California-based chipmaker Nvidia announced Tuesday that it will resume sales of its H20 artificial intelligence chips to China, following a U.S. government decision to ease export restrictions.

The company has started filing license applications and expects to begin deliveries shortly, as the U.S. government has assured that licenses will be granted, according to its statement.

Nvidia had designed the H20 chip as a less powerful alternative to its flagship AI processors, specifically for the Chinese market. However, export plans were disrupted after the U.S. tightened licensing rules in April under restrictions on advanced semiconductor shipments to China, following a tariff standoff between the two countries.

The suspension of H20 exports had also carried financial consequences for the company, leading it to reduce the value of unsold inventory by $5.5 billion.

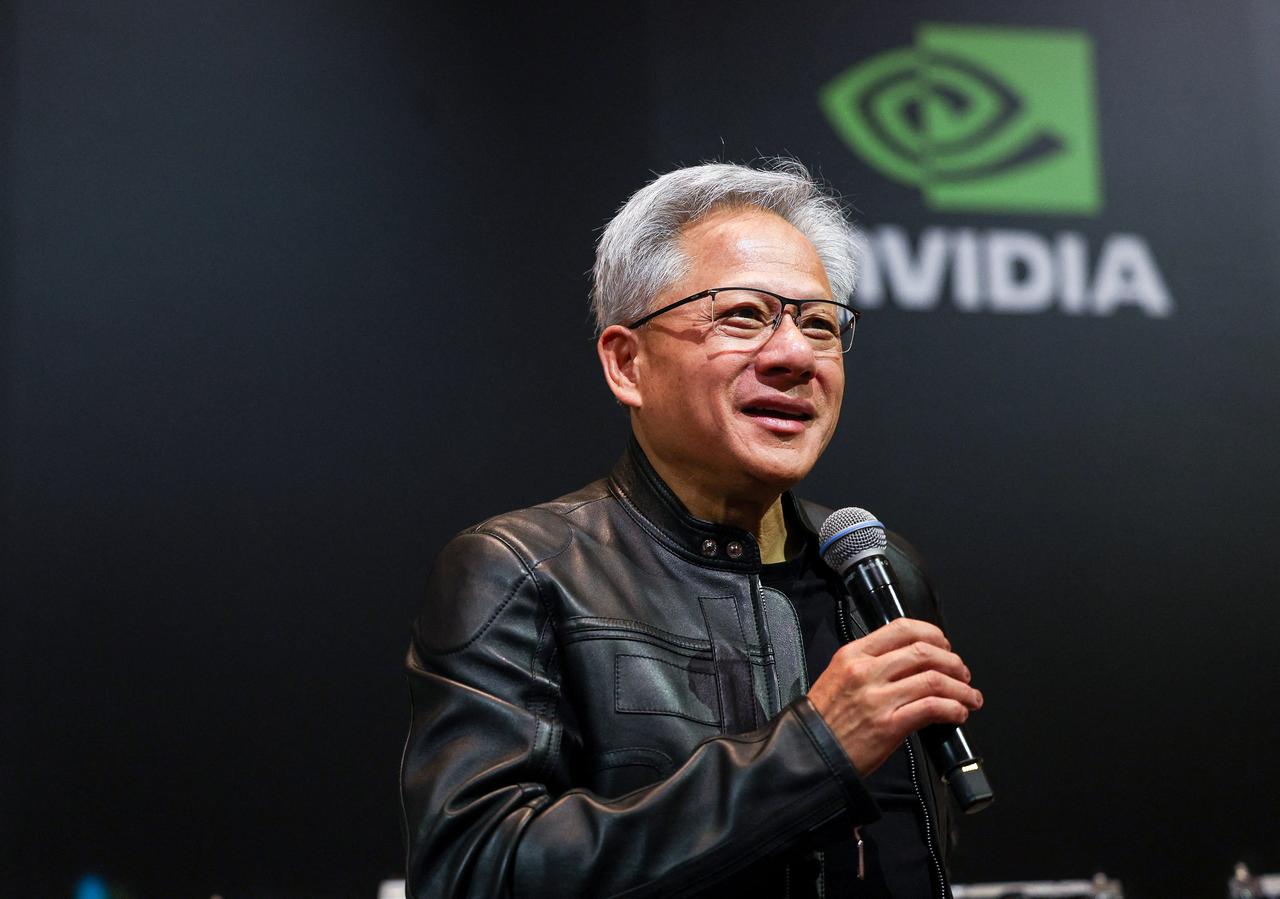

Nvidia CEO Jensen Huang confirmed the development in a video broadcast by Chinese state television CCTV, saying the firm is "very happy" to resume shipments to China.

Huang is expected to appear at the opening of the third China International Supply Chain Expo in Beijing on July 16, according to CCTV. The event is organized by the China Council for the Promotion of International Trade, a government-affiliated body under the commerce ministry. This will mark Huang’s third visit to China in 2025.

CCTV also reported that Huang will participate in various activities during the expo, which brings together international stakeholders in manufacturing and technology supply chains.

Despite mounting restrictions, China continues to represent a major market for Nvidia. However, the company has faced increasing competition from domestic firms, including Huawei, as Beijing seeks to boost its own technological capabilities.

In a meeting with Chinese Vice Premier He Lifeng in April, Huang expressed a long-term commitment to the Chinese market and emphasized Nvidia’s intention to support U.S.-China trade relations. Chinese state media agency Xinhua quoted him as saying he is willing to "play a positive role" in bilateral economic cooperation.

In the fiscal year ending Jan. 26, the Chinese market contributed $17 billion in sales—equivalent to 13% of the company’s global revenue—according to the world's largest publicly traded company with a market cap exceeding $4 trillion on Wall Street.