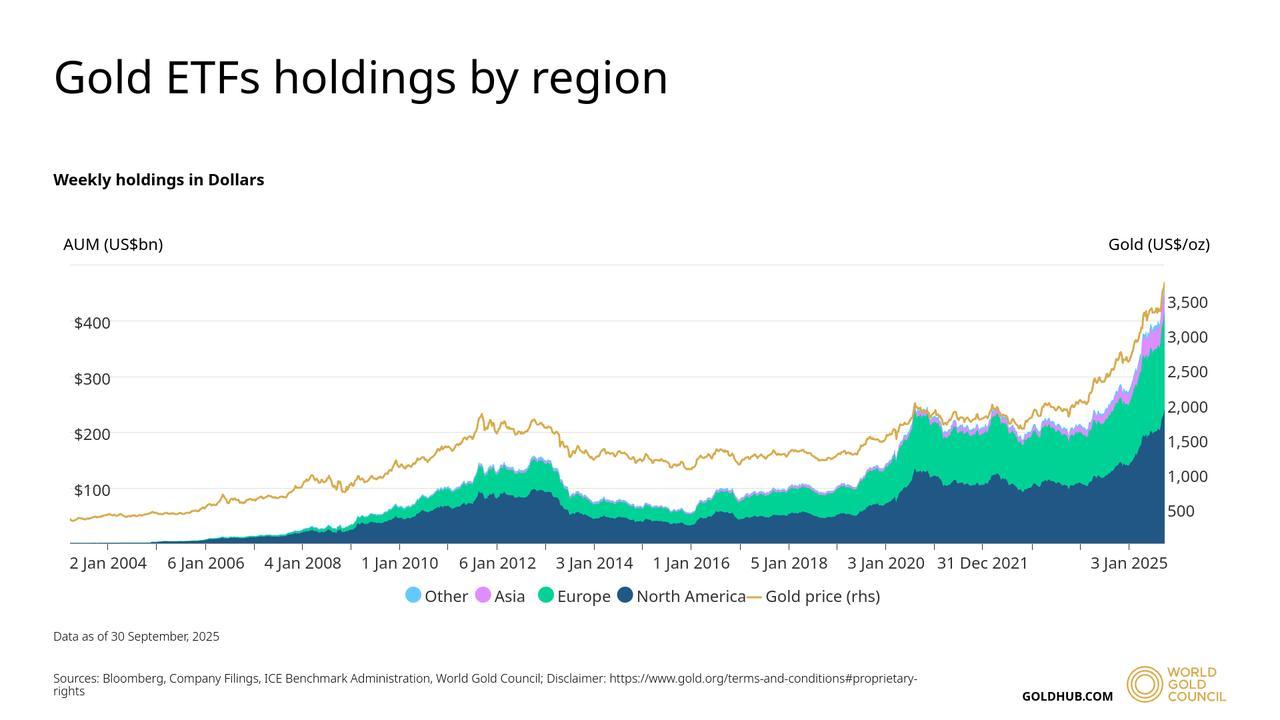

Meanwhile, a report by the World Gold Council showed that the safe-haven demand was mostly reflected through strong ETF inflows by the end of September.

These funds, which hold bullion as underlying assets and trade on regulated exchanges, have become a key vehicle for investors seeking exposure to gold.

By the end of the third quarter, total assets under management in gold ETFs rose to $472 billion, a 23% increase from the previous quarter. Holdings climbed 6% to 3,838 tonnes, just 2% below the all-time peak recorded in late 2020.

North American investors drove the bulk of the inflows, adding $16.1 billion during the quarter—marking the region’s largest third-quarter inflow and second-largest quarter ever.

European funds followed with $8.2 billion, led by activity in the United Kingdom, Switzerland and Germany.

Asia contributed $1.7 billion, supported by strong demand in India, China, and Japan, while inflows in other regions remained relatively flat.

