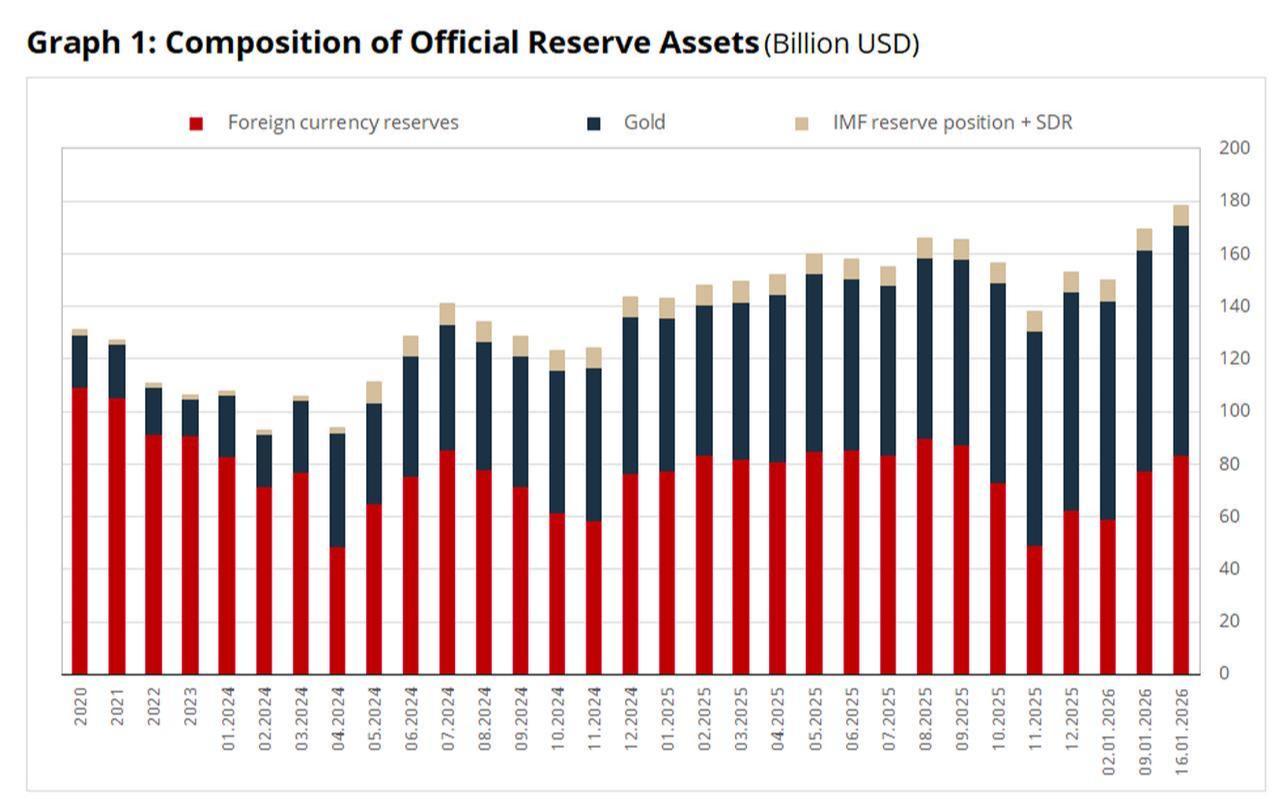

The Central Bank of the Republic of Türkiye (CBRT) announced Thursday that its international reserves exceeded the $200 billion mark for the first time as of Jan. 16, reaching $205.2 billion.

Gross foreign currency reserves rose 6.7% to $76.4 billion, while gold reserves increased 3.7% to $121 billion during the same period.

The net reserves, total reserves after subtracting short-term liabilities, rose from $82.9 billion to $91 billion in a week, while net reserves excluding swaps, excluding funds obtained through temporary currency exchange agreements with other banks, increased by $8.7 billion to $78.8 billion.

Commenting on the figures, Treasury and Finance Minister Mehmet Simsek attributed the central bank’s continued reserve growth to the government’s macroeconomic program launched in mid-2023.

"Thanks to the program we implemented, the Central Bank's gross reserves rose by approximately $107 billion to $205.2 billion since mid-2023," Simsek said. "The rise in net reserves excluding swaps totaled $139.3 billion. We have ensured reserve adequacy according to international standards."

Reserve adequacy standards refer to internationally recognized benchmarks that assess whether a country holds sufficient foreign exchange reserves to cover short-term external debt, imports, and potential capital outflows.

He added that overall improvements in the country’s foreign exchange position had exceeded $280 billion, contributing to a decline in risk premiums to around 200 basis points and strengthening the Turkish economy’s resilience to external shocks.

