Türkiye’s benchmark BIST 100 index climbed to 10,926 on Monday, reaching its highest level in four and a half months as better-than-expected July inflation boosted optimism over a continued rate-cut cycle.

The index closed the session at 10,853, up 1%, with a trading volume of $4.6 billion, erasing all losses sustained since the market volatility in March.

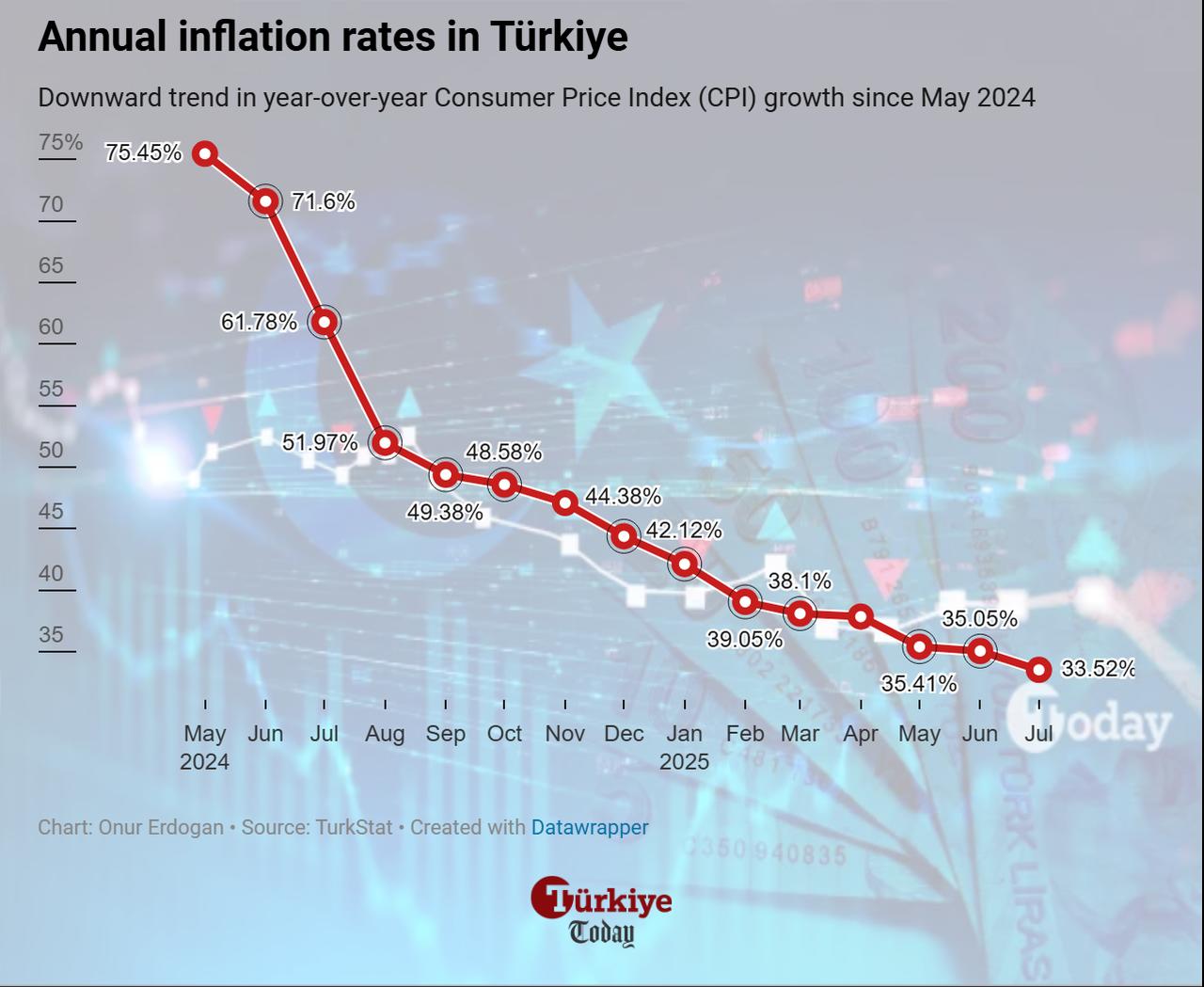

Consumer prices rose by 2.06% in July, driven by falling clothing prices and moderate food cost increases despite mid-year price revisions, bringing the annual inflation rate down to 33.52%—its lowest level since November 2021.

All major sectoral indices closed higher, as the technology index rose 1.75%, the financials index gained 1.08%, the services index added 1.12%, and the industrials index increased 0.81%. The liquid banking index recorded the strongest gain, rising 1.8%.

Out of the 100 stocks listed on the BIST 100 index, 71 advanced, 27 declined, and 2 ended flat. The most actively traded stocks were Turkish Airlines, Akbank, Yapi Kredi Bank, Is Bank (C), and Koc Holding.

On the exchange rates, the Central Bank of the Republic of Türkiye (CBRT) set the effective USD rate at 40.5656 for buying and 40.7282 for selling.

Following the latest inflation data, expectations for a policy rate cut by the central bank have gained momentum.

Market analysts suggest that if the consumer inflation data for August also remains subdued, the Monetary Policy Committee may consider reducing the benchmark interest rate by up to 300 basis points in its September meeting.

New York-based investment bank Goldman Sachs said in a research note that the Turkish central bank’s resumption of rate cuts could ease margin pressure on banks and act as a catalyst for recovery, with sector profitability expected to gradually rebound from the third quarter of 2025.

The Turkish central bank resumed interest rate cuts at its July meeting with a 300-basis-point reduction, lowering the policy rate to 43%.