The Central Bank of the Republic of Türkiye (CBRT) has released its 2026 monetary policy schedule, outlining the dates of its Monetary Policy Committee (MPC) meetings and planned economic reports, while also providing an overview of its policy actions in 2025.

According to the published calendar, the CBRT will hold eight MPC meetings next year and will publish four inflation reports and two financial stability reports, mirroring the previous year’s schedule.

The meetings are scheduled for January 22, March 12, April 22, June 11, July 23, September 10, October 22, and December 10, while the inflation reports will be released on February 12, May 14, August 13, and November 12, and the financial stability reports on May 22 and November 27.

In its assessment for 2025, the central bank underscored its core objective of ensuring and maintaining price stability, which it defined as a prerequisite for sustainable growth and enhanced societal welfare.

The CBRT reaffirmed its commitment to inflation targeting, keeping the official inflation goal at 5%, as agreed with the government. The statement noted that the uncertainty band, which defines the permissible deviation around the inflation target, remains at 2 percentage points in both directions, unchanged from previous years.

Policymakers emphasized that all policy tools will be used decisively in pursuit of price stability, while financial stability will continue to be considered a supportive factor.

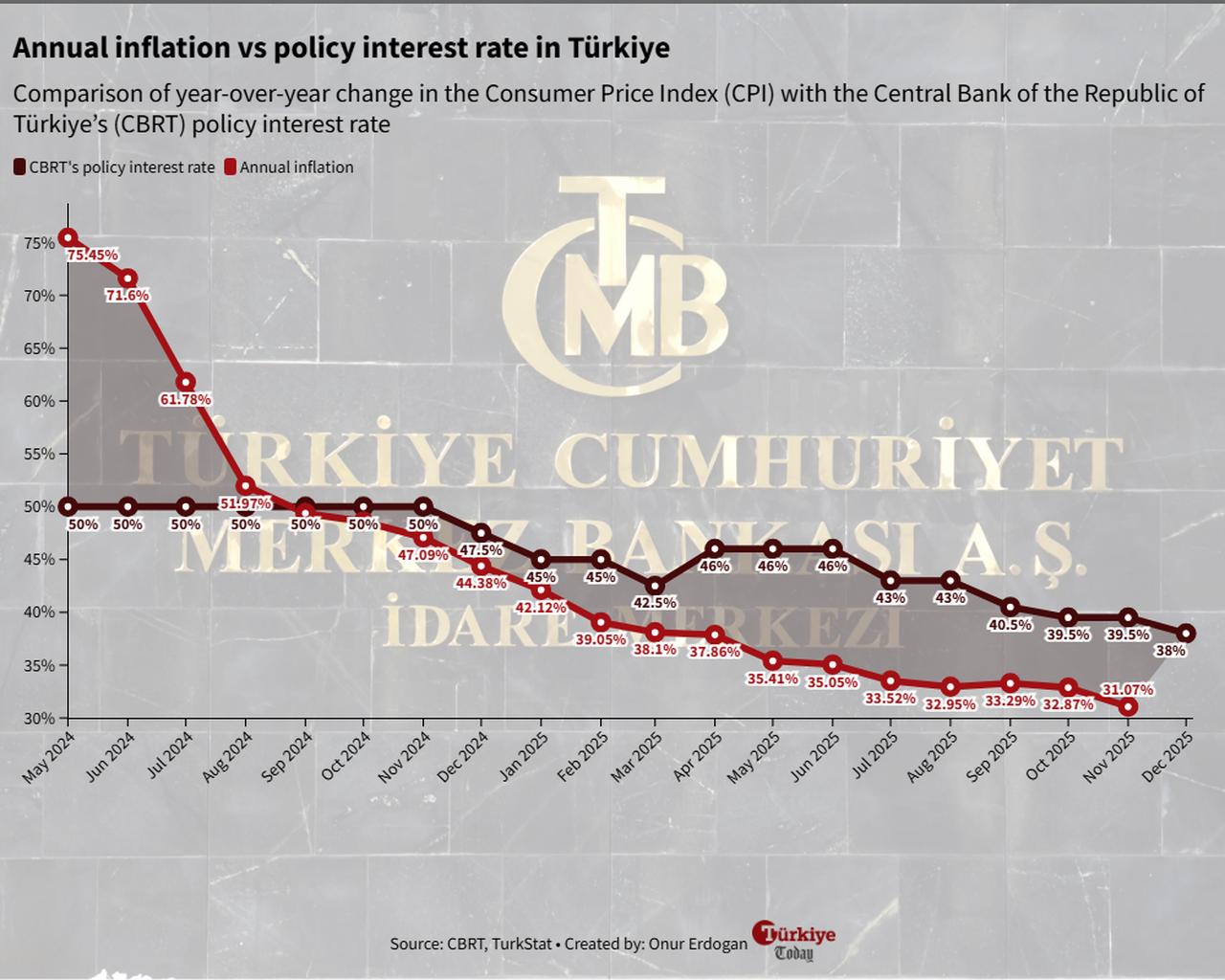

The CBRT began 2025 with a total of 500 basis points of rate cuts over three consecutive meetings, bringing the policy rate down to 42.5% by March. However, amid heightened market volatility in March and April, the bank raised the policy rate to 46% in April to safeguard the disinflation process from potential disruption. After keeping the rate unchanged in June, it resumed easing in subsequent meetings, cutting the policy rate by an additional 800 basis points to 38% by December 2025.

Closing 2024 at 44.38%, Türkiye’s inflation declined to 31.07% by November, maintaining a downward trend throughout the year with the exception of September.

The CBRT said it would maintain a macroprudential policy framework prioritizing Turkish lira deposits and long-term external borrowing in 2026.

Under the latest measures, the monthly credit growth cap for Turkish lira commercial loans was set at 2% for SMEs, 2.5% for specific SME segments, and 1.5% for other firms, while the cap for foreign-currency loans was cut from 1.5% to 1%, and then to 0.5%.

The central bank also noted that it had allocated ₺45.7 billion ($1.06 billion) in loans through the Investment Commitment Advance Loan (YTAK) program as of December 12, aiming to support long-term, productivity-enhancing investments. In addition, it reported that rediscount credits, low-cost financing instruments designed to boost export competitiveness, totaled ₺965 billion ($22.47 billion) throughout 2025, benefiting exporters and firms generating foreign currency income.

The CBRT also set a nominal limit of ₺450 billion ($10.48 billion) for its 2026 Open Market Operations (OMO) portfolio, representing a ₺188 billion increase from its current size. According to economists at QNB Türkiye, this planned level of purchases amounts to roughly 5% of the Treasury’s 2026 borrowing target and is therefore unlikely to function as a major source of monetary expansion or have a strong impact on interest rates.

Meanwhile, the policymakers also reiterated that the bank has no target level for exchange rates and does not intend to conduct foreign exchange purchases or sales to influence the direction or level of the lira.

Stressing the importance of strengthening international reserves for effective monetary policy and financial stability, the central bank also stated that it would continue efforts to boost reserve levels as a key component of its policy framework. The CBRT's gross international reserves stood at $190.8 billion, while net reserves excluding swaps had increased by $20.8 billion since the start of the year, reaching $66 billion as of December 12.