Türkiye’s economic authorities’ orthodox policies have come under pressure recently as the slowing disinflation path raises questions about the effectiveness of the current policy framework, with business figures close to the government publicly criticizing still-elevated inflation despite long-standing tightening.

Türkiye returned to orthodox economic policy in mid-2023, shifting toward tighter monetary measures such as higher interest rates in an effort to restore price stability and rebuild investor confidence after earlier policies kept borrowing costs low despite inflation rising as high as 85.5% in 2022.

Taking his seat as the Turkish economy’s new driver following the general elections, Treasury and Finance Minister Mehmet Simsek ushered in the program with his words marking the shift, stating that "Türkiye has no choice but to return to a rational ground," leading a period of financial bottleneck for Turkish businesses as the policy rate remained at 50% for over one year.

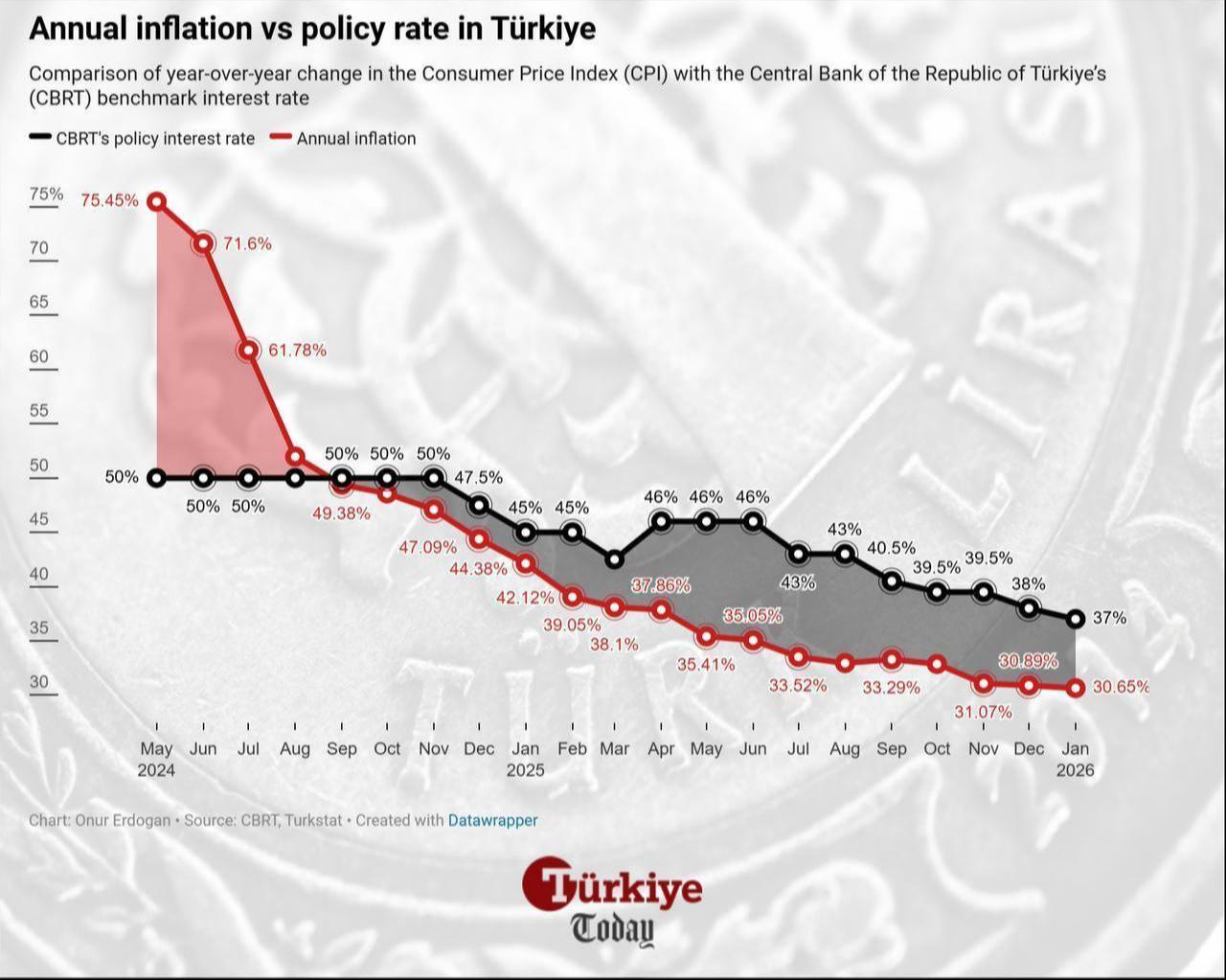

After nearly three years of the bitter prescription, Simsek’s team and policymakers at the Turkish central bank succeeded in bringing inflation down to 30.65% as of January 2026, from its peak of 74.5% at the end of the program’s first year in May 2024. However, stubborn price pressures in the services sector and nationwide food supply shocks continue to weigh on the disinflation process, limiting room for faster rate cuts and delaying relief for the real economy.

Türkiye’s central bank recently raised its inflation forecast range for 2026 to 15%–21% and signaled caution over further rate cuts, highlighting ongoing uncertainty over the inflation outlook. Following the update, policymakers were brought under the spotlight for their cautious tone, signaling a possible pause at the March meeting or a limited interest rate cut from the current 37%.

Burhan Ozdemir, chairman of the Independent Industrialists’ and Businessmen’s Association (MUSIAD), a business group aligned with pro-government business circles, said inflation can no longer be brought down solely through tight monetary policy or the central bank’s actions, arguing that deeper structural issues now drive price pressures.

"It is not normal to drink the same tea for 500 lira in one place and 5 lira in another. There is no such price gap anywhere in the world," Ozdemir told Turkish news outlet Nefes, criticizing what he described as a lack of effective pricing discipline across the economy.

He said the tightening program implemented over the past two to three years had removed inflated costs and pessimistic expectations built up before the elections but warned that further tightening alone would not resolve inflation.

