Iran’s cryptocurrency ecosystem expanded rapidly in 2025, reaching a total value of $7.78 billion amid severe domestic tensions, according to new data from blockchain analysis firm Chainalysis.

Crypto activity accelerated during Israeli missile strikes in October 2024 and the 12-day war in June 2025, and lastly, mass protests that erupted around December 28, following the collapse of the Iranian rial.

During the protests, the number and value of daily transfers surged, the report noted, suggesting many Iranians turned to Bitcoin as a financial refuge.

Chainalysis observed a substantial increase in both average daily transaction volume and transfers to personal wallets when comparing November 1–December 27, 2025, to December 28–January 8, 2026, just before authorities implemented a nationwide internet blackout.

"Most telling is the surge in withdrawals from Iranian exchanges to unattributed personal Bitcoin (BTC) wallets," the report stated. "This surge suggests Iranians are taking possession of Bitcoin at a markedly higher rate during protests than they were beforehand."

Faced with inflation rates between 40% and 50%, and a national currency that has lost approximately 90% of its value since 2018, many Iranians have turned to cryptocurrency as an alternative financial system.

The rial’s sharp depreciation in late 2025 further accelerated the shift toward digital assets, which provide a stronger hedge against inflationary erosion, the report said.

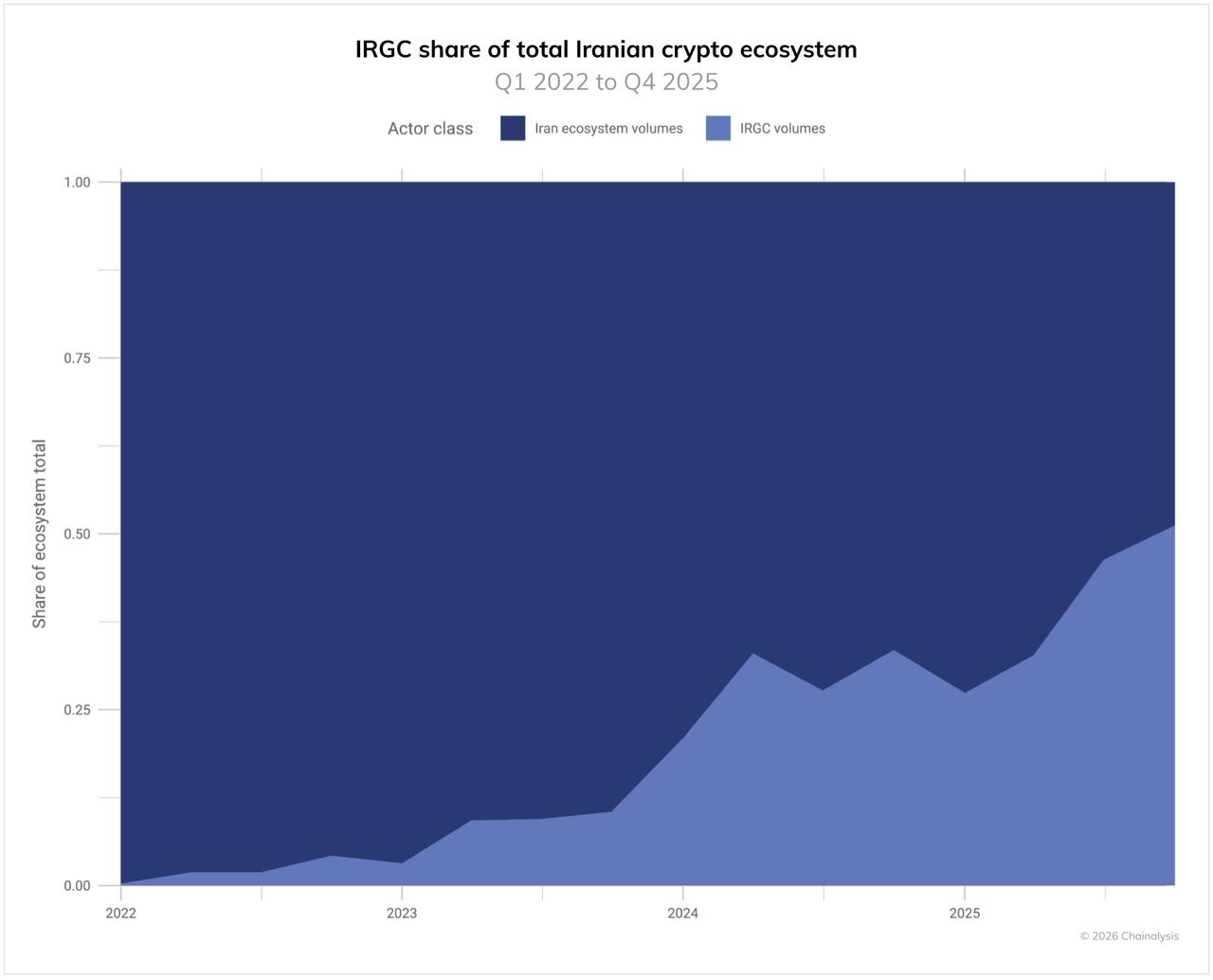

While individual citizens are using crypto to protect personal savings, Iran’s Islamic Revolutionary Guard Corps (IRGC) has also emerged as a major player in the country’s digital economy.

Chainalysis found that addresses linked to the IRGC and its transnational networks accounted for more than half of all crypto inflows in the fourth quarter of 2025.

The volume of funds directed to IRGC-related wallets exceeded $3 billion in 2025, up from over $2 billion in 2024. Observers added that the figures are likely underestimated, as they exclude unidentified wallets and shell companies.

The IRGC is known to use crypto for financing proxy networks, laundering funds, transferring arms, and circumventing international sanctions.

Bitcoin is a decentralized digital currency launched in 2009 that allows peer-to-peer transactions without relying on banks or governments. It operates on blockchain technology, which records transactions on a public, tamper-resistant ledger.