Türkiye’s stock exchange closed a sluggish and volatile year shaped by tight monetary policy and political turmoil, with the benchmark BIST 100 index failing to deliver returns that outpaced annual inflation or the U.S. dollar.

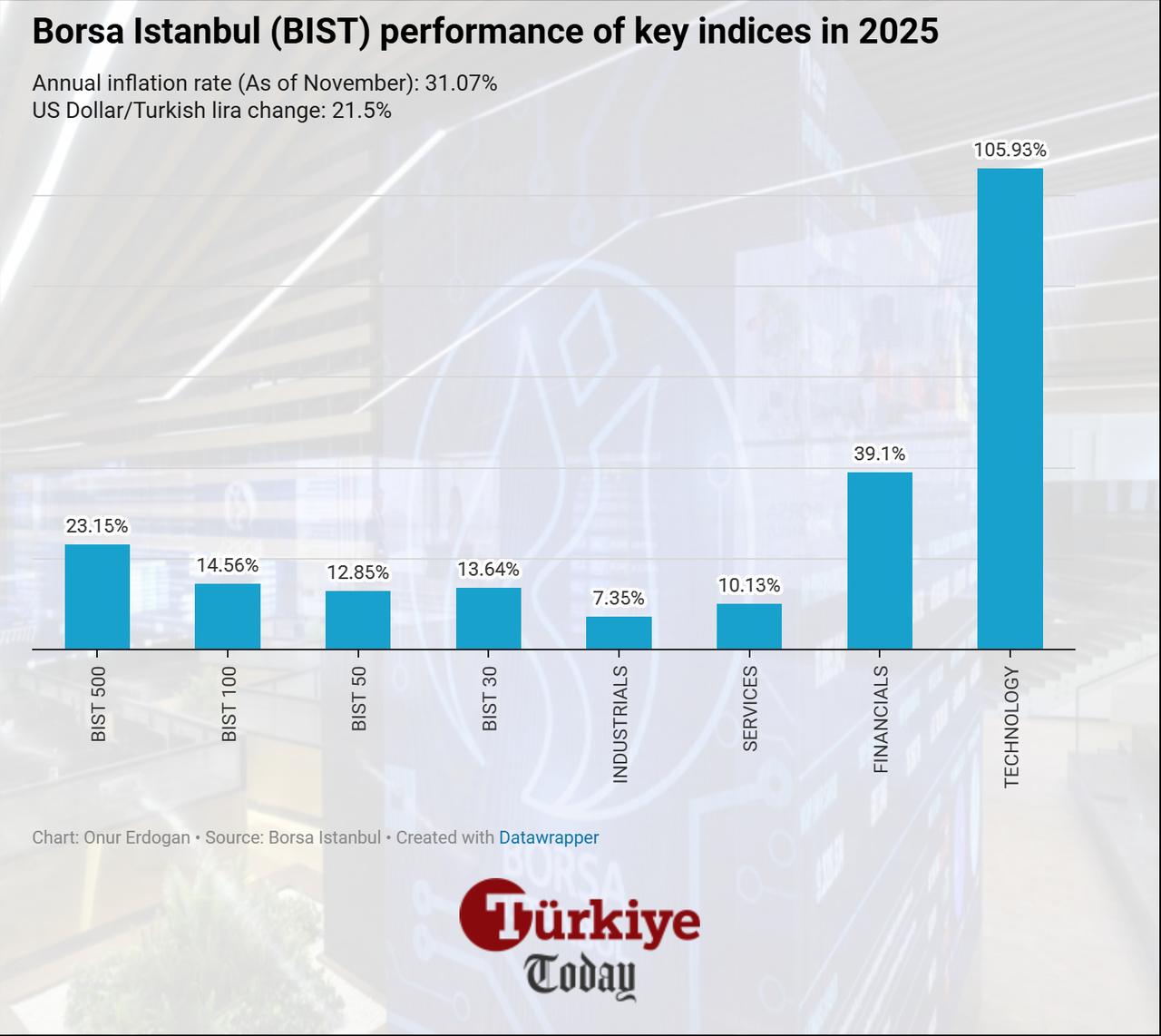

The index ended the Dec. 31 session at 11,261.52 points, marking a 14.56% year-over-year increase, falling short of annual inflation by 16.54% and trailing the Turkish lira’s depreciation against the U.S. dollar by 6.94%.

The BIST 100 hit a low of 8,872.75 during the year, while reaching a record high of 11,605.30. Total market capitalization of Borsa Istanbul reached ₺15.51 trillion ($361.53 billion), with the BIST 100 accounting for ₺10.64 trillion ($247.69 billion) of that amount.

The average daily transaction volume across Borsa Istanbul stood at ₺172.22 billion ($4.35 billion).

Among other benchmark indices, the BIST 30 rose by 13.64% in 2025, while the BIST 50 gained 12.85%. The broader BIST 500 outperformed with a 23.15% increase over the same period.

In terms of sector performance, financials and technology stood out with annual gains of 39.1% and 105.93%, respectively. In contrast, industrials and services underperformed even the BIST 100, with increases of just 7.35% and 10.13%.

All sub-sectoral indices ended the year higher except for sports, non-metal mineral products, and metal products and machinery, which fell by 35.13%, 7.87%, and 4.37%, respectively. The top gainer was leasing and factoring, surging by 376.58%, followed by brokerage houses at 108% and mining at 73.77%.

Foreign investor inflows into equities totaled $1.98 billion for the year, the highest on record, according to the latest available data as of Dec. 19, 2025.

In March, when a corruption probe targeting then-Istanbul Mayor Ekrem Imamoglu triggered a market downturn, non-resident outflows reached $399 million, followed by $377 million in April.

However, as the turbulence began to ease in May, foreign investors returned, remaining net buyers for four consecutive months and contributing $2.7 billion in inflows. The renewed appetite drove a sharp rally, lifting the BIST 100 by nearly 30% from its low to a record high in September.

Heading into 2026, markets are bracing for a more optimistic tone, with the Turkish central bank’s ongoing easing cycle and improving disinflation outlook expected to alleviate financial pressures under tight monetary conditions.