Persistent inflation inertia is considered a "low probability" in 2026 under the disinflation program, as the government targets an annual inflation range of 13% to 19% by year-end, Türkiye’s Treasury and Finance Minister Mehmet Simsek told global investors during meetings in London and New York this week.

"Services inflation has declined from 90.7% in 2023 to 44% in 2025; therefore, this is unlikely to be the case," Simsek said, addressing concerns over sticky inflation that can slow the pace of price easing, while also pointing to favorable domestic conditions created by the government’s program and external factors.

Türkiye's inflation closed 2025 at 30.89%, down from the previous year's 44.38%, slightly above the government's forecast at 28.5%.

Simsek shared Türkiye’s 2026 outlook during a high-level investor roadshow across London and New York, where he met with over 800 institutional investors managing a combined $88 trillion in assets.

The meetings, including 15 sessions held over two days in New York, focused on macroeconomic stability, disinflation progress, and the country’s medium-term economic framework.

According to the presentation shared by the ministry, Simsek outlined several measures to support disinflation. The central bank continues to maintain a tight monetary stance, while fiscal and income policies are aligned to avoid demand-side pressures.

On the supply side, Simsek pointed to expanded housing supply, investments in irrigation and food logistics, and ongoing construction in earthquake-affected regions as key factors contributing to easing price pressures.

Surveys conducted by the central bank also show that expectations are improving across households and market participants, he underscored.

While progress is being made, Simsek acknowledged several risks that could complicate the disinflation process. These include persistent services inflation inertia, which remains elevated despite recent declines; potential volatility in global risk appetite; sudden increases in oil prices; and extreme weather events affecting food supply and prices.

Simsek noted that the IMF forecasts Brent crude prices to decline to $65.84 in 2026, which he described as a positive factor for Türkiye, as it would help ease the country’s annual energy bill, currently around $60 billion.

Nonetheless, external shocks remain a key concern for policymakers, even as the government views these risks as manageable in its baseline scenario.

Simsek also emphasized Türkiye’s focus on fiscal consolidation. The government aims to keep the general government budget deficit at 3.5% of GDP by 2026, higher than 2025's estimated 2.9%. The primary budget balance is projected to stabilize near zero.

This effort is underpinned by tighter spending controls, reduced tax expenditures, and increased revenues through privatization. In 2025, the government generated $10.2 billion in asset sales, including telecom licenses, vehicle inspections, energy facilities, and infrastructure concessions. Broader fiscal reforms are underway, including changes to public procurement rules, tax simplification, and enhanced transparency.

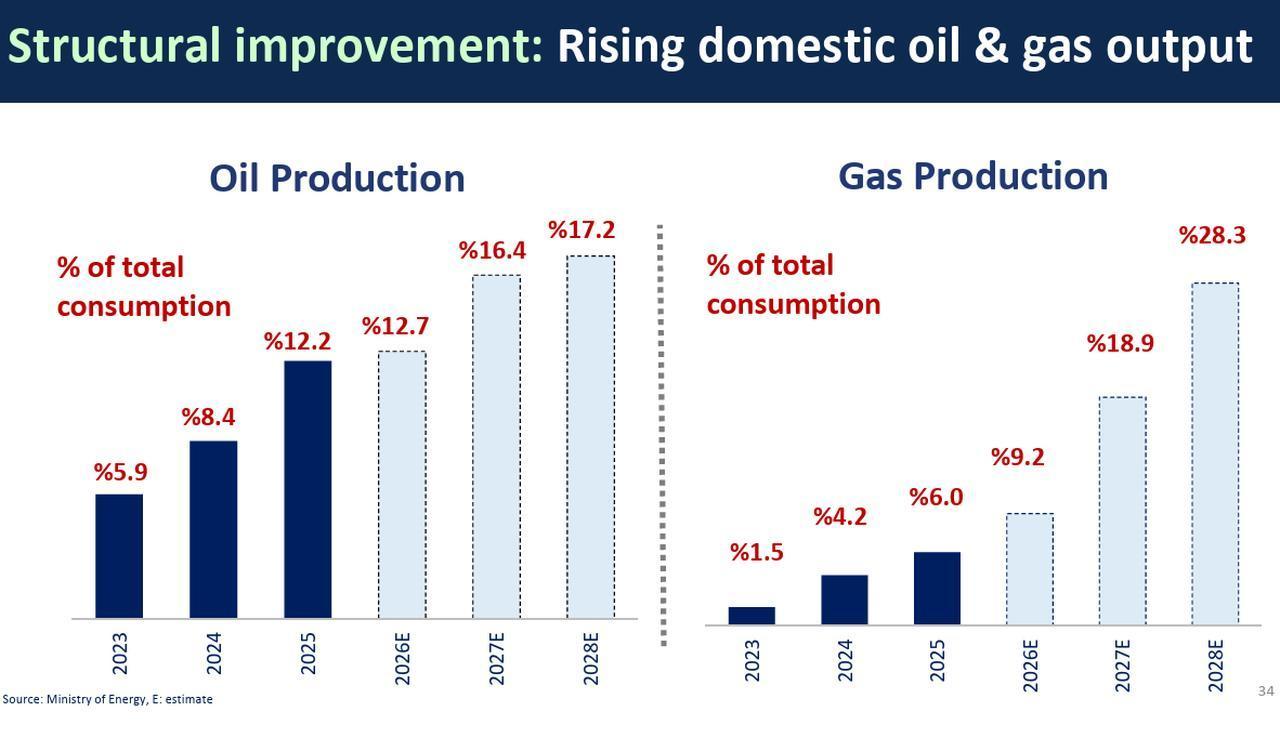

Simsek presented Türkiye’s energy policy as a key element of its strategy to reduce external vulnerabilities. Domestic natural gas production is projected to meet nearly 30% of national demand by 2028, helping to lower energy imports. Renewable energy and nuclear development are expected to attract $99 billion in investment by 2035.

