Türkiye’s main stock index, Borsa Istanbul’s BIST 100, ended the Friday session down 0.4% at 10,642.60, as markets turned cautious ahead of updated credit assessments from international agencies Moody’s and Fitch.

The trading volume on the day stood at ₺83.23 billion ($2.05 billion), while the banking index slipped by 0.25%.

On Thursday, the BIST 100 had climbed 0.92% to close at 10,689.05 points, with daily trading volume reaching ₺139 billion ($3.43 billion). The gains were driven by renewed easing from the central bank in the Monetary Policy Committee (MPC) meeting on Thursday, which cut its benchmark interest rate by 300 basis points to 43%.

Despite Friday’s decline, the index ended the week with a net gain of 2.4%.

Investors are closely watching the credit updates from Moody’s and Fitch, both scheduled for release on Friday, July 25. The agencies had earlier announced their 2025 calendar for Türkiye.

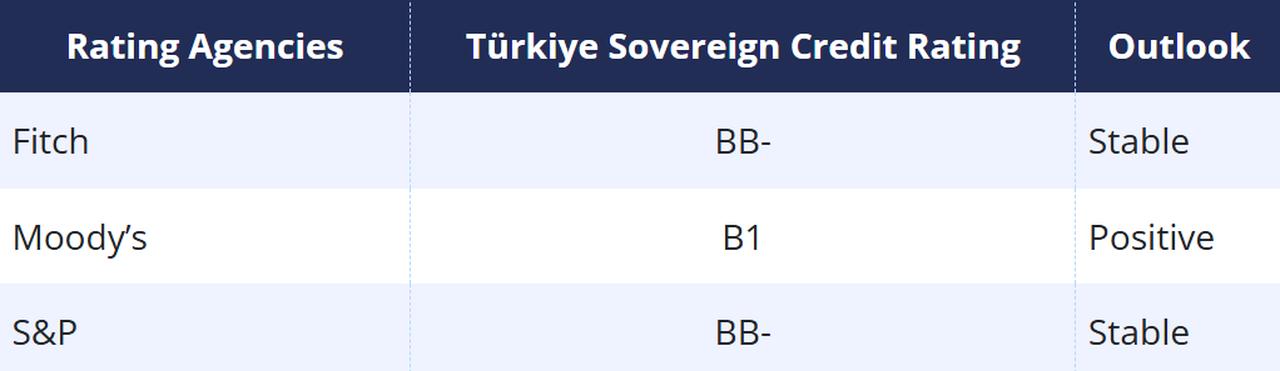

Moody’s last raised Türkiye’s credit rating in July 2024 from B3 to B1 with a “Positive” outlook. The agency held the rating steady at B1 in its January 2025 review. Fitch upgraded Türkiye’s rating from B+ to BB in February 2025 and maintained a “Stable” outlook.

Another major credit rating agency, S&P Global, also maintains Türkiye’s credit rating at BB- with a Stable outlook.

In 2024, Türkiye was the only country to receive credit rating upgrades from all three major rating agencies.

Credit ratings are important as they influence a country's borrowing costs and investor confidence.

In an April report, Fitch noted that Türkiye’s central bank had demonstrated its ability to manage market volatility stemming from domestic political uncertainties and global trade disruptions. The agency highlighted the country’s strong reserves and improving current account position.

In April, the central bank recorded a $25 billion reserve loss—the largest on record—due to interventions aimed at stabilizing the Turkish lira. However, conditions improved in May, with reserves rebounding by $13.5 billion.

As of the week ending July 18, gross international reserves stood at $168.6 billion. Excluding foreign exchange swap agreements, net reserves rose to $44.3 billion, up from the year’s low of $13.8 billion in early May.

Türkiye’s current account deficit also showed signs of recovery, with the annualized gap narrowing to $16 billion in May, down from $19 billion in 2024.