Higher-than-expected January inflation figures reinforced institutional investors’ cautious stance on Türkiye’s disinflation outlook, as major investment banks warned of mounting risks that could jeopardize the year-end inflation target of 16%.

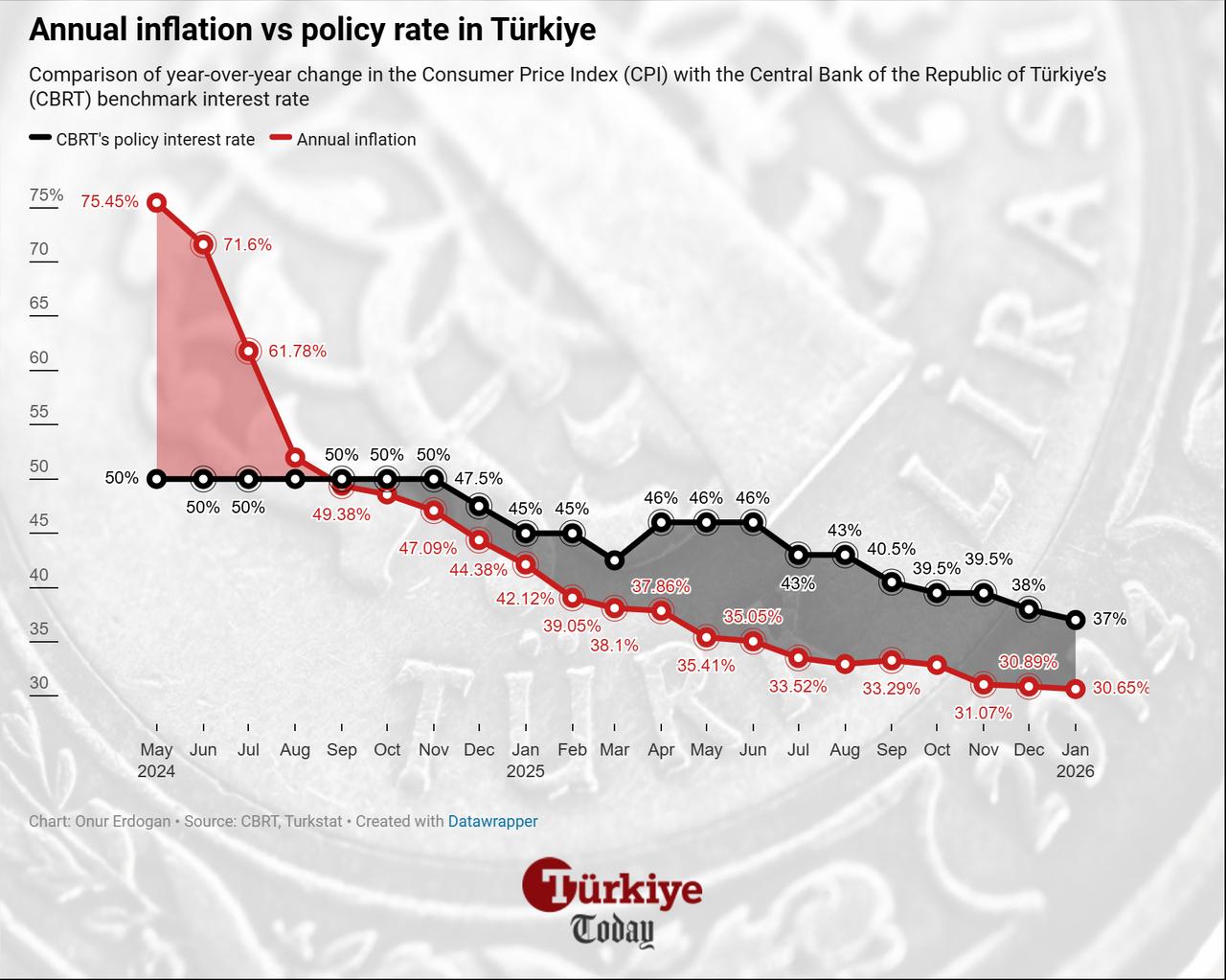

After closing 2025 at 30.9%, following two consecutive months of lower-than-expected inflation readings below 1%, the Consumer Price Index (CPI) started 2026 on a sharp note, with monthly inflation rising to 4.85% and the annual rate edging slightly down to 30.65%. The accelerated price growth was largely driven by seasonal factors such as food supply shocks and new year price hikes.

