While spot gold prices continue to push toward new record highs on the back of elevated global demand, China’s intensified gold activity has come under the spotlight as the country seeks to position itself as a reserve custodian for allied nations, according to people familiar with the matter.

Gold prices touched a new high of $3,791 per ounce on Tuesday, buoyed by expectations of further U.S. Federal Reserve interest rate cuts and a wave of inflows into exchange-traded funds (ETFs).

The People’s Bank of China (PBOC) is using the Shanghai Gold Exchange (SGE) to court central banks from allied countries, encouraging them to buy bullion and store it within China’s borders, Bloomberg reported. Such a move would diversify custodial services away from established centers like London and New York, where Western banks and vaults have long dominated the trade.

A World Gold Council survey in June showed that central banks are increasingly favoring domestic storage over reliance on major hubs, citing concerns about access during crises or sanctions.

By offering itself as a trusted storage hub, Beijing could create alternatives to Western custodianship at a time of shifting geopolitical alignments. If successful, such a move would deepen China’s influence in setting bullion prices and expand the role of gold in international finance.

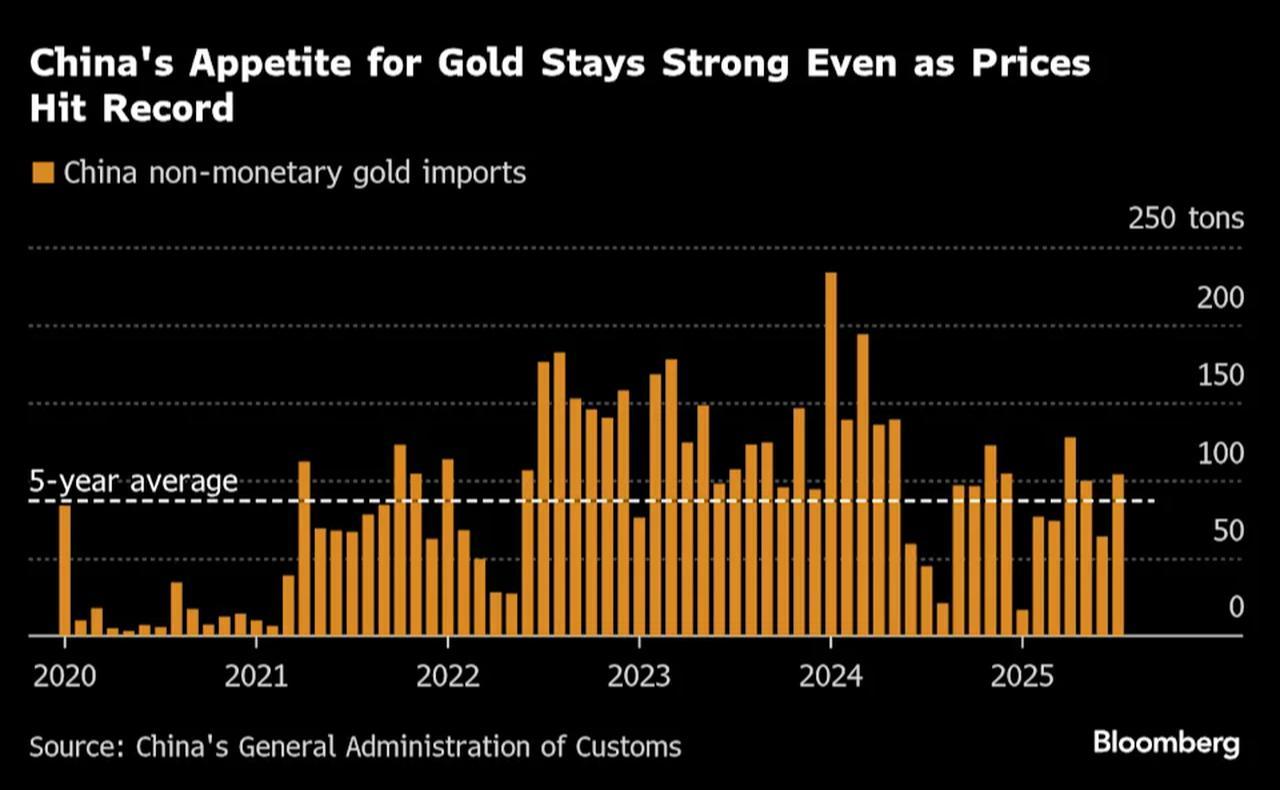

China is already the world’s largest producer and consumer of gold. Expanding into reserve custody would give Beijing not only a greater role in bullion flows but also a stronger hand in global price discovery, and the policy could eventually lead to looser import restrictions and a broader integration of gold into China’s financial system, according to the report.

