Türkiye's benchmark stock index reached an all-time high of 11,301.84 points on Thursday, rising about 1.3% despite sluggish second-quarter financial reports, as nearly half of the listed companies posted losses.

After opening at 11,195.98 points, Borsa Istanbul's BIST 100 index gained more than 129 points from Wednesday's close.

As of 11 a.m. GMT, the index slightly pared its gains to 11,262.44, with a trading volume of ₺77.29 billion ($1.93 billion).

Earlier this month, the stock index surpassed the 11,000-point threshold for the first time since July 2024, before stabilizing at around that level.

The BIST 100’s previous historic peak was recorded on July 18, 2024, at 11,252 points.

Before the recent rally, Istanbul stocks had been hit hard in March following political turmoil after then-Istanbul Mayor Ekrem Imamoglu’s arrest on corruption charges, which triggered a massive sell-off and led to record steep losses in the BIST 100 index. The benchmark dropped to a low of 9,044.64 on March 21, plunging more than 16.7% from its year-to-date high of 10,862.14 on March 17.

However, the Turkish central bank intervened in the market, stabilizing the lira by deploying additional monetary policy tools to tighten liquidity and curb demand for foreign currencies. As a result, Istanbul stocks quickly reversed the outflow trend and have maintained a bullish trajectory since then.

A decision by the Turkish Capital Markets Board also allowed companies to repurchase their shares without requiring approval from their boards of directors, providing relief to battered market sentiment and helping to prevent further losses.

The upward trend accelerated after the Turkish central bank resumed rate cuts in July, lowering the policy rate by 300 basis points to 43%, slightly above the 42.5% level set in the meeting before the March market turmoil.

Inflation fell to 33.5% in June, its lowest since November 2021, extending a 14-month decline from 75.5% in May 2024 and boosting market sentiment with raised expectations for continued monetary easing.

With the recent rally, Borsa Istanbul’s BIST 100 has outpaced major global benchmarks, posting a year-to-date return of around 14.4%. Since its March 21 low, the index has advanced nearly 25%.

The market capitalization of the BIST 100 also exceeded ₺10.3 trillion ($254 billion), while the total market cap of all Istanbul-listed stocks reached ₺17.87 trillion.

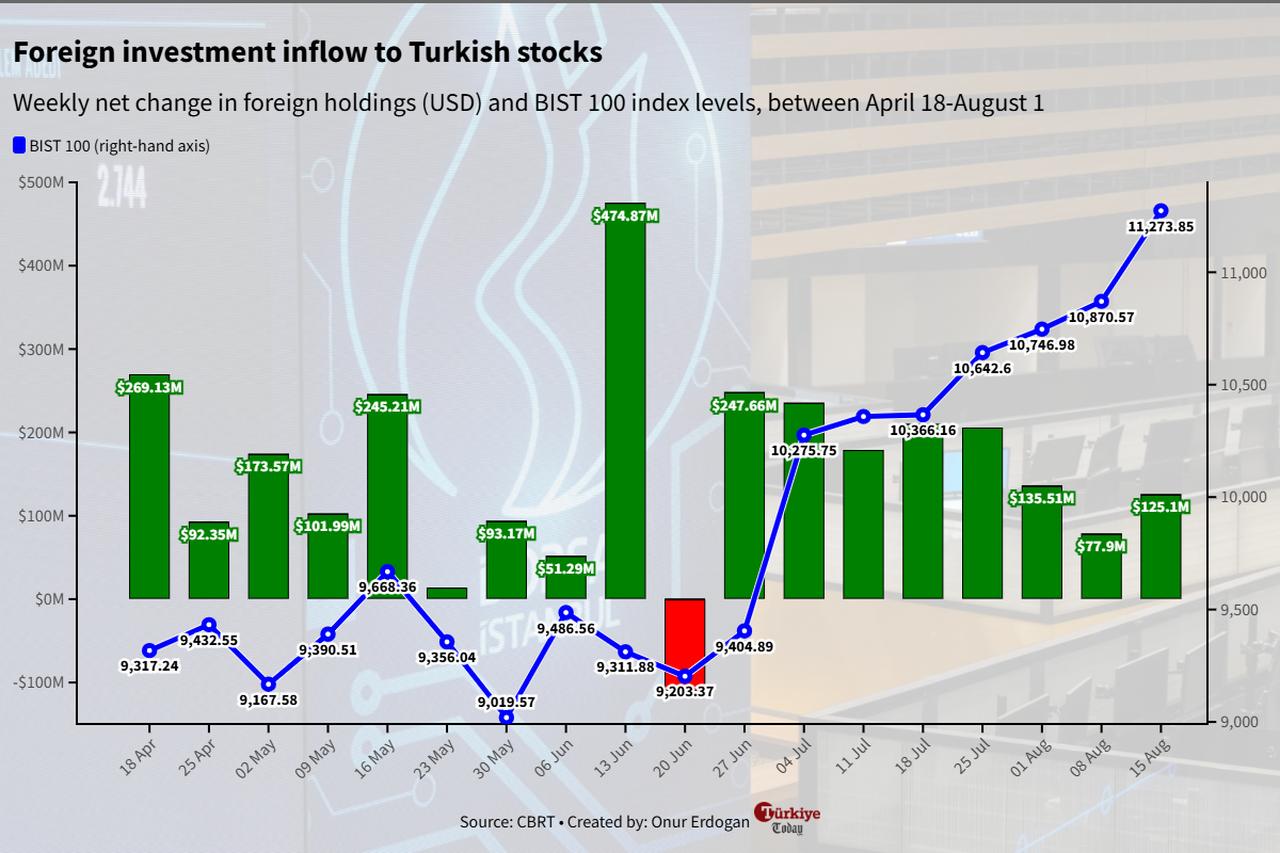

The upward trend in net foreign holdings of Turkish stocks has continued since April 18, with the only exception being a net outflow in the week ending June 20. According to central bank data, total inflows into Turkish equities have exceeded a net $2.8 billion as of the week ending Aug. 15.

