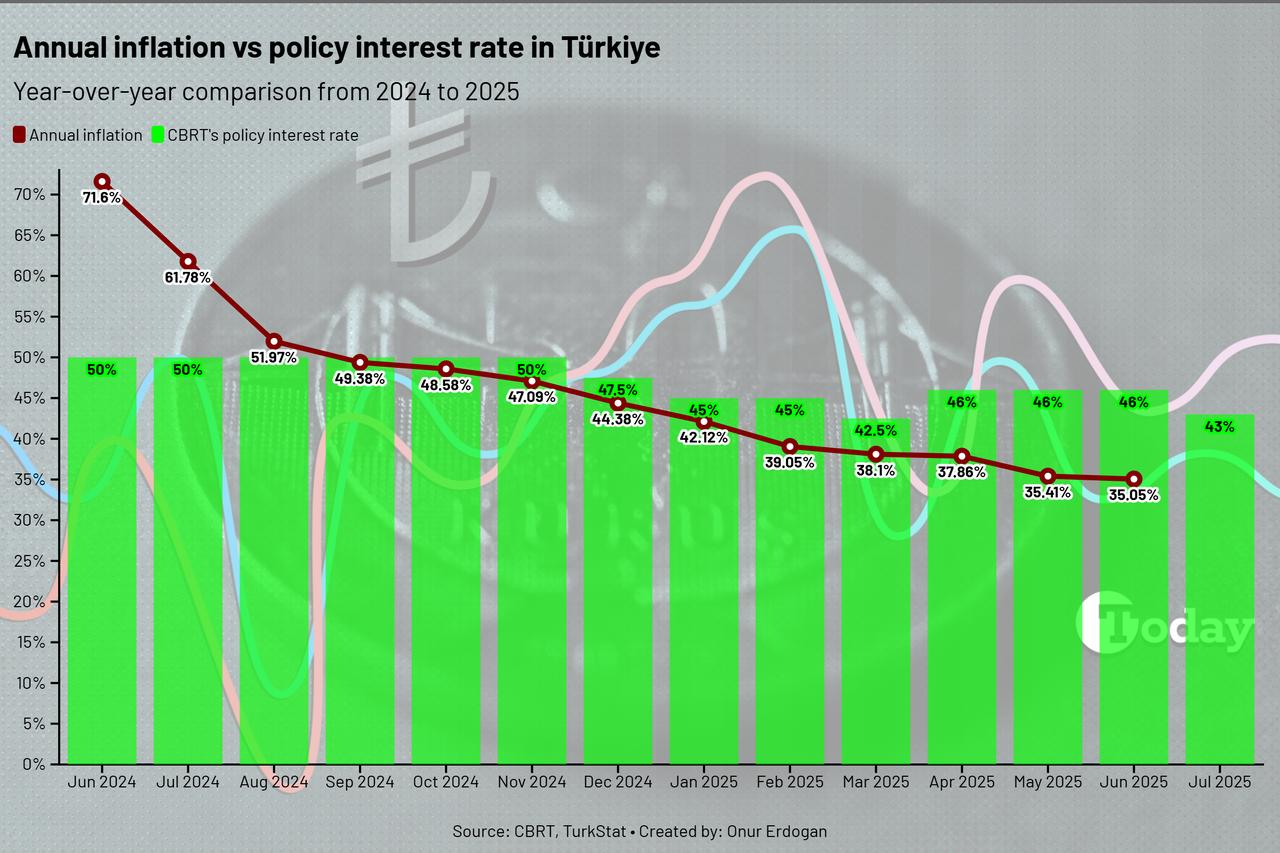

The Central Bank of the Republic of Türkiye (CBRT) lowered its policy rate by 300 basis points on Thursday, bringing it down to 43%.

The bank also lowered the overnight lending rate from 49% to 46%, and the overnight borrowing rate from 44.5% to 41.5%.

The decision aligns with market expectations, as the central bank’s July market survey had forecast a rate cut of at least 250 basis points, and marking a return to a potential interest rate cycle that paused in April due to global and domestic market downturn.

The Turkish central bank raised interest rates by 350 basis points to 46% at its April meeting, increasing the overnight lending rate to 49%, following a rate-cut cycle that began in December and lowered the policy rate from 50% to 42.5% over three consecutive 250-basis-point cuts.

In a press release following the Monetary Policy Committee (MPC) meeting, the central bank said the underlying trend of inflation remained flat in June, while preliminary data pointed to a temporary increase in monthly inflation in July due to month-specific factors.

Türkiye's annual inflation fell to 35.05% in June, marking the 13th consecutive month of decline. Monthly consumer price inflation stood at 1.37%, according to TurkStat.

In its latest inflation report released in May, the central bank maintained its year-end inflation forecast at 24%.

The bank noted that recent data indicate an increasing disinflationary effect from domestic demand conditions. It also emphasized that the potential impact of geopolitical developments and rising protectionism in global trade on the disinflation process is being closely monitored.

"The tight monetary policy stance, which will be maintained until price stability is achieved, will support the disinflation process through moderation in domestic demand, real appreciation in Turkish lira, and improvement in inflation expectations," the central bank said.

The bank also signaled a more accommodative stance going forward, implying that further rate reductions may be considered depending on the inflation outlook.

In its statement, the Monetary Policy Committee emphasized that future policy rate decisions will be guided by both realized and expected inflation, as well as the underlying trend, in a manner that ensures the level of monetary tightness necessary to stay on course with the projected disinflation path.

Meanwhile, Türkiye's stock exchange, Borsa Istanbul, responded positively to the decision, with the benchmark BIST 100 index climbing 1.5% to close at 10,750 points. Total trading volume reached $3.71 billion, reflecting increased investor confidence.

The banking index outperformed the broader market, rising more than 2%, as expectations of stable monetary policy and easing financial conditions lifted sentiment in the financial sector.