Nevertheless, analysts noted that the magnitude of the increase exceeded typical seasonal patterns, raising concerns about the sustainability of Türkiye’s disinflation trajectory.

In its note assessing the figures, U.S.-based investment bank J.P. Morgan revised its 2026 year-end inflation forecast upward from 23% to 24%, signaling that the Central Bank of the Republic of Türkiye (CBRT) is likely to maintain a cautious stance in its rate-cut cycle, similar to its approach in January, despite December’s more optimistic readings.

At its latest Monetary Policy Committee (MPC) meeting in late January, Turkish policymakers delivered a 100-basis-point cut, lowering the policy rate to 37%. The move came in below market expectations for a 150-basis-point cut, as the CBRT cited preliminary data indicating increased price pressures in the first two months of the year.

J.P. Morgan analysts projected a total of 700 basis points in rate cuts over the remaining seven monetary policy meetings, bringing the policy rate down to 30% by year-end. The report also noted that the upcoming Ramadan period could result in another elevated inflation reading in February, potentially limiting the size of the next rate cut.

Economists at another U.S. banking giant, Citigroup, also raised concerns that Türkiye’s path to lower inflation may unfold more slowly than the central bank anticipates. While the CBRT has set an interim inflation target of 16% for 2026, sectoral pricing dynamics, particularly in services, could delay progress, the bank noted.

Citigroup economists further emphasized that currency stability alone may not be sufficient to anchor inflation expectations, flagging persistent risks such as sticky services prices, ongoing food cost pressures, and unfavorable base effects. "Against this backdrop, we expect annual inflation to decline from 30.9% at the end of 2025 to 24% by end-2026, but we see the balance of risks as tilted to the upside," the report said.

Dutch lender ING also echoed apprehension, stressing that price pressures are likely to persist in February, largely fueled by rising food costs ahead of Ramadan. The analysts projected that year-end inflation would likely exceed the upper bound of the CBRT’s forecast range of 19% outlined in its November inflation report. "Given the upside risks and uncertainty surrounding heavyweight food and energy prices, the central bank will likely maintain its cautious stance in its current rate-cutting cycle," ING stated.

Another factor behind January’s inflation spike was a structural shift in the Consumer Price Index (CPI) composition, following methodological changes introduced by the Turkish Statistical Institute (TurkStat). In line with European Commission regulations, TurkStat updated the base year from 2003 to 2025, establishing it as the new benchmark where the index equals 100.

The number of main expenditure groups increased from 12 to 13, and several category names were revised to reflect changing consumption patterns.

Among the largest categories, housing recorded the sharpest drop, falling 3.81 percentage points to 11.40%. The food group also edged down by 0.52 points but remains the largest component at 24.44%. In contrast, services-related categories gained weight: restaurants and cafés rose 2.82 points to 11.03%, transportation climbed 1.28 points to 16.62%, now the second-largest category, and recreation, leisure, and culture increased by 0.98 points.

According to a Central Bank blog post analyzing the impact of these changes, the new weighting system slightly reduced January inflation—by about 0.1 percentage points. The most notable shift was in the services sector, which saw its overall share rise by 7.4 points, mainly due to higher weights in transportation, hospitality, and other services.

Recalling that annual inflation in 2025 stood at 25% for goods and 44% for services, CBRT economists added that if services inflation remains higher in 2026, the increased weight of services could put additional pressure on this year’s overall rate. "The same as in 2025, the annual services inflation is likely to decline faster than the goods inflation in 2026," they noted.

Taking both dynamics into account, the bank estimated the net impact of the services reweighting on annual inflation to be close to 1 percentage point.

The CBRT is also set to release its first inflation report of the year on Thursday, Feb. 12, with markets expected to closely watch the bank’s updated assessments, particularly any revisions to the inflation projection range and the interim target currently set between 13–19% and 16%.