U.S. President Donald Trump escalated his criticism of the Federal Reserve, sending a direct letter to Fed Chair Jerome Powell urging a significant cut in interest rates.

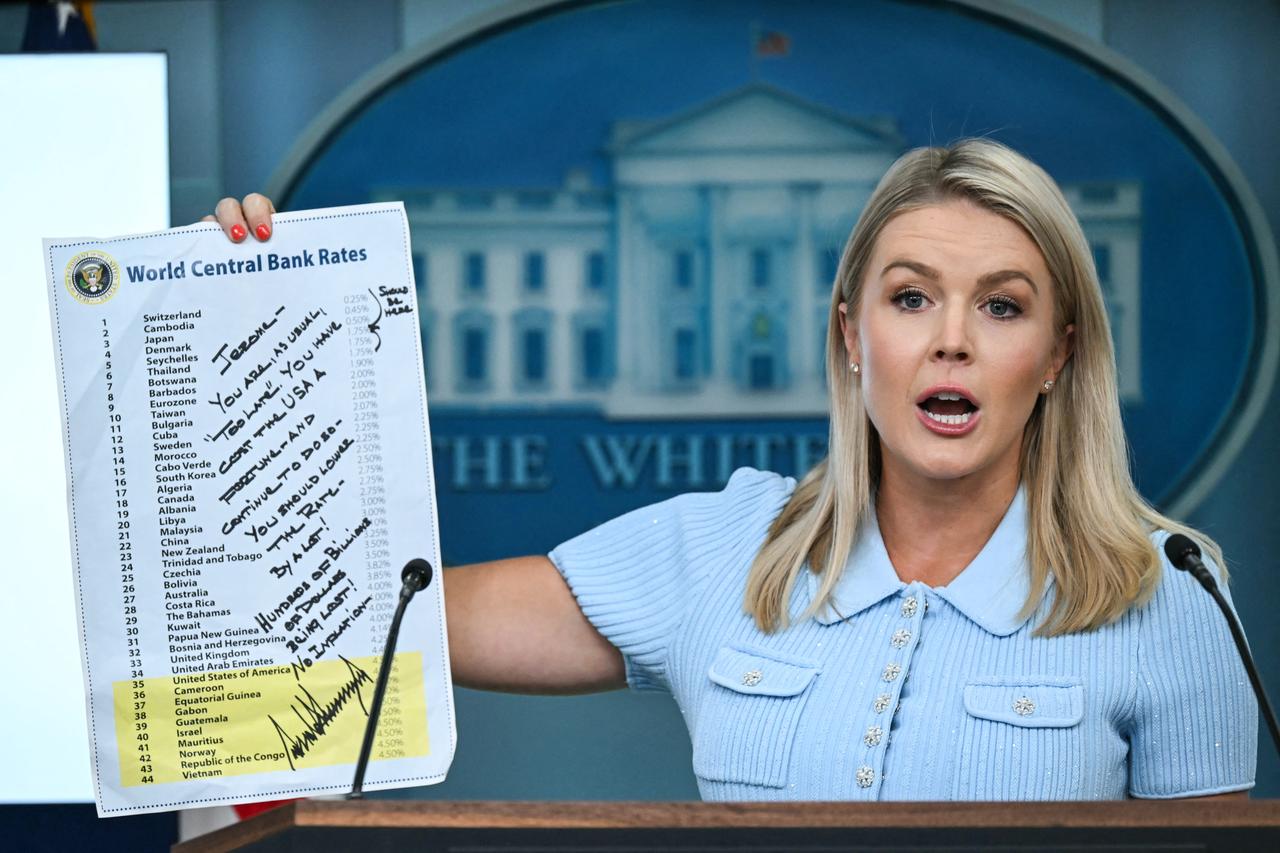

At a daily press briefing on Monday, White House Press Secretary Karoline Leavitt confirmed that Trump had sent a formal memo to Powell, reiterating his view that the Fed’s current policy is damaging the economy.

She said the letter included a note accusing Powell of “costing the U.S. a fortune” and calling for a sharp reduction in interest rates.

