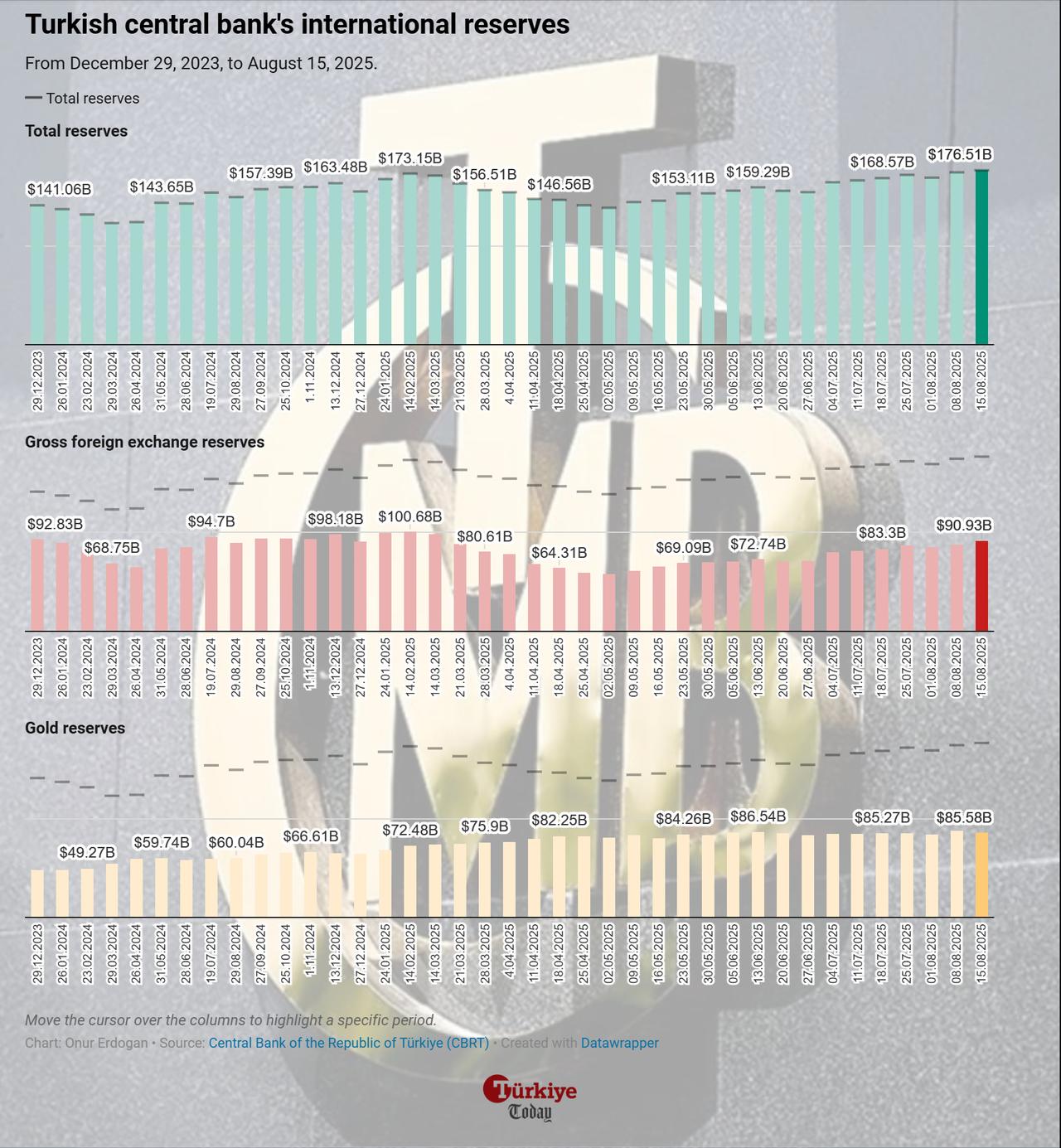

The Central Bank of the Republic of Türkiye (CBRT) increased its total reserves to an all-time high of $176.51 billion in the week ending August 15, a rise of $2.15 billion that renewed the record set a week earlier.

Net reserves excluding currency swap transactions, a measure closely followed by analysts to gauge the central bank’s own liquidity position, climbed by $2.5 billion to $52.1 billion in the same period.

The bank’s gross foreign exchange reserves grew by $3.32 billion, reaching $90.93 billion. In contrast, gold reserves declined by $1.18 billion, falling from $86.76 billion to $85.58 billion. The shift reflects changes in both market prices and reserve management decisions.

Data also showed continued foreign investor interest in Turkish financial markets, as non-resident investors made a net purchase of $125.1 million in equities when adjusted for price and exchange rate effects, extending the streak of net equity purchases to eight consecutive weeks.

Meanwhile, government domestic debt securities (GDDSs), excluding purchases by foreign branches of Turkish banks, recorded a net inflow of $1.05 billion in the same week.

Foreign currency deposits held by domestic residents declined by $1.44 billion to $194.25 billion in the week ending August 15. By contrast, Turkish lira-denominated deposits increased by 3.4% to ₺13.99 trillion ($341.74 billion).

When adjusted for exchange rate movements, residents’ total deposits fell by $901 million over the week.

On the lending side, consumer loans in the domestic banking sector decreased by 0.2% from the previous week, amounting to ₺4.80 trillion ($117.25 billion).