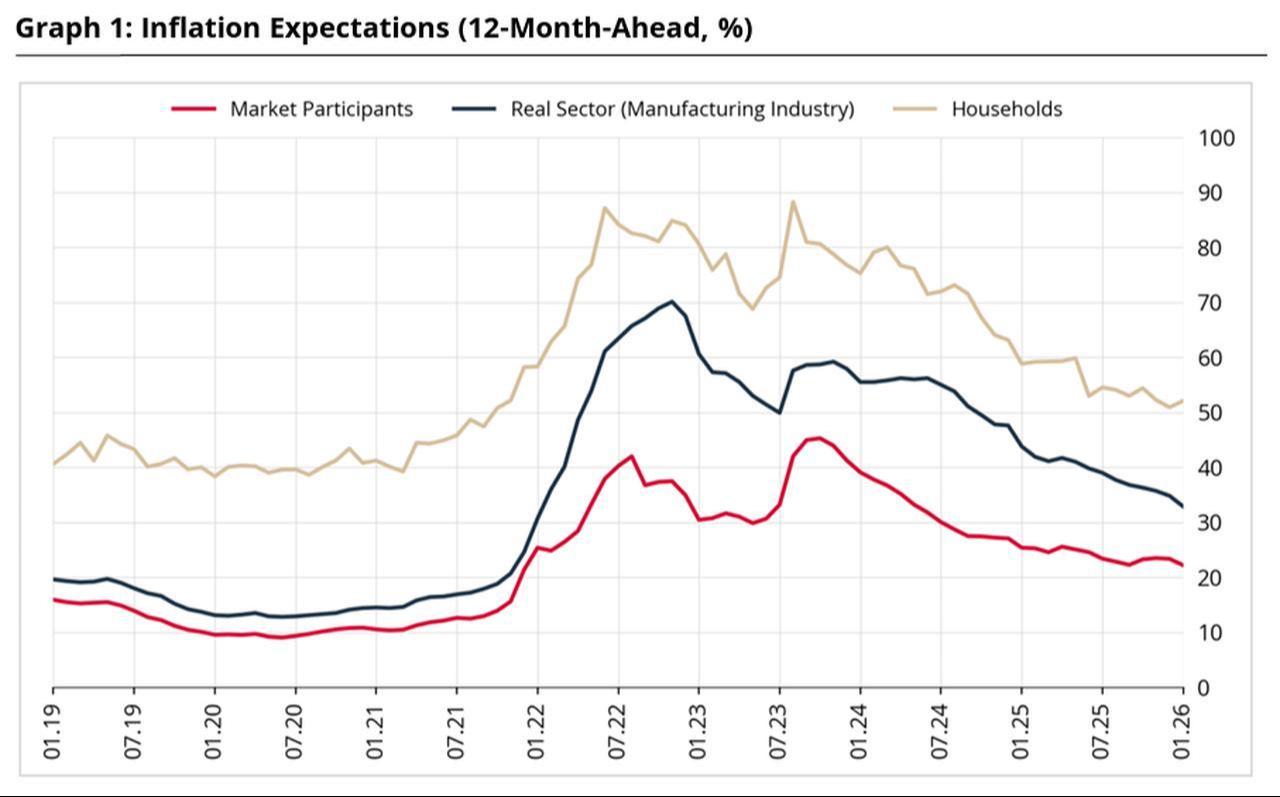

Sectoral inflation expectations in Türkiye declined sharply in January among market participants and industrial firms, according to data from the central bank, reflecting increased confidence in the disinflation trend.

According to the Central Bank of the Republic of Türkiye (CBRT), market participants cut their inflation forecast for the next year by 1.15 points to 22.2%, while the real sector trimmed its outlook by 1.9 points to 32.9%.

Households, however, raised their 12-month outlook by 1.18 points to 52.08%, suggesting lingering concerns about the cost of living despite broader disinflation.

Local brokerage Pusula Investment noted a continued decline in perceived inflation momentum, emphasizing that the likelihood of further upward price pressures appears to be receding.

The firm highlighted that this softening in expectations is being reinforced by growing alignment across market forecasts.

"The convergence of year-end CPI expectations toward 22% among market participants supports the trend," the firm said. "We maintain our year-end CPI forecast at 22%. We view the data as modestly positive for risk assets."

Türkiye’s inflation declined to 30.9% in December 2025, with monthly inflation at 0.9%, well below expectations. However, in its most recent Monetary Policy Committee (MPC) decision last week, the Turkish central bank limited the rate cut to 100 basis points, falling short of market expectations for a 150 basis point reduction. The bank cited lingering inflationary pressures in January based on preliminary data.

According to the Medium-Term Program, the government aims to lower headline inflation to 19% by the end of 2026. During a recent investor roadshow in London and New York, Finance Minister Mehmet Simsek reaffirmed Türkiye’s commitment to the target.

He noted that the government would continue to curb or forgo biannual tax increases linked to changes in the producer price index, just as it had with fuel, tobacco, and alcoholic beverages, and would also cap the revaluation rate below the actual inflation level at the start of the year.