The amortization period has drastically decreased over the past five years in Türkiye, now averaging 13 years nationwide—down from 23 to 24 years—driven by unprecedented rises in both property and rent prices.

The figure is also reflected in housing demand, which demonstrated a huge boom during the first half of 2025, increasing by 26.9% compared to last year, reaching a total of 691,893.

In Türkiye’s top five major cities, the trend has been even more pronounced, as the figure dropped in Europe’s largest city, Istanbul, from around 20–23 years in 2021 to 16–19 years by 2024. Ankara showed one of the most stable improvements, narrowing from 15–18 to 14–17 years. Izmir recorded the sharpest drop, falling from 20–23 to 15–17 years.

Antalya, a popular tourism and real estate investment destination for foreigners—particularly Russians—saw a steady decline from 16–18 to 14–17 years, while Bursa maintained the highest amortization range among the five, decreasing from 19–22 to 17–19 years.

In 2022, amortization periods in Istanbul and Izmir peaked at 22 and 23 years respectively, while Antalya saw its lowest level that year at 14–16 years. By 2023, most cities showed signs of stabilization, with ranges in Istanbul and Bursa remaining at 18–21 years, and Antalya and Ankara aligning at 16–18 and 15–18 years, respectively. As of 2024, all five cities recorded their shortest return periods within the four years.

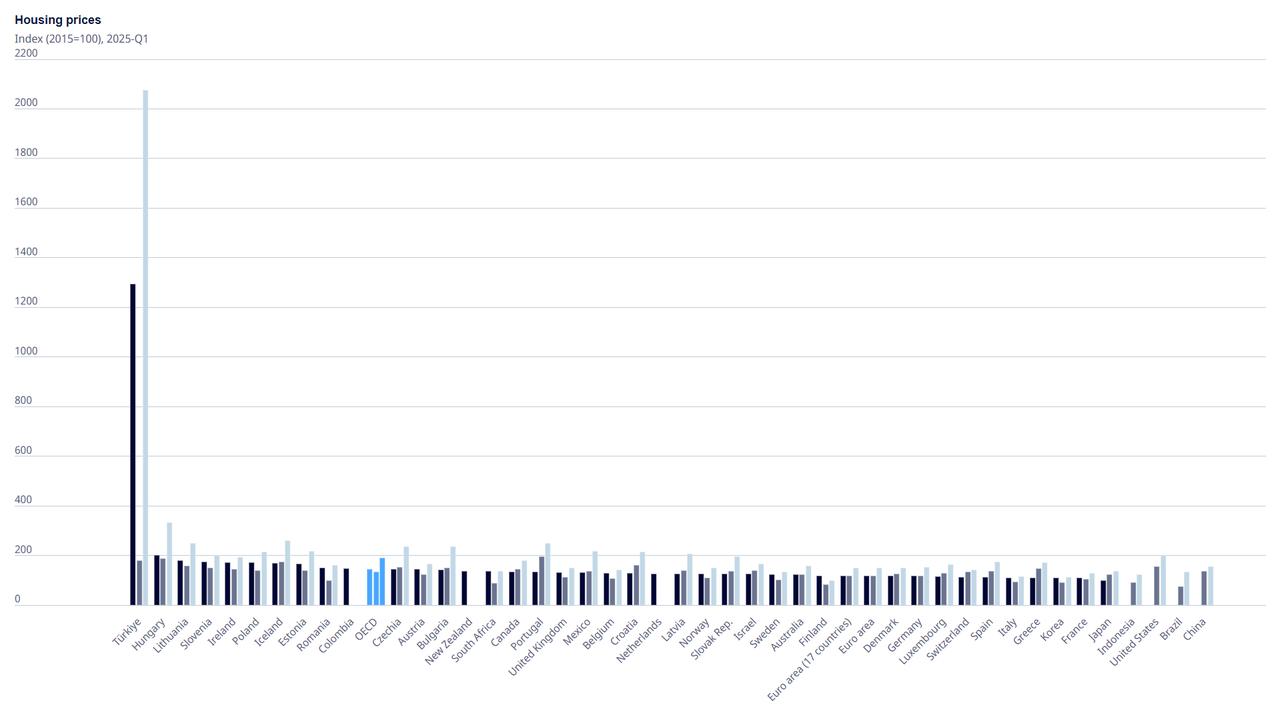

Türkiye still far outpaces all countries in nominal price increases over the decade, with prices multiplying over 20 times, according to the OECD’s Housing Price Index. It also leads in rent prices, which have risen 12 times during the period. In real terms, Türkiye ranks third in the housing price index.

Turkish central bank's Residential Property Price Index (RPPI) confirms the trend, as the index rose to 185.98 from 2015's 8.26 as of June, reflecting a nearly 22.5-fold increase.