He also drew attention to the rise in services exports, which reached an annualized $122.1 billion as of November 2025, supporting the country’s external balance.

Simsek said Türkiye is expanding its logistics infrastructure to support trade, with railways linking industrial hubs to ports being rapidly developed.

The country currently operates 287 freight lines totaling 446 kilometers, with 9 lines (151 kilometers) under construction, 10 (82 kilometers) ready to be built, and 17 (189 kilometers) in the planning stage. These efforts aim to better connect industrial zones with ports and strengthen trade links across Eurasia.

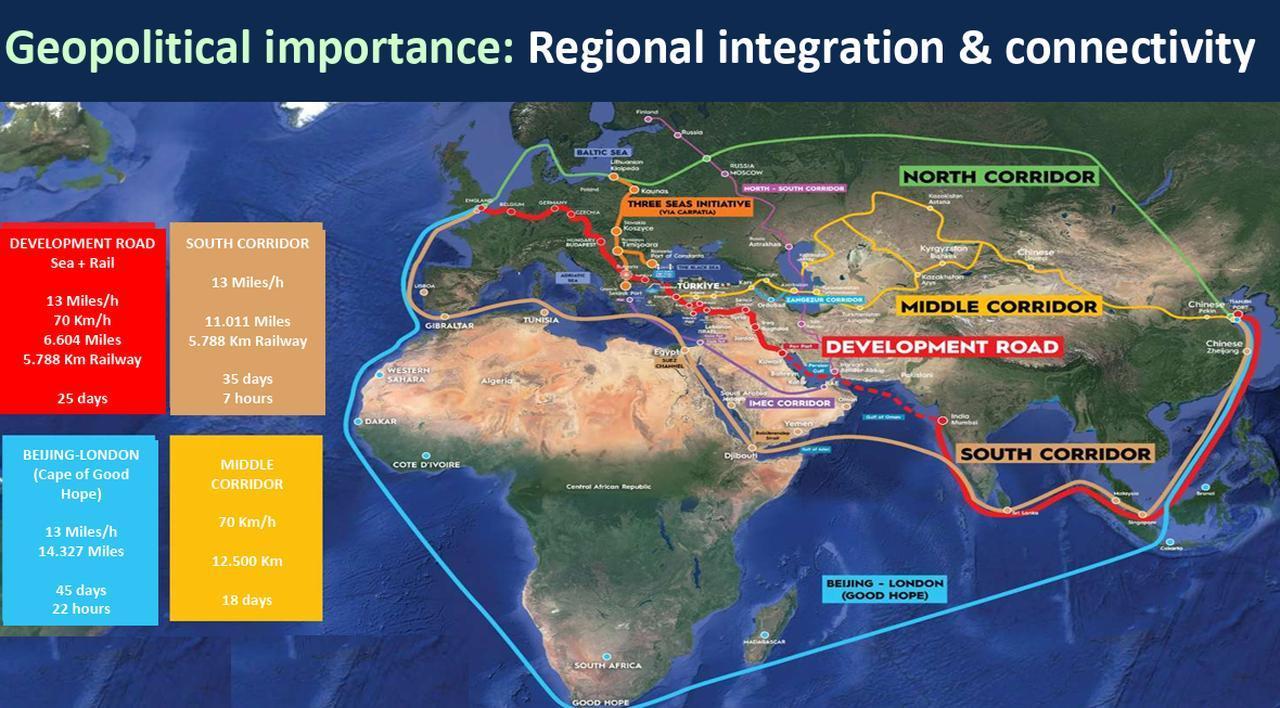

Simsek addressed the shifting dynamics in global trade, noting that China is increasingly rerouting its exports away from traditional maritime channels toward overland routes, particularly those running through Central Asia and Türkiye.

Türkiye plays a central role in several emerging trade routes, Simsek said, positioning the country as a key link in global supply chains. The Middle Corridor offers an 18-day overland route from China to Europe, while the Development Road connects Türkiye to the Gulf via Iraq.

Türkiye also features in the South Corridor and the India–Middle East–Europe Corridor (IMEC), reinforcing its role in both east–west and north–south logistics.

Building on this geostrategic context, Simsek underscored Türkiye’s growing geopolitical relevance. He pointed to strengthening ties with the United States and rising European reliance on Türkiye in the defense sector, reflecting a broader alignment with Western partners.

He also cited signs of regional stabilization. Syria, he noted, appears to be entering a more stable phase, while a ceasefire in Gaza remains in effect. Diplomatic engagement between Armenia and Azerbaijan is progressing, and Simsek added that an eventual resolution to the Russia–Ukraine conflict seems more plausible than in previous years.

Türkiye is set to host both the NATO and COP31 summits in 2026, a reflection, Simsek said, of the country’s elevated international standing.

With more than 80% domestic defense industry sufficiency and the second-largest military in NATO, Türkiye continues to present itself as a reliable partner in both regional security and global economic integration.