The Central Bank of the Republic of Türkiye (CBRT) introduced a new round of changes to its reserve requirement framework on Tuesday, aiming to streamline monetary tools, promote long-term foreign currency funding, and limit excessive loan growth.

Under the revised framework, the CBRT eliminated the difference in reserve requirement ratios between foreign currency (FX) deposit accounts and gold deposit accounts, unifying the treatment of both instruments and simplifying banks’ reserve obligations. Additionally, reserve requirement ratios for non-deposit FX liabilities, such as syndicated loans or securitized borrowings with longer maturities, have been reduced in an effort to promote the use of longer-term foreign funding sources and reduce reliance on short-term inflows.

The reserve requirement is a monetary policy tool used by central banks that mandates commercial banks to hold a certain percentage of their deposits or liabilities, whether in local or foreign currency, as reserves with the central bank to control the money supply, manage liquidity, and ensure financial stability.

A temporary exemption from reserve requirements for increases in long-term FX liabilities sourced directly from abroad will expire as scheduled at the end of the year and will not be renewed. In place of this measure, the CBRT introduced permanent maturity-based reserve requirement reductions.

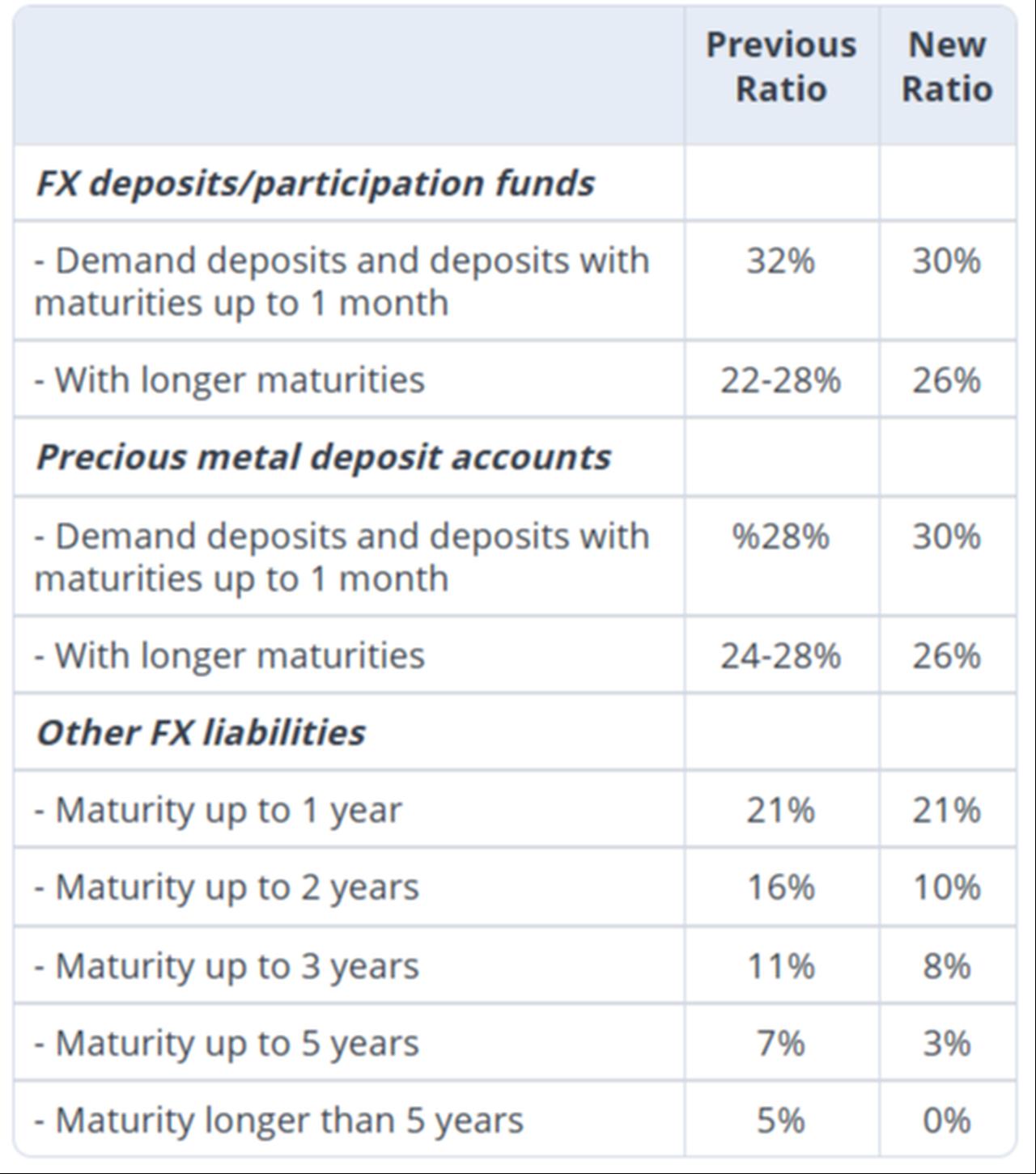

The ratios for FX liabilities now remain at 21% for maturities up to one year, while those with longer terms benefit from substantial reductions. Liabilities up to two years now carry a 10% requirement, down from 16%, while those up to three years are subject to 8%, down from 11%. The ratio for liabilities up to five years has been cut from 7% to 3%, and those exceeding five years are now exempt entirely, down from 5%.

By setting the ratio to zero for FX liabilities with maturities exceeding five years, the central bank apparently seeks to encourage more stable, long-duration funding channels into the financial system.

For FX deposit and participation funds, the reserve ratio for sight and up-to-one-month maturities has been lowered from 32% to 30%. Longer-term accounts, previously subject to a range between 22% and 28%, are now uniformly set at 26%. Meanwhile, for precious metal deposit accounts, the reserve requirement has increased for short-term holdings, from 28% to 30%, while longer maturities are also aligned to a 26% level, up from a previous range of 24% to 28%.

As part of the same regulatory update, the CBRT also extended the existing 0.5% credit growth limit for an additional year to curb excessive loan expansion and support broader monetary tightening efforts.

In another reversal, the CBRT removed domestic bank liabilities owed by financing companies from the scope of reserve requirements, which were initially included under the reserve base in 2022 but have now been excluded once more.