"At this point, tightening monetary policy, tightening belts, and restricting financing will not deliver results, because the problems are structural," Ozdemir said, adding that coordinated policies across industry, agriculture, trade, and finance institutions are needed to address persistent inflation in housing and food sectors.

Before the release of last week’s inflation report, the pro-government newspaper Yeni Safak, widely seen as one of the strongest media voices advocating a shift toward heterodox policies and sharply critical of the current framework since its implementation, stepped up its criticism of the central bank’s cautious easing cycle and high interest rates.

Following the policy decision, which delivered a lower-than-expected 100-basis-point rate cut to 37% amid January’s uptick in inflation, the newspaper slammed the move as maintaining a restrictive stance despite signs of slowing inflation, running the headline "No such interest rate exists anywhere in the world."

It said the decision reflected an "overly cautious" approach and warned that the gap between inflation and interest rates continues to widen, arguing that "while inflation and interest rates move in parallel in advanced economies, the gap is widening in Türkiye."

It also pointed to growing strain across the real economy, saying tight financial conditions have drained companies’ working capital and forced more firms to seek legal protection from creditors.

Leading business representatives cited by the newspaper said high borrowing costs and limited access to credit have weakened investment and export competitiveness. Türkiye Exporters Assembly Chairman Mustafa Gultepe said firms are increasingly shrinking to survive, warning that "companies are now trying to survive by shrinking," and questioned the incentive to produce under current conditions, asking, "Why would anyone produce in an environment where interest rates remain at 37%–38%?"

Gultepe said meaningful relief would require much lower borrowing costs, adding that "there will be no real relief in the economy unless interest rates and inflation fall below 20%," and warned that without stronger rate cuts, economic conditions in 2026 may remain similar to the previous year.

Since November 2023, the weighted interest rate on Turkish lira commercial loans has remained above 50%, easing only slowly despite policy rate cuts, as strict credit growth limits continue to constrain lending. Monthly growth limits were set at 2.5% for SME loans and 1.5% for other commercial loans, while the cap on foreign currency loans was lowered to 0.5% for eight-week periods.