U.S.-based investment bank Citi forecasted that Türkiye’s inflation will ease to 30% by end-2025, with the policy rate falling to 37%—about 350 basis points below the current 40.5%—in its latest client note following September’s worse-than-expected consumer price data.

Türkiye’s inflation broke a 15-month downward trend in September, rising to 33.2% as monthly consumer prices increased sharply by 3.19%.

In their note, the bank's economists Ilker Domac and Gultekin Isiklar emphasized that weakening domestic demand, a softer labor market, and inflation expectations diverging from interim targets have created a complicated setting for monetary policy.

The economists described the outlook as one where cautious easing appears justified, though risks remain skewed toward higher inflation, as the September figures confirmed that price pressures remain elevated despite recent interest rate reductions.

The note highlighted food costs, with prices rising 36.08% annually, as the main driver of the stronger inflation reading, which the economists said showed how persistent pressures continue to weigh on households even as spending slows.

They noted that the combination of weaker consumption and rising joblessness, which reached 8.5% in August, is making it harder for the central bank to maintain a restrictive stance for an extended period.

The CBRT cut its policy rate in September from 43% to 40.5%, continuing a gradual easing cycle.

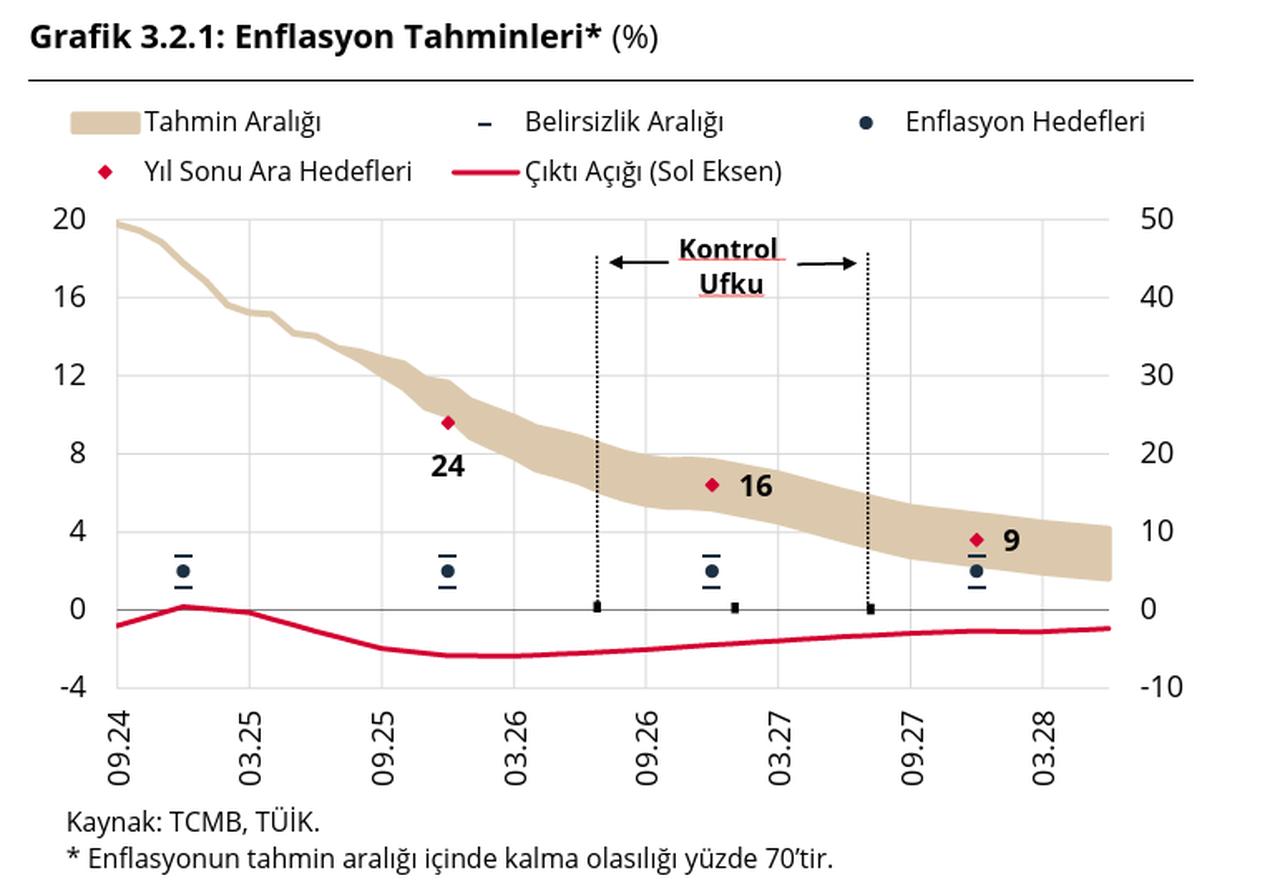

Citi argued that while growth prospects have weakened and unemployment has risen, the shift in inflation expectations away from the central bank’s interim goal of 24%—with a 70% probability of year-end inflation between 25% and 29%—provides the rationale for further cuts.

The bank’s next move, Citi economists suggested, will depend heavily on developments in international reserves—which hit a record high of $183 billion in the week ending September 26—capital flows, which amounted to $574.5 million into Turkish assets during the same period, and the degree of dollarization in the economy.

Dollarization refers to the tendency of individuals and businesses to hold savings in foreign currencies such as the U.S. dollar rather than in the Turkish lira, a trend that complicates monetary policy decisions and reduces the effectiveness of interest rate changes. In the week ending September 26, Turkish lira deposits in banks rose by