Türkiye’s central bank reported Thursday a sharp decline in its total reserves for the week ending June 20, representing a reversal after 6 consecutive weeks of gains.

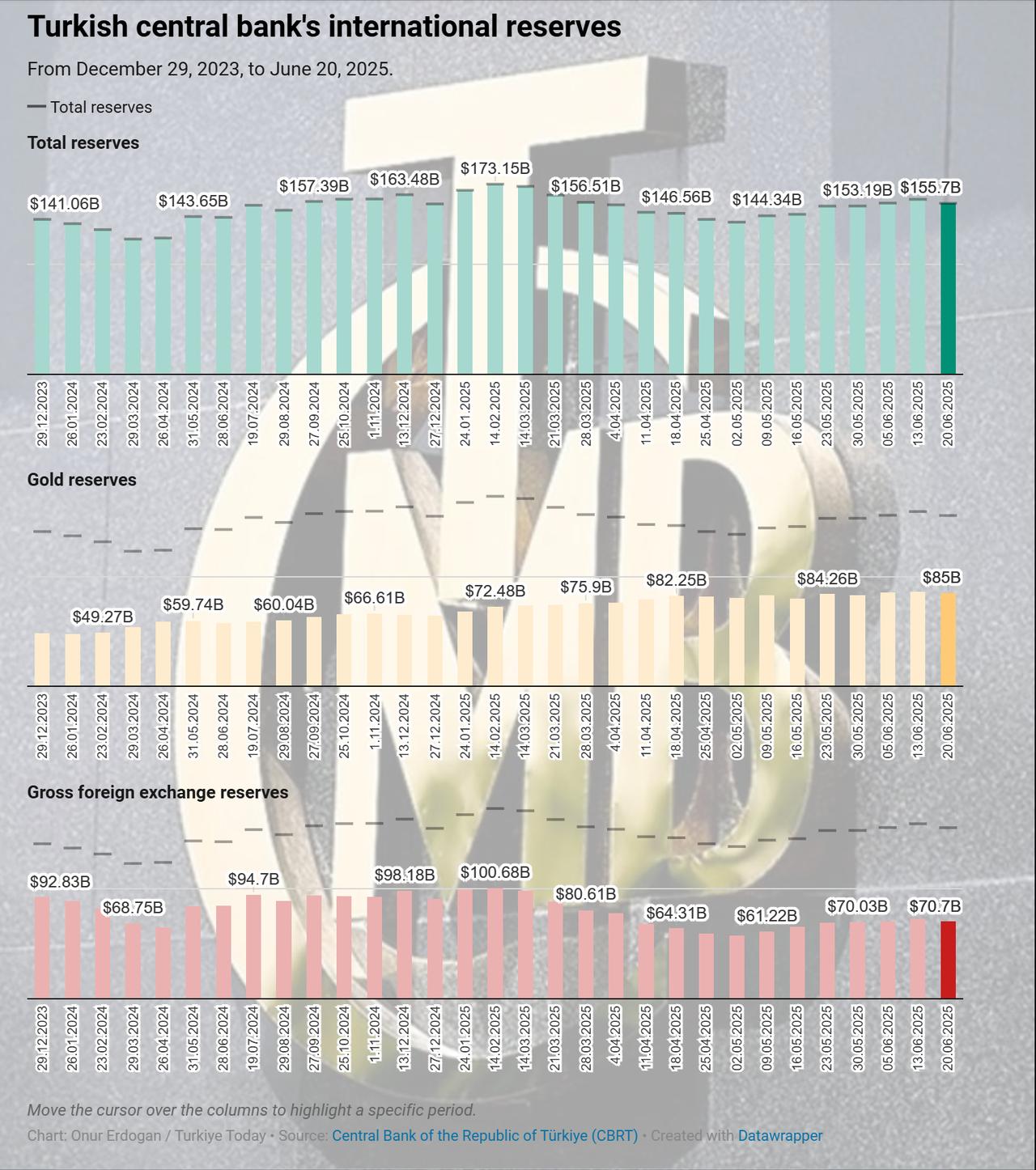

The Central Bank of the Republic of Türkiye (CBRT) reported that total reserves fell by $3.59 billion from the previous week, declining to $155.7 billion from $159.3 billion.

The drop stemmed from simultaneous decreases in both foreign exchange and gold reserves, as gross foreign exchange reserves declined by $2.05 billion to $70.7 billion, while gold reserves decreased by $1.54 billion to $85.0 billion.

The CBRT’s net international reserves, excluding swap agreements, also dropped notably. During the same week, the figure fell by $5.3 billion to settle at $30.2 billion, suggesting tighter foreign currency liquidity.

In securities markets, foreign investors increased their exposure to Turkish government debt but pulled back from equities.

According to the CBRT’s weekly data, non-resident investors purchased $685.6 million worth of government domestic bonds (DIBS), while offloading $109.2 million in equities and $2.7 million in non-government sector instruments.

Consequently, foreign investors’ equity holdings dropped from $28.4 billion to $28.06 billion. In contrast, their holdings of DIBS rose from $10.83 billion to $11.48 billion.

Holdings in other public-sector securities slipped to $670.2 million.

Despite the volatility in reserves and portfolio flows, Türkiye’s banking sector deposits continued to expand. Total deposits rose by ₺12.6 billion during the same week, reaching ₺23.78 trillion ($597.98 billion).

Lira-denominated deposits increased by 0.3% to ₺13.17 trillion, while foreign currency deposits declined by 0.1%, falling to ₺7.64 trillion.