The Turkish central bank is expected to keep its policy rate steady at 46% during Thursday's Monetary Policy Committee (MPC) meeting, while a 300-basis-point cut in the overnight lending rate is anticipated to neutralize the interest rate corridor.

At its most recent meeting in April, the MPC raised the policy rate to 46% with a surprising 350-basis-point hike to curb renewed inflationary pressures, while increasing the overnight lending rate to 49%.

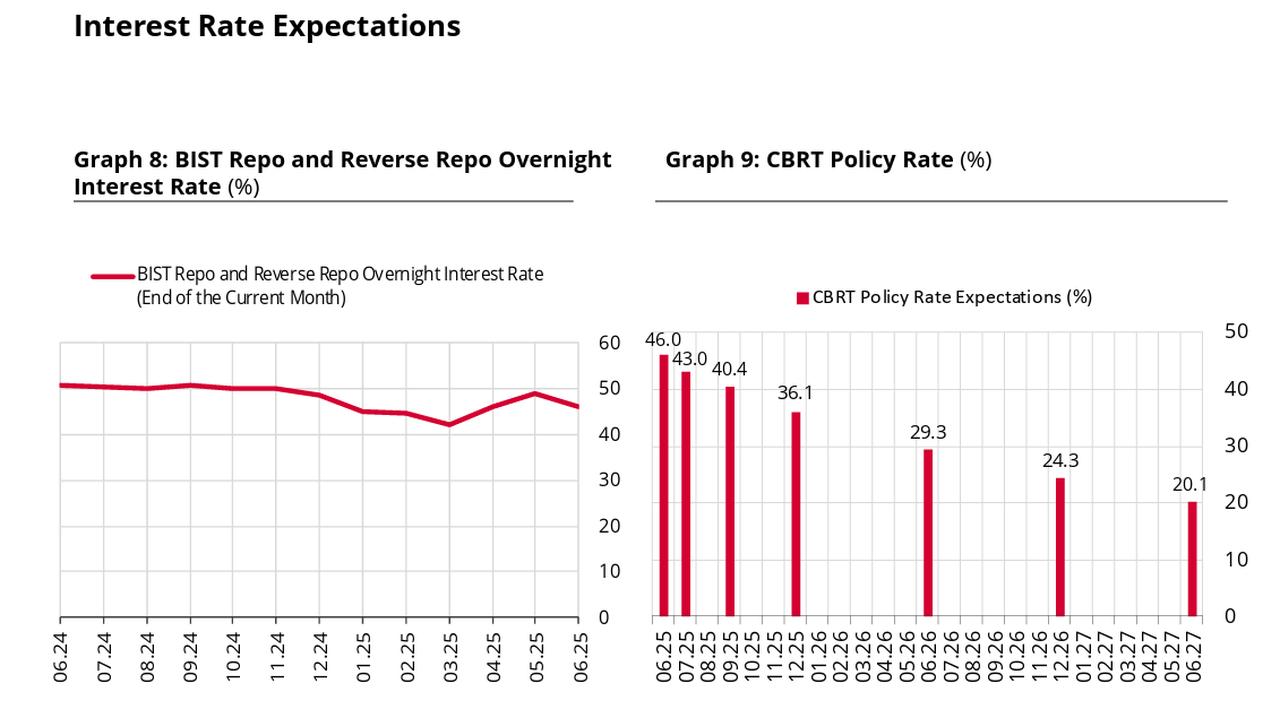

According to the June Survey of Market Participants conducted by the Turkish central bank among 69 representatives from the real and financial sectors, most respondents expect the bank to maintain the policy rate at 46%. However, the survey also indicated that the first rate cut is expected at the July meeting, by 300 basis points.

Out of 23 economists surveyed by the state-run Anadolu Agency, 19 forecast that the central bank (CBRT) will keep the policy rate steady at 46% in June 2025. However, two economists expect a 100-basis-point cut, one anticipates a 150-basis-point cut, and another projects a 350-basis-point cut.

According to the survey, the median policy rate expectation for year-end stands at 35.5%.

Türkiye’s annual inflation unexpectedly dropped to 35.41% in May, while monthly inflation came in at 1.53%. This development boosted expectations for interest rate cuts.