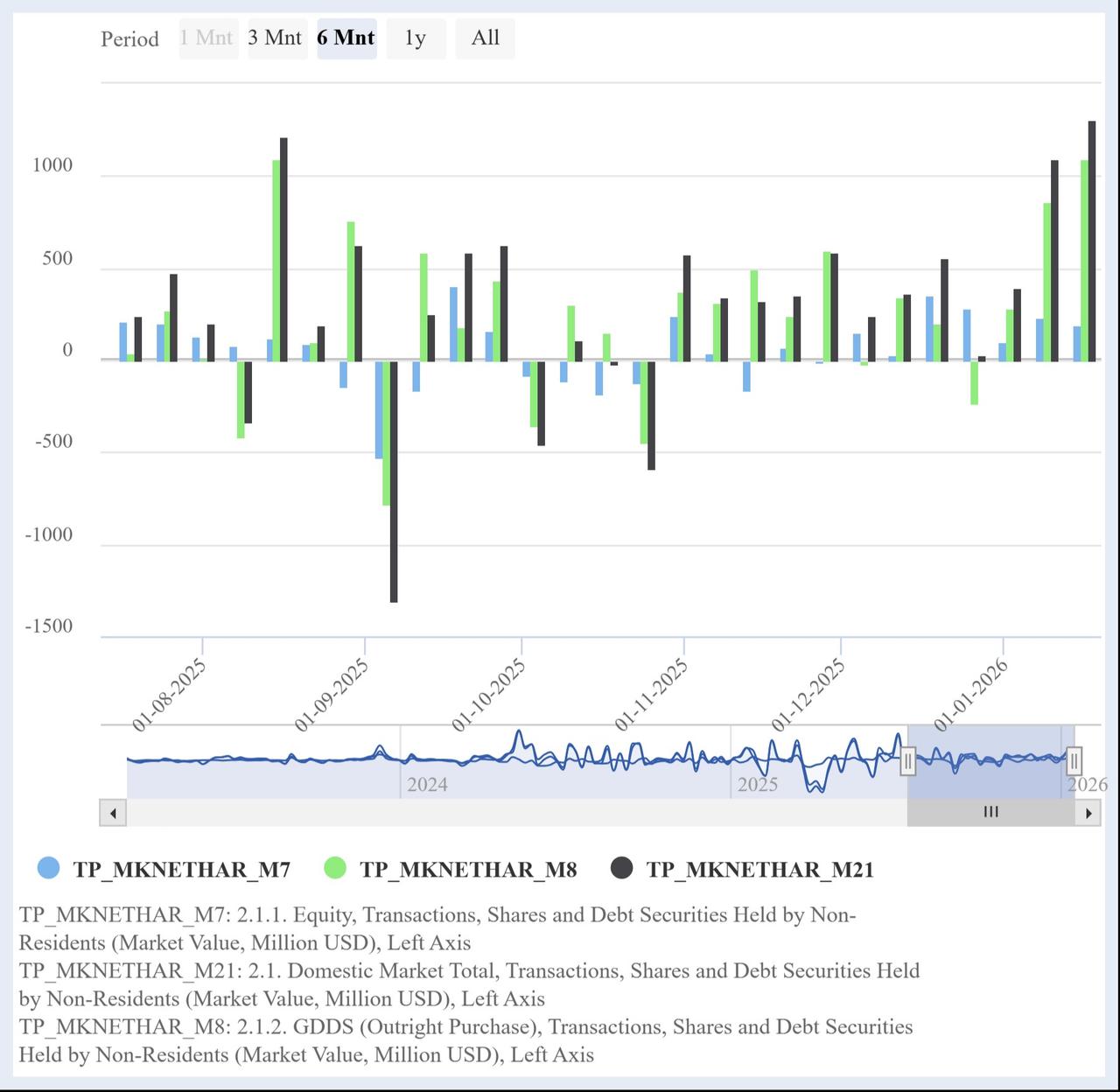

In the week ending January 16, foreign investors continued to channel funds into Turkish assets, purchasing $196.9 million in equities and $1.1 billion in government domestic debt securities (GDSs).

Thus, since the start of 2026, foreign portfolio investments have amounted to $536.7 million in equities and $2.25 billion in government domestic debt securities, bringing the total to $2.79 billion.

These inflows boosted the total foreign-held equity stock to $38.53 billion. Meanwhile, holdings in government bonds rose to $20.02 billion from $19.25 billion. Foreign investors also acquired $11.6 million in non-public sector securities, bringing their total holdings in this category to $628.2 million.

The banking sector’s total deposits increased by 1.8% in the same week, reaching ₺28.63 trillion ($661.81 billion).

Foreign currency deposits totaled $260.03 billion, of which $222.61 billion were held by residents in Türkiye, reflecting a $548 million weekly increase.

On the lending side, domestic consumer loans contracted by 1.3% to ₺5.62 trillion, suggesting tighter credit conditions and more cautious borrowing behavior among households.