The International Finance Corporation (IFC) has coordinated a $335 million syndicated loan for Türkiye-based Arkas Holding to finance the company’s long-term logistics and infrastructure projects.

The first tranche, totaling $260.3 million, has been released, while the remaining portion is expected to follow through additional lender participation.

The financing package includes contributions from global institutions such as Emirates NBD and the ILX Fund. According to Arkas, the funds will be used to expand port infrastructure, increase intermodal transport capacity, and support environmentally sustainable operations. Part of the loan will also be used to refinance existing short- and medium-term liabilities.

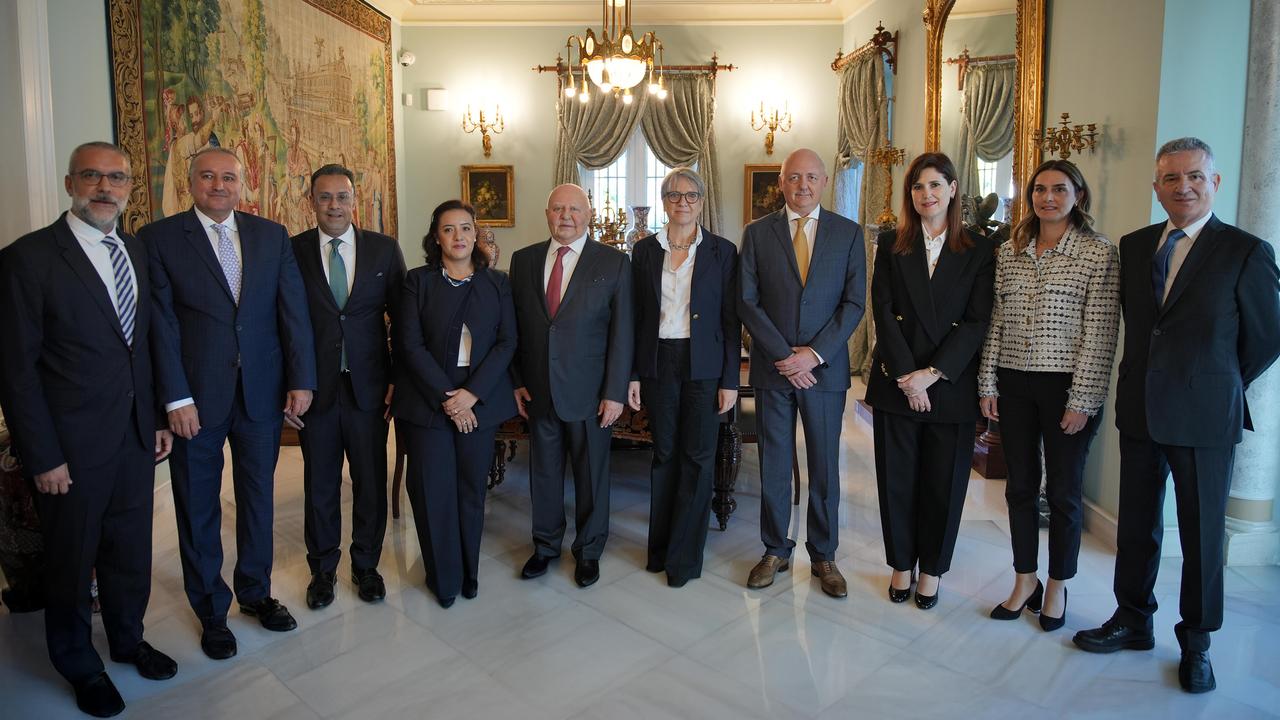

At the signing event in Izmir, Arkas Holding Chairman Lucien Arkas said the IFC-led agreement confirms both the company’s and Türkiye’s growing presence in international transportation networks. He added that the investments will enhance Türkiye’s role along the Middle Corridor — a trade route linking Central Asia, the Caucasus, Türkiye, and Europe.

IFC Regional Head of Infrastructure and Natural Resources Laura Vecvagare said the investment reflects the importance of private sector involvement in modernizing transport systems. She noted that the loan will support port expansion and network upgrades that contribute to economic development and help strengthen Türkiye’s position in global logistics chains.

The transaction is part of the World Bank Group’s broader initiative to promote East–West trade through improved infrastructure along the Middle Corridor. Enhancing port efficiency, rail and road connectivity, and cleaner energy use in freight operations are among the strategy’s key goals.

Arkas’s planned investments are expected to support these objectives by expanding capacity, modernizing facilities, and increasing the competitiveness of Türkiye’s transportation sector.