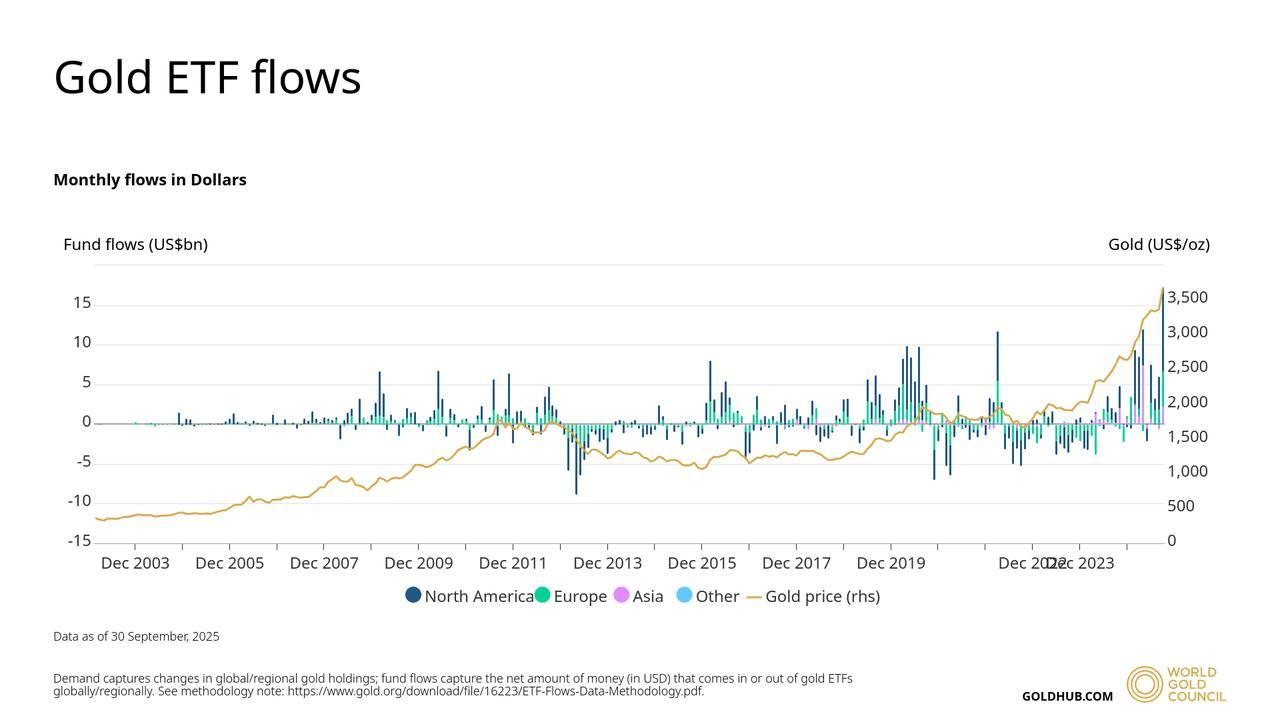

Inflows in September alone totaled $17.3 billion, the highest monthly figure ever recorded.

According to the Council, North American funds alone added $10.6 billion in September, supported by persistent geopolitical risks, a weaker U.S. dollar, and expectations of lower yields following the Federal Reserve’s 25 basis-point rate cut.

European inflows, totaling $4.4 billion in the month, marked the region’s third-strongest month ever, reflecting both momentum buying and investor demand for protection against rising inflation and policy uncertainty.

Asia posted $2.1 billion in inflows, led by India with $902 million, while China and Japan followed with $622 million and $415 million, respectively.

Other regions saw modest contributions, with Australia recording inflows of $182 million, partially offset by outflows from South Africa.

Among individual funds, SPDR Gold Shares in the U.S. attracted the largest single inflow at $4.2 billion in September, followed by iShares Gold Trust with $2.9 billion and SPDR Gold MiniShares Trust with $1.7 billion.

In Europe, the iShares Physical Gold ETC in the UK drew $1.4 billion, while Switzerland’s Pictet CH Precious Metals Fund added $540 million.

In Asia, China’s Huaan Yifu Gold ETF gained $739 million, Japan’s Physical Gold ETF added $415 million, and India’s Nippon India ETF Gold BeES saw $268 million.

Analysts noted that momentum also played a role, as investors moved into ETFs to capture gains during a period when gold repeatedly set new records.

Trading activity in gold mirrored the investment flows. Average daily volumes jumped 34% in September to $388 billion, the second-strongest monthly performance in 2025.

Exchange-traded volumes rose sharply on COMEX in New York and the Shanghai Futures Exchange, while gold ETF trading volumes reached $8 billion per day, with North American products accounting for nearly four-fifths of the total.