Central Bank of the Republic of Türkiye (CBRT) Governor Fatih Karahan reaffirmed on Wednesday the bank’s determination to maintain a tight monetary policy until price stability is achieved, saying that Türkiye’s ongoing disinflation process will not be derailed by domestic demand pressures.

Delivering a presentation in Washington, D.C. titled "Challenges in Reading Macroeconomic Data in Türkiye," Karahan addressed how the country’s rapid digitalization has complicated the interpretation of macroeconomic indicators while reiterating the central bank’s focus on curbing inflation.

Karahan said the CBRT’s restrictive monetary stance will remain in place as long as inflationary risks persist. "The tight monetary policy stance, which will be maintained until price stability is achieved, will strengthen the disinflation process through demand, exchange rate, and expectation channels," he said.

He stressed that the central bank would continue to monitor a wide range of real-time indicators to support its policy decisions.

The Turkish central bank’s next Monetary Policy Committee (MPC) meeting is scheduled for Oct. 23, with the bank expected to continue its rate-cut cycle from the current 40.5% level, adopting a more cautious tone following September’s inflation figures.

According to Karahan, Türkiye’s current economic indicators suggest that domestic demand is cooling, though variations among data sources make it harder to assess the exact pace of moderation.

Karahan said Türkiye’s shift toward a more digital economy has made traditional data harder to interpret. "Data sources differ regarding the strength of economic activity," he noted, adding that the growing use of electronic invoicing and digital payments has blurred the usual signals used to gauge consumption and output.

While digitalization promotes transparency and curbs tax evasion, it can also make short-term figures appear stronger than underlying demand, he said. "Headlines tend to overstate economic activity, particularly in areas like retail sales and credit."

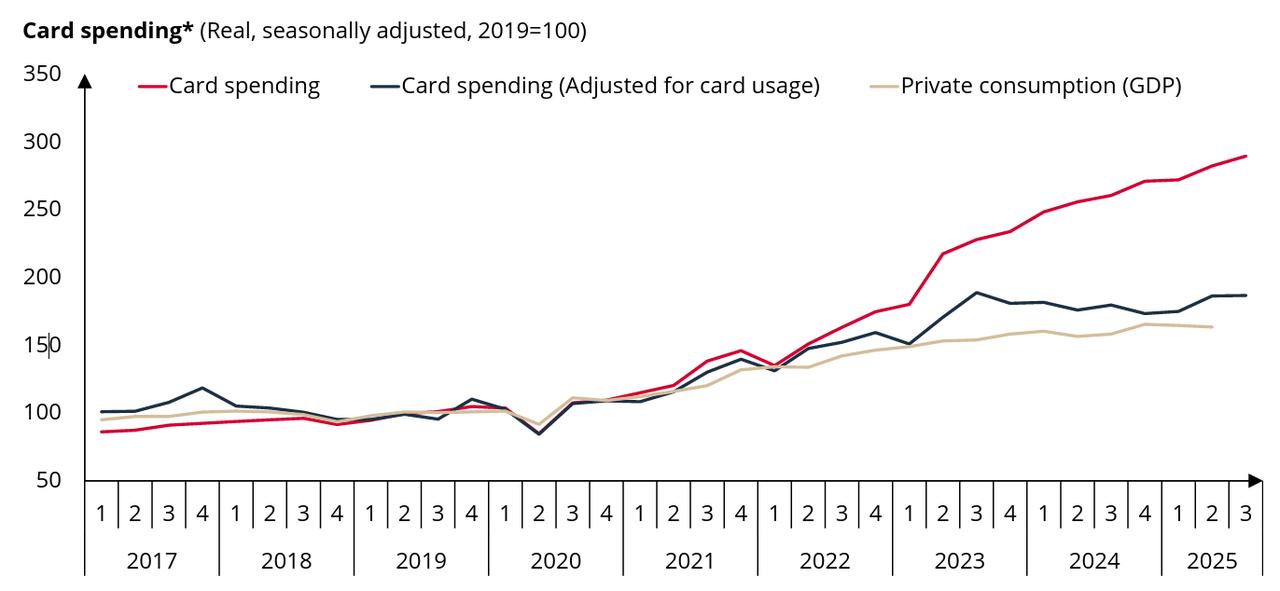

According to his presentation, the number of e-invoicing firms nearly tripled between mid-2021 and mid-2025, inflating reported sales across multiple sectors. CBRT analyses showed that retail and card spending data exaggerate consumption growth, while adjusted figures track more closely with GDP-based private consumption.

Credit indicators point to cooling demand, with interest-bearing credit card balances falling to 36% in August 2025 from 41.4% in early 2022. "Loan growth excluding credit card balances has remained stable," Karahan said.

He added that the CBRT now monitors a broader set of indicators to make more accurate real-time assessments. "Put together, economic activity and demand indicators point to a continued moderation," he concluded, citing the bank’s firm stance on maintaining price stability.