Türkiye’s benchmark Borsa Istanbul (BIST) 100 index closed at 11,372.33 points on Friday, surpassing the previous day’s level to set a new all-time high.

The index gained 0.52% from the previous day and advanced 4.6% over the week, supported by expectations of further interest rate cuts.

Among the sectors, chemicals posted the largest daily increase at 2.7%. Real estate shares followed with a 2.1% gain, while banking stocks rose by 1.3%.

The BIST 100 has now outpaced major global benchmarks nominally, with a return of more than 16% since the start of the year. From its March 21 low, the index has surged more than 25%.

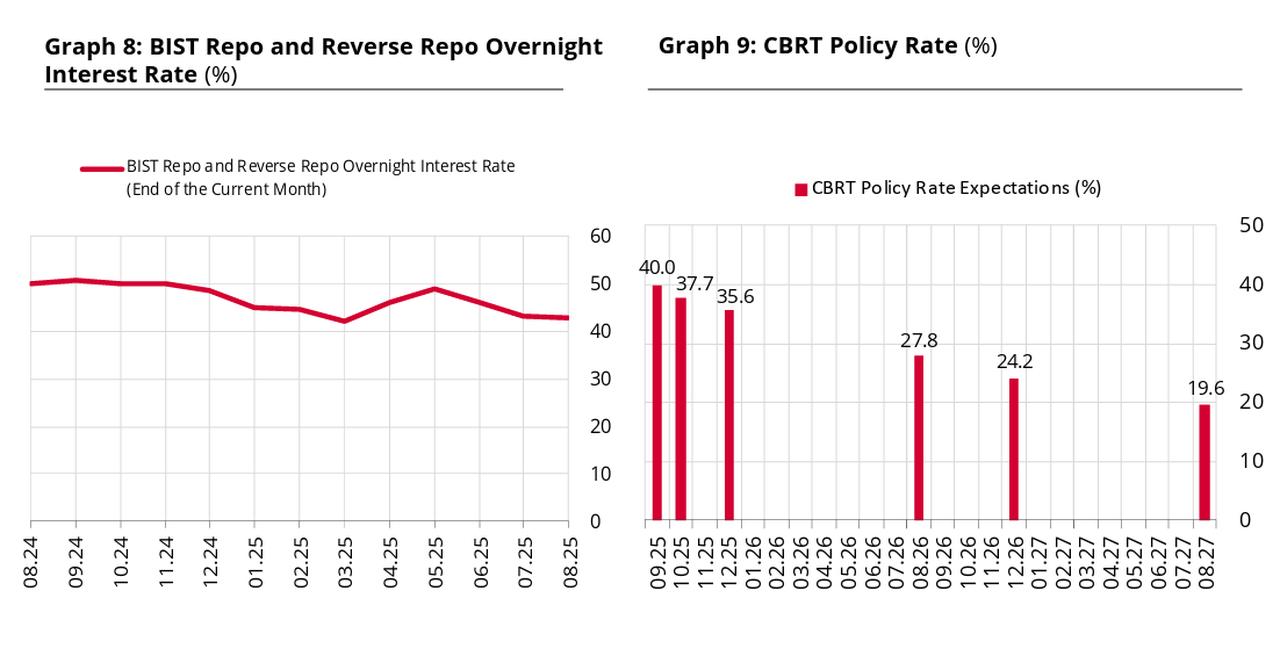

Investors increasingly expect the Turkish central bank to deliver another rate cut of at least 300 basis points in September, after it lowered the policy rate by the same amount to 43% in July, according to the bank’s August market participants survey.

Burak Pirlanta, a research specialist at local brokerage Gedik Investment, said the rally has been fueled primarily by the start of Türkiye’s interest rate cutting cycle, which has renewed investor risk appetite. Lower interest rates have encouraged both individual and institutional investors to shift from alternative assets into equities, he added.

Pirlanta also pointed out that corporate profits, while not yet strongly positive, have exceeded expectations and supported equity valuations. He noted that strong global risk appetite has further boosted interest in emerging markets such as Türkiye.

He suggested that if economic recovery accelerates with continued rate cuts and corporate earnings remain supportive, the index may test higher levels in the final quarter of the year.