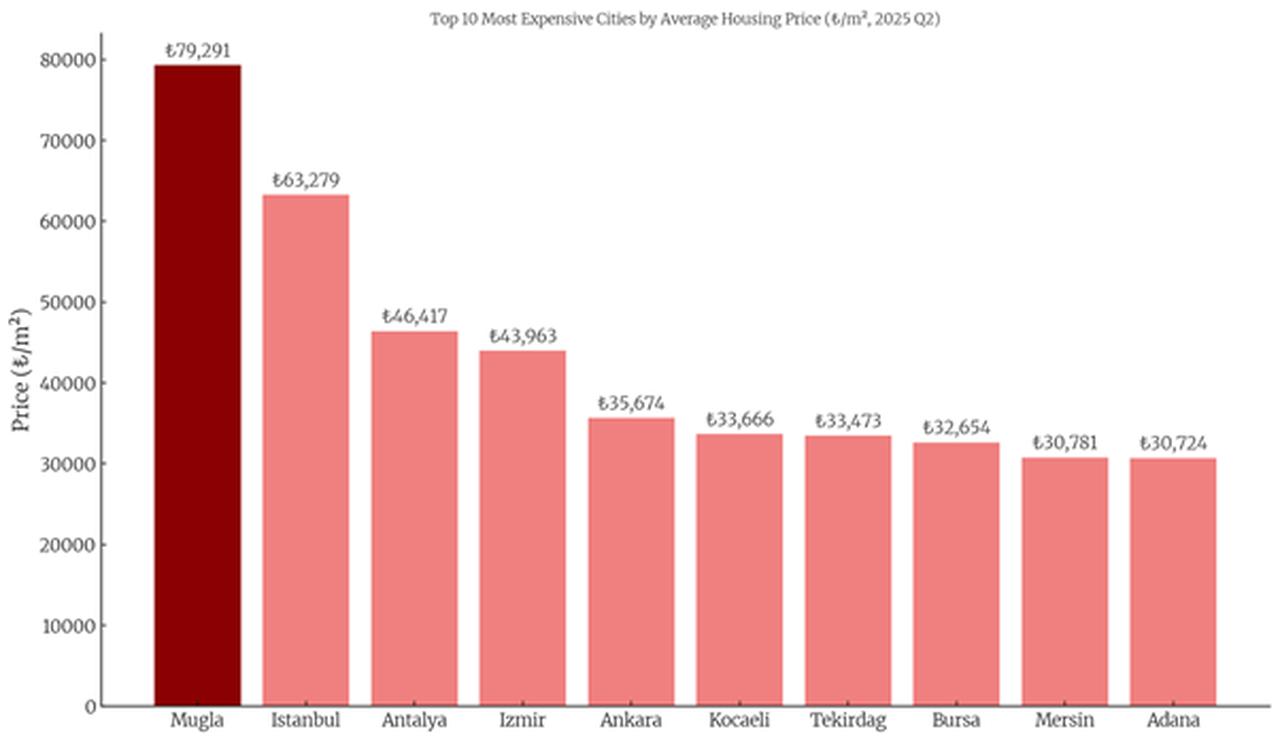

Meanwhile, in the second quarter of 2025, the average residential price per square meter across Türkiye rose to ₺39,738 ($982.29), according to the Turkish central bank. The most expensive province was Mugla at ₺79,291, followed by:

The average price per square meter in:

On the rental side, housing prices increased by 21.5% in the first half of 2025, according to AI-powered real estate price tracker Endeksa. When adjusted for inflation, rents rose by 4.4% in real terms during this period. On an annual basis, rents across Türkiye increased by 32.6% compared to June 2024, though they declined by 1.9% in real terms. The average rental price per square meter nationwide is calculated at ₺220, with the average monthly rent at ₺22,681.

This strong growth in rental prices—outpacing the rise in sale prices—has been a key driver behind the sharp decrease in amortization periods across the country.

Berk Unsal, an evaluation expert from the Industrial Development Bank of Türkiye, told Turkish news outlet Hurriyet that viable financing conditions and increasing demand have been instrumental in driving up dwelling prices in both city centers and suburbs. “During the pandemic, favorable financing conditions led to a surge in housing demand, especially in coastal areas and central districts of major cities, which caused rapid value increases,” he said.

“Since the second half of 2023, however, rising mortgage interest rates have both narrowed housing sales and limited the pace of price growth,” he added. Average housing loan rates have been hovering above 40% since mid-2023, according to the Turkish central bank.

Unsal emphasized that economic conditions, interest rate fluctuations, purchasing power, and volatility in housing prices have played a major role in changing return periods: “According to our study based on standard apartment types in the top 10 provinces with the highest home sales, amortization periods have steadily shortened in favor of buyers year by year,” he said. “The average return period across these 10 cities has now reached its lowest level in the past five years.”

The situation has ultimately benefited homeowners, as amortization periods have narrowed, also attracting new investors to the real estate sector, he stressed.