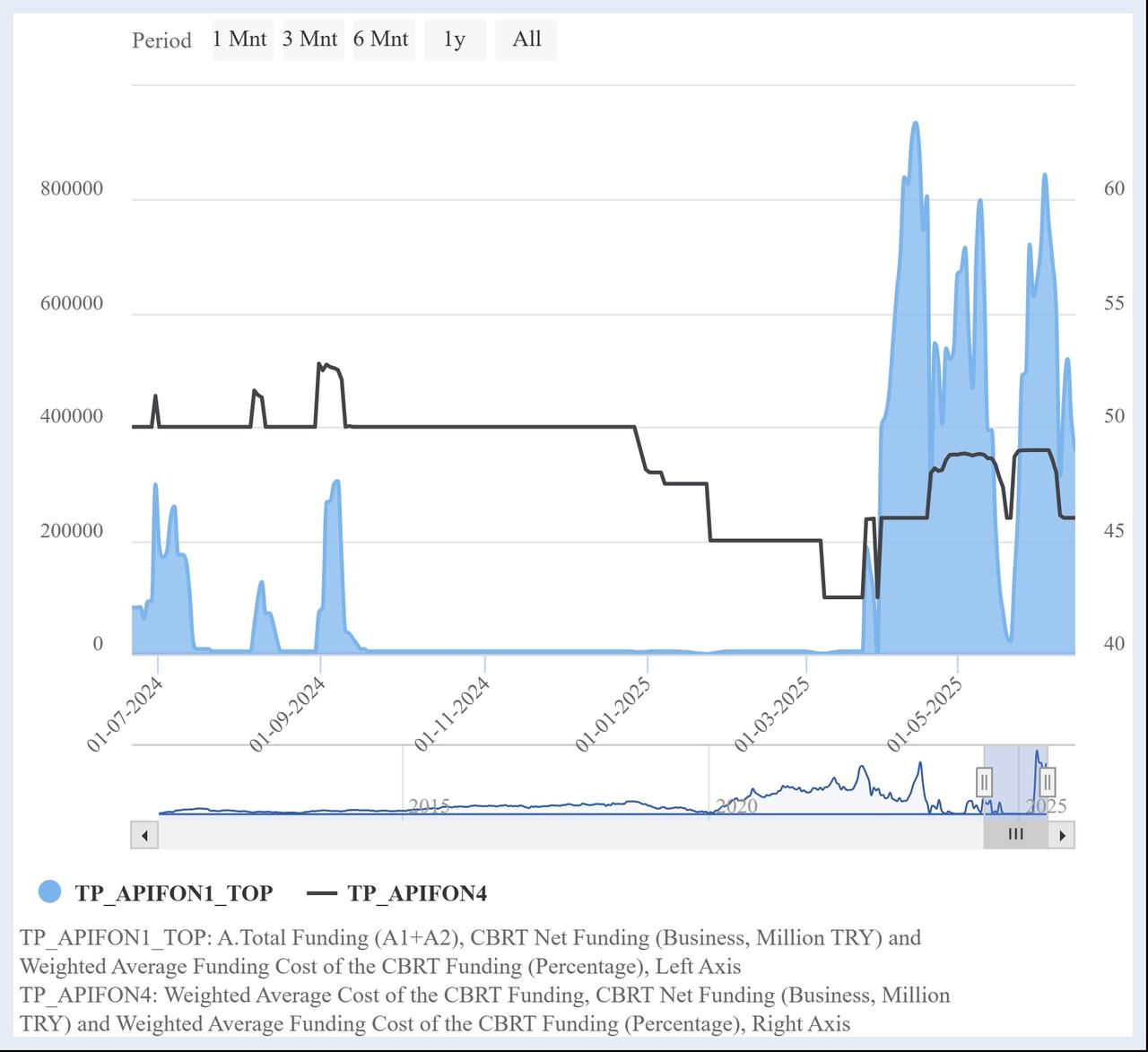

In parallel, the Turkish central bank launched its largest one-week repo auctions in the past year to ease market liquidity. According to the central bank’s open market operations data, the CBRT has injected ₺640 billion (approximately $16.18 billion as of June 19) since June 10.

As a result, the Turkish Lira Overnight Reference Rate (TLREF) fell to 46.18%, while the central bank’s average cost of funding declined to 46%.

The Turkish central bank is scheduled to announce its interest rate decision on Thursday at 2 p.m. local time (GMT+3).