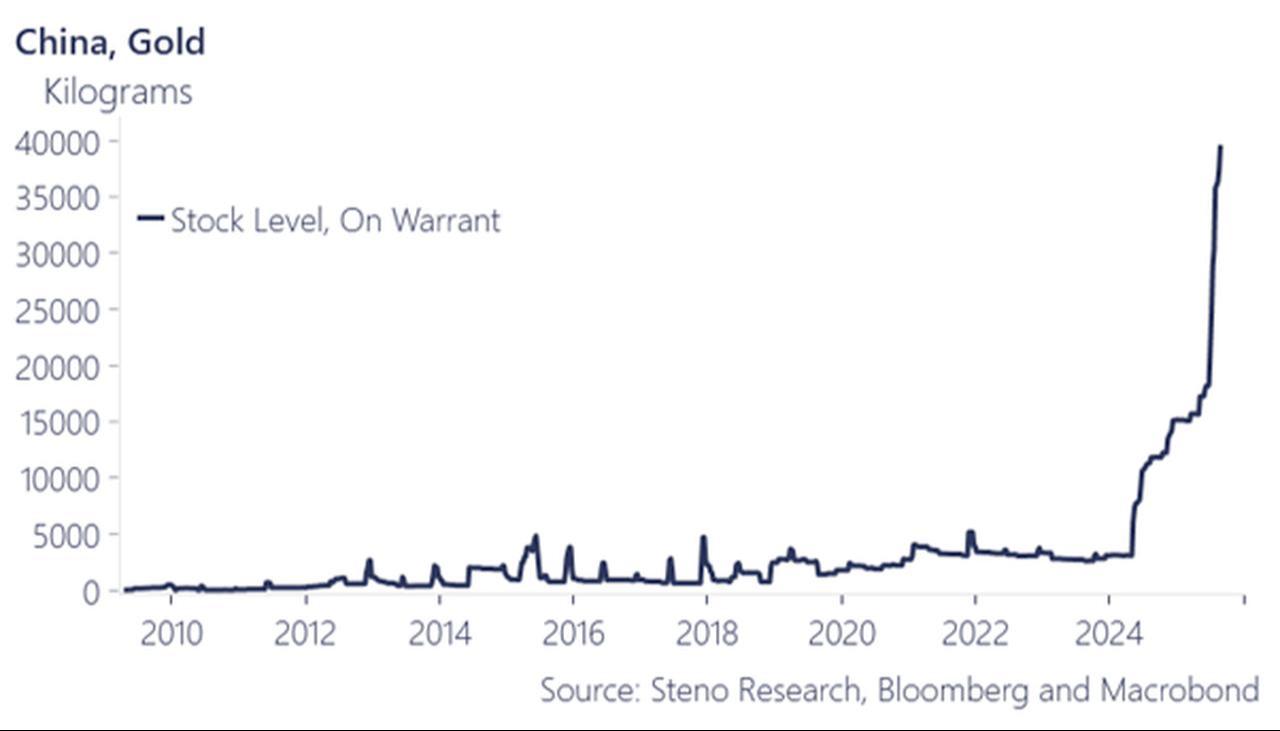

Official data shows the PBOC increased its gold holdings by 18.97 tonnes in the first half of 2025, bringing total reserves to 2,298.53 tonnes. At the same time, China’s gold stock registered "on warrant" — meaning formally recognized as available for exchange transactions — climbed above 40,000 kilograms, its highest level ever.

Gold "on warrant" refers to inventory held in approved vaults that has been issued a document of title, making it visible and tradeable on exchanges. Finance-focused TFTC's analysis explains that by raising these volumes, Beijing could be seeking to ease liquidity shortages in domestic markets, make gold more readily available as collateral, or simply demonstrate its growing bullion base. Some also interpret the increase as a signal to the world that China’s purchases are not just hidden reserves but assets it is willing to mobilize.

China’s initiatives coincide with broader dynamics in the bullion market. Central banks globally have accelerated their purchases, while ETF investors have added exposure at the fastest pace in more than three years. The World Gold Council reported inflows of $4.2 billion into gold-backed ETFs in the week ending September 19, with total inflows above $10.2 billion for the month.

Investors are responding both to looser U.S. monetary policy and to lingering geopolitical uncertainty. The Federal Reserve’s recent 25 basis-point rate cut, and expectations for further easing, have reduced the opportunity cost of holding non-yielding assets like gold. Analysts at banks including Goldman Sachs forecast that the combination of monetary easing and strong central bank demand could push prices higher.