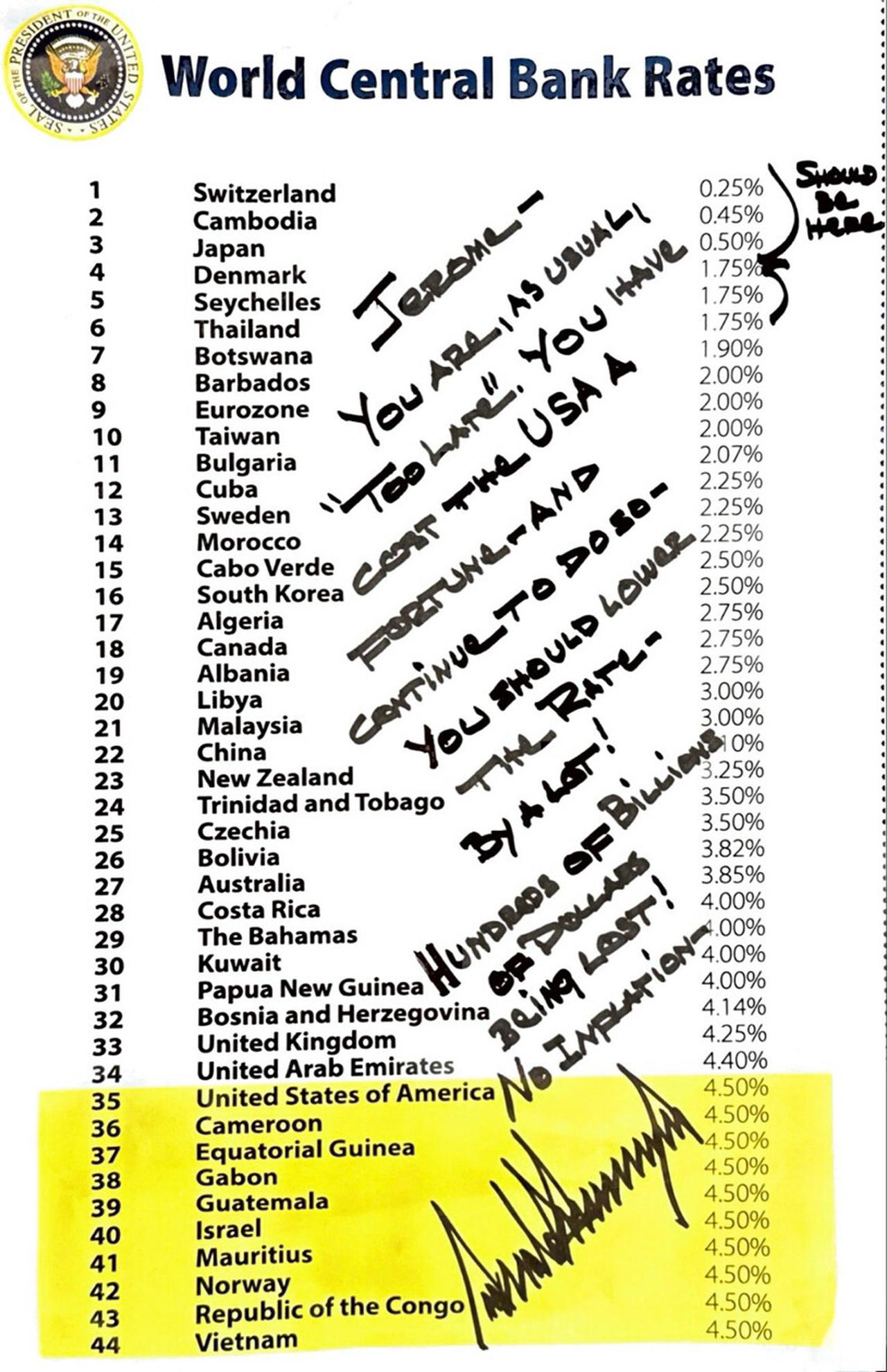

Leavitt displayed the memo, which included a handwritten message that read, “Jerome, you are, as usual, too late. You have cost the U.S. a fortune and continue to do so. You should lower the rate by a lot. Hundreds of billions of dollars are being lost, and there is no inflation.”

She emphasized that the president is a “businessman first” and understands economic strategy, arguing that high interest rates are the only barrier to continued economic momentum. “The American people want to borrow cheaply, and they should be able to do that,” she said.

Leavitt also claimed that the U.S. stock market has responded positively to Trump’s broader economic policies, with the S&P 500 and Nasdaq indexes reaching record highs. She attributed this performance to what she called “Trump’s economic boom,” while continuing to frame the Fed’s current policy as a threat to long-term growth.

Posting on his Truth Social platform, Trump stated that interest rates in the U.S. should be closer to 1%, compared to levels seen in other advanced economies such as Japan and Denmark. A chart he shared indicated that U.S. rates are unnecessarily high, with a handwritten mark showing the desired range between Japan’s 0.5% and Denmark’s 1.75%.

“Jerome ‘Too Late’ Powell and his entire board should be ashamed of themselves for allowing this to happen to the United States,” Trump wrote, accusing the central bank of failing to act despite having what he called “one of the easiest, yet most prestigious, jobs in America.”

Trump has repeatedly called on the Federal Reserve to follow the lead of more dovish central banks abroad, warning that delays in cutting rates could stall the U.S. economy.

In its latest meeting in June, the Fed kept its benchmark rate unchanged at a range of 4.25% to 4.5%.