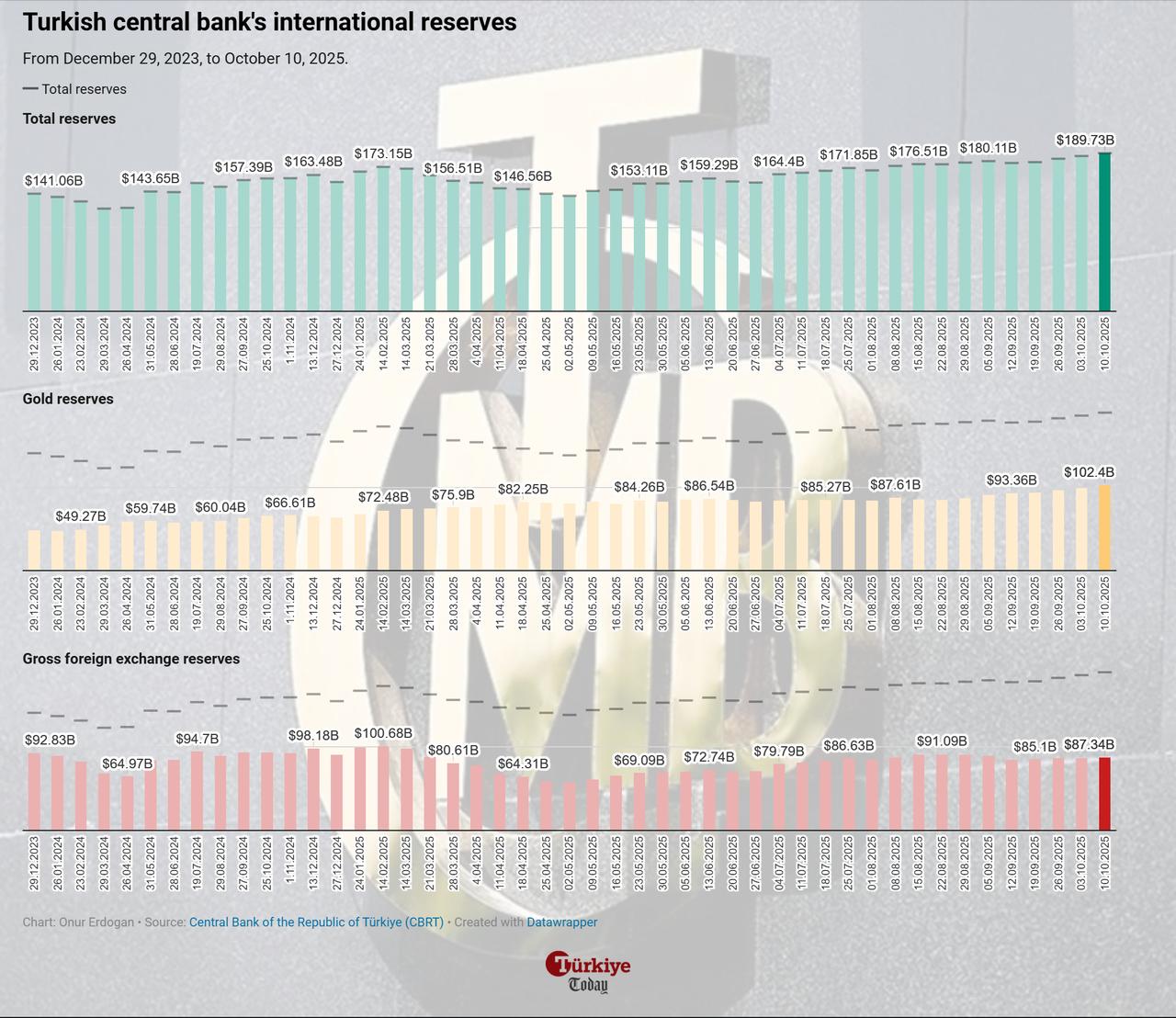

Türkiye’s central bank reserves reached an all-time high of $189.73 billion in the week ending Oct. 10, boosted by a sharp increase in the market value of its gold holdings.

According to official data, total reserves rose from $186.22 billion a week earlier, extending the upward trend supported by both foreign-exchange and gold components.

The Central Bank of the Republic of Türkiye (CBRT) reported that gross foreign-exchange reserves increased by $309 million to $87.34 billion, while gold reserves surged by $3.21 billion to $102.4 billion. The rise in gold holdings largely reflected the impact of the global rally that has driven bullion prices to record highs, with gold closing the week at $3,989.61.

The CBRT’s net international reserves—excluding currency-swap transactions with local banks—rose to $61.8 billion, compared to $59.5 billion in the previous week. These figures are closely monitored by investors as an indicator of the country’s short-term external liquidity position.

During the same week, non-resident investors sold $109.7 million worth of Turkish equities while purchasing $307.8 million in government domestic debt securities (GDSs).

Their total equity holdings declined from $33.26 billion to $32.53 billion, whereas their holdings of government bonds rose from $15.39 billion to $15.45 billion.

The total deposits in Türkiye’s banking system fell by ₺92.49 billion ($2.20 billion ) week-on-week to ₺25.80 trillion. Turkish-lira deposits dropped by 0.8% to ₺13.97 trillion, while foreign-currency deposits rose 1.8% to ₺8.67 trillion.

The increase in foreign-currency deposits partly stemmed from maturing accounts under the government’s foreign-exchange–protected deposit scheme, which the CBRT plans to phase out by the end of 2025. The program’s share in total deposits has fallen below 1%, totaling ₺239.54 billion, the Banking Regulation and Supervision Agency (BRSA) reported.

Meanwhile, domestic consumer loans grew by 0.5% from the previous week to reach ₺5.16 trillion, reflecting a moderate increase in household borrowing across the banking sector.