Tether, the issuer of the world’s largest stablecoin pegged to the U.S. dollar, announced plans on Wednesday to re-enter the U.S. market with a renewed focus on institutional clients.

The company had exited the market in 2021 following regulatory bans and fines, during which it paid approximately $60 million in settlements.

The company's CEO, Paolo Ardoino, announced the decision in an interview with Bloomberg, stating that the company has made significant progress in shaping its internal strategy in the U.S.

Ardoino stated that this strategy will specifically target institutional markets in the U.S. and aims to use stablecoin not only for payments but also for interbank transfers and trade.

This announcement came shortly after U.S. President Donald Trump signed the stablecoin regulation known as the GENIUS Act last week. The new law aims to expand the role of stablecoins in the global financial system and allows banks, card networks, and technology companies to develop their digital tokens.

As the circulating supply of the U.S. dollar Tether (USDT) continues to grow, Tether is showing signs of emerging from the regulatory pressures it has faced in the past.

In 2021, the company was accused of making misleading statements about its cryptocurrency reserves, leading to a ban on its operations in New York. Additionally, the Commodity Futures Trading Commission (CFTC) imposed a fine on Tether for allegedly misleading the public about the adequacy of its stablecoin reserves.

Tether has long been criticized for its lack of transparency regarding its reserves. Independent audit reports, which have been promised to the public for years, have yet to be released. However, Ardoino noted that they have been in contact with various audit firms in recent weeks.

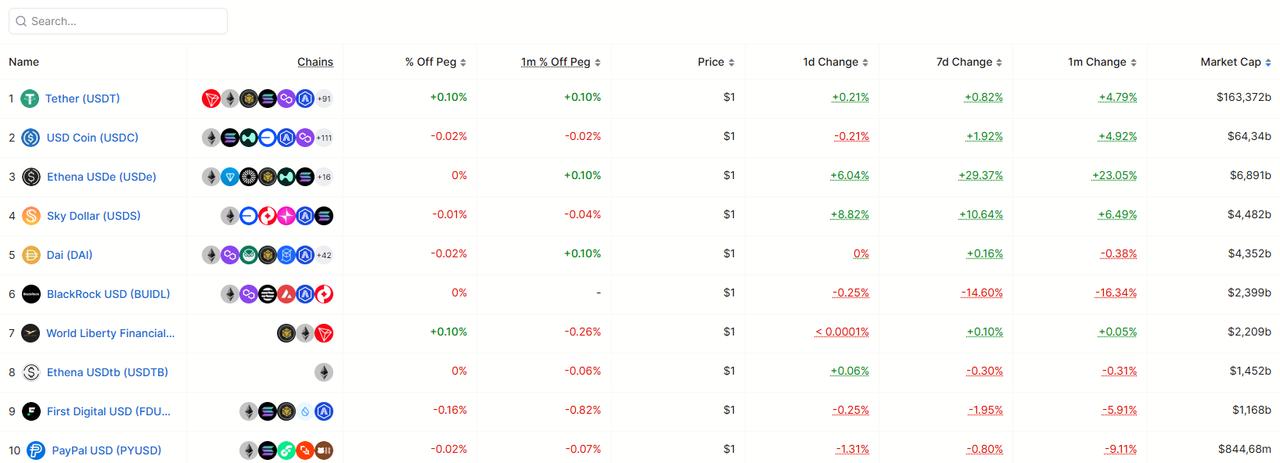

Despite all these regulatory issues, Tether's USDT token continues to lead global markets with a circulating supply exceeding $162 billion. This value has increased by 18% since the beginning of the year, while the supply of USDC, issued by its closest competitor Circle, remained at approximately $64.7 billion.

Tether's refocus on the U.S. comes at a time when stablecoin competition is heating up. Shares of its rival Circle, which went public in June, have gained over 500% in value since trading began. However, Tether has made it clear that it has no plans for a similar IPO. CEO Paolo Ardoino stated, “We are generally not interested in becoming a publicly traded company.”

The newly passed GENIUS Act has the potential to open doors that were previously closed. Ardoino attended the signing ceremony for the bill at the White House alongside other crypto executives. The new regulation could pave the way for stablecoins to be used more widely and legally within both the crypto ecosystem and traditional financial infrastructure.

While Tether is redefining its relationship with the U.S., it remains committed to its core strategy of targeting emerging markets. Ardoino said these markets are key regions where the company has a competitive advantage and that they are maintaining their priorities.

“This is something Tether has done very well over the past decade,” he said. “We have better technology and understand this market much more deeply than our competitors.”