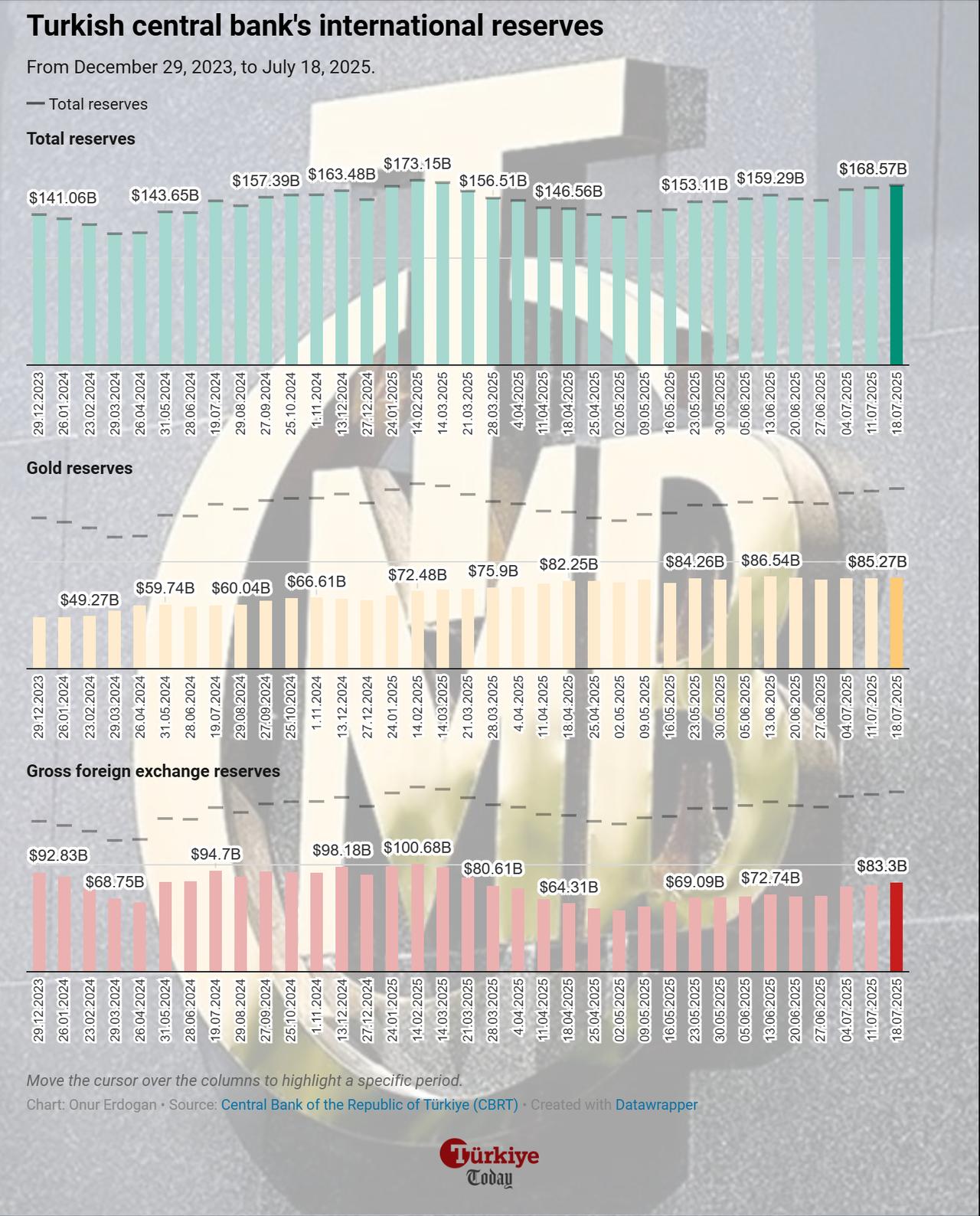

Türkiye's international reserves continue to rise, with the central bank reporting on Thursday that gross reserves reached $168.6 billion in the week ending July 18, marking a $2.3 billion weekly increase from the previous week.

The central bank's net reserves also advanced during the same period, climbing to $62.8 billion from $59.8 billion. Excluding foreign exchange swap agreements, net reserves improved to $44.3 billion.

The increase was driven by gains in both foreign currency and gold holdings, as the CBRT’s gross foreign exchange reserves increased by nearly $1.75 billion to reach $83.3 billion, up from $81.55 billion the previous week.

Simultaneously, gold reserves grew by $574 million, reaching $85.27 billion as of July 18.

Data from the CBRT’s weekly securities statistics showed that foreign investors purchased $209.4 million worth of Turkish equities in the week of July 18. This brought the total stock of foreign-held equities to approximately $31.95 billion, up from $31.85 billion a week earlier.

During the same period, foreign holdings of government domestic debt securities (GDDS) decreased to $13.93 billion from $14.05 billion, while holdings in other sectors remained largely unchanged at just under $781 million.

Total deposits in the Turkish banking sector rose to ₺24.42 trillion in the same week, increasing by approximately ₺195 billion, according to the weekly banking statistics. Turkish lira-denominated deposits rose by 0.7% to ₺13.56 trillion , while foreign currency deposits increased by 1.5% to ₺7.79 trillion.

Foreign currency deposits held by domestic residents reached $194.04 billion, contributing to a total foreign currency deposit level of $232.85 billion across all accounts. Adjusted for exchange rate effects, resident foreign currency deposits grew by $1.99 billion during the reporting period.

The sector’s total credit volume, including central bank financing, rose by ₺63.83 billion to reach ₺19.18 trillion. However, consumer loans declined by 0.6% to ₺4.63 trillion, with modest decreases across housing, vehicle, and personal loan categories. During the same week, the weighted average interest rate on consumer loans stood at 60.63%.