US stock markets closed the week with strong gains on Friday, buoyed by better-than-expected employment data and renewed optimism surrounding the resolution of the ongoing trade conflict between Washington and Beijing.

The tech-heavy Nasdaq Composite rose by 1.2%, or 231.5 points, to close at 19,529.95, while the S&P 500 climbed 1.03% to finish at 6,000.36. The Dow Jones Industrial Average, which tracks 30 of the largest U.S. companies, gained 1.05%, ending the session at 42,762.87.

The rally was supported by the U.S. Labor Department’s latest jobs report, which showed that non-farm payrolls rose by 139,000 in May, beating market forecasts of 126,000, suggesting that the labor market remains robust despite concerns about a broader economic slowdown. April’s job gain was revised down from 177,000 to 147,000.

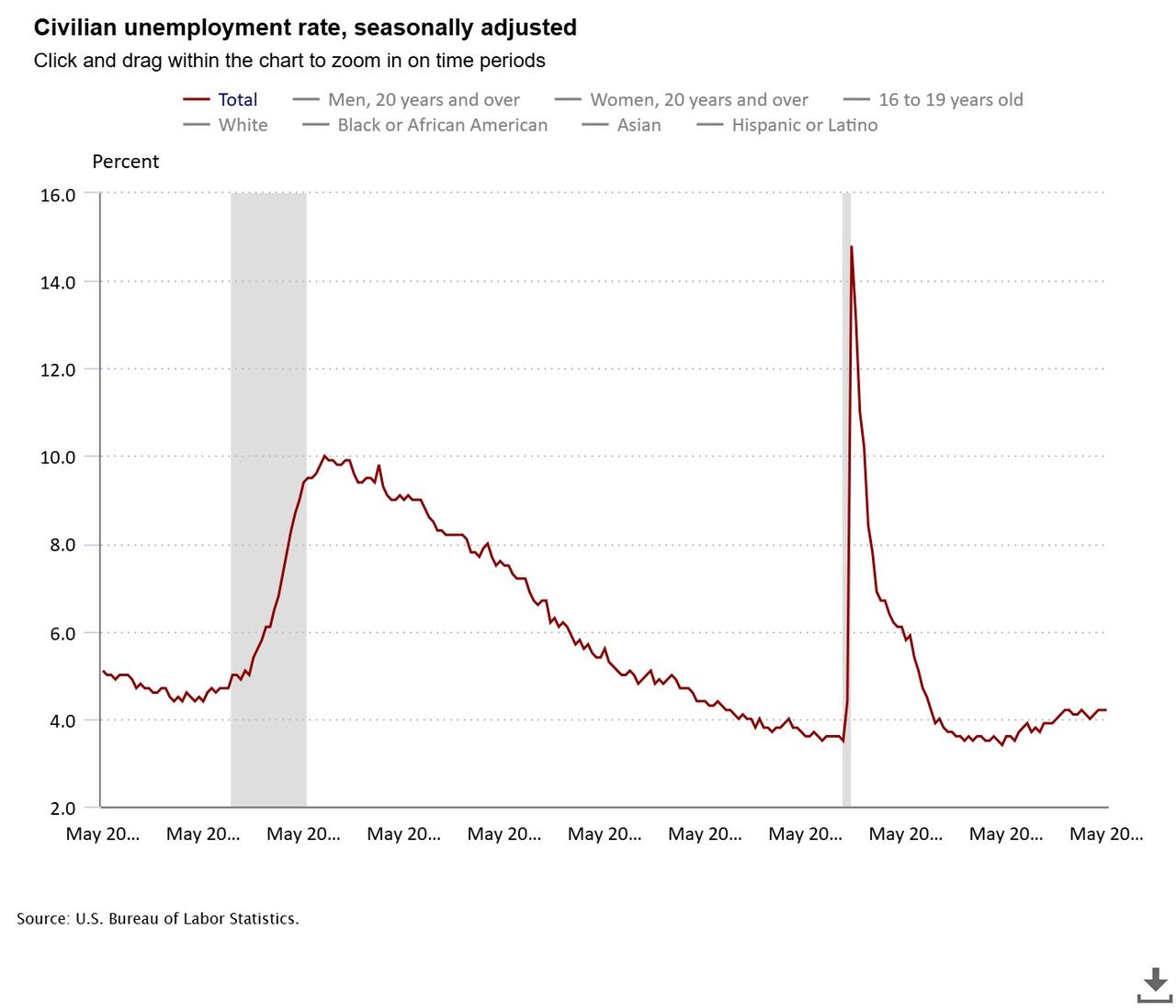

Employment growth was concentrated in healthcare, leisure and hospitality, and social assistance, while the federal government recorded further job losses. The unemployment rate held steady at 4.2%, in line with expectations.

The labor force participation rate dipped by 0.2 percentage points to 62.4%, and the employment-to-population ratio declined to 59.7%. Meanwhile, average hourly earnings increased by 0.4% from the previous month to $36.24, and marked a 3.9% rise year-on-year.

Investors were further encouraged by signs that bilateral negotiations between the world’s two largest economies could be back on track. Trump said on Friday that U.S. officials would meet their Chinese counterparts in London to discuss the trade deal.

The meeting will include Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and U.S. Trade Representative Jamieson Greer.

“The meeting should go very well,” Trump posted on Truth Social, following a 90-minute phone call with Chinese President Xi Jinping. He described the conversation as having “a very positive conclusion for both countries.”

The upcoming talks come after a May 12 agreement between the U.S. and China to suspend most tariffs for 90 days and reverse measures imposed since April. However, that accord quickly unraveled, with both countries accusing each other of failing to meet their obligations.

Trump has claimed that China did not uphold the terms of the agreement, while Beijing rejected the allegations as “groundless” and warned it would take strong countermeasures to defend its interests.

Tesla shares, which fell by around 14% on Thursday following a public dispute between CEO Elon Musk and President Trump, recovered by 3.67% to close the week. The previous drop wiped out nearly $150 billion in market value, but the partial rebound signaled improved investor confidence amid broader market strength.

During a public showdown on Thursday, Trump announced that government contracts linked to Musk's companies, particularly SpaceX’s collaboration with NASA, had been suspended over Musk’s sharp criticism of the Republican president’s proposed tax bill.