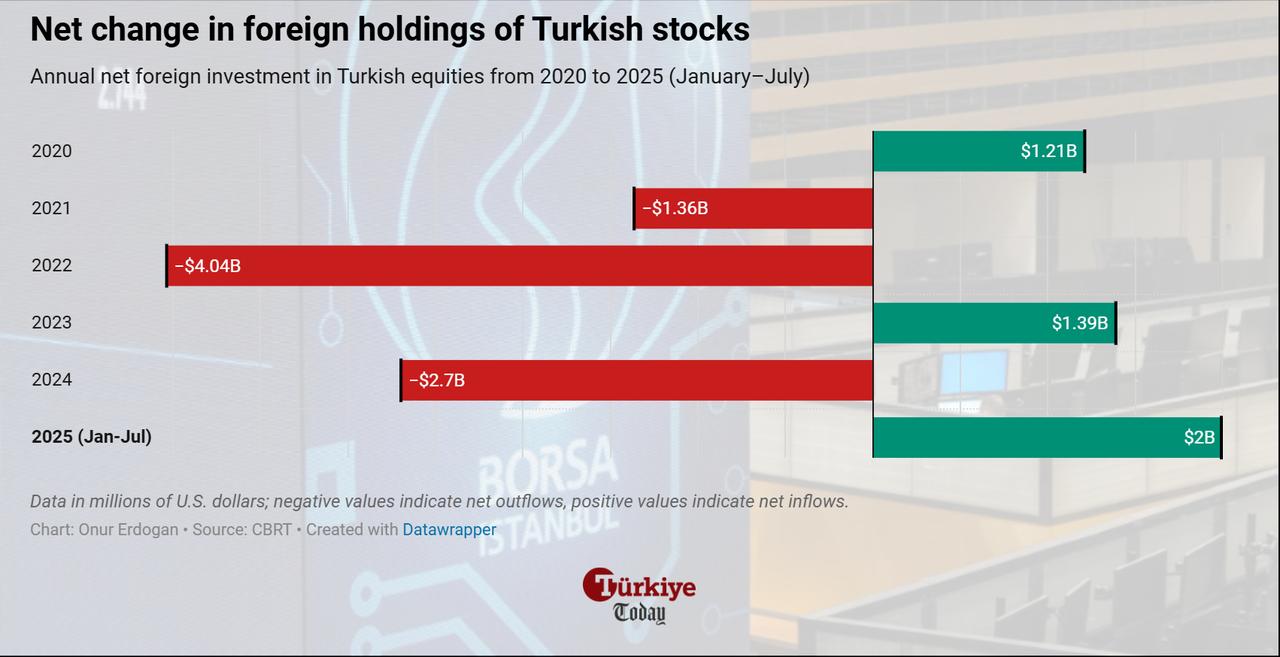

As a result, the net change in foreign holdings of Turkish stocks reached its highest level in recent years, surpassing $2 billion year-to-date by August.

The unprecedented surge in Istanbul stocks comes amid mounting financial strain on companies, as 42.4%—or 236 of 557 listed firms—reported net losses for the period covering March–June.

Among the top 10 companies, the steepest loss came from home appliances producer Vestel, a subsidiary of Zorlu Holding, which posted a ₺12.64 billion loss, nearly wiping out its market capitalization of ₺13.32 billion. Another home appliances producer, Arcelik, owned by Türkiye’s largest conglomerate Koc Holding, also reported a loss of ₺4.07 billion, reflecting rising costs, weakening domestic and export demand, intensifying competition from Chinese manufacturers, and ongoing restructuring efforts.

Energy companies dominated the loss list, as Zorlu Energy, another Zorlu Holding subsidiary, reported a ₺8.3 billion loss, while Mogan Energy posted ₺4.22 billion in losses. Alarko also ended the period with a ₺3.25 billion loss.

Petkim, one of Türkiye’s largest petrochemical firms owned by Azerbaijan’s state-run Socar, reported a ₺3.31 billion loss, primarily linked to its restructuring program. Similarly, Sasa, a leading chemical and polyester producer, posted a ₺8.83 billion loss due to sharply higher investment costs.

By contrast, Turkish banks led the profit charts with sharply rising revenues. Garanti BBVA topped the list with a ₺52.94 billion net profit, followed by state-run Vakifbank and Is Bank.

According to data from the Banking Regulation and Supervision Agency (BRSA), the Turkish banking sector as a whole posted a net profit of ₺422.5 billion in the first half of 2025.

In a research note following the central bank’s July rate cut, U.S.-based Goldman Sachs projected a “gradual rebound” in the sector beginning in the third quarter of 2025. However, Morgan Stanley warned that the latest rate cut increased the Turkish lira’s vulnerability, raising investor concerns about profitability compared with other currencies.

Outside the banking sector, Turkish Airlines was the only non-bank company to rank among the top 10 profit-makers, with a ₺25.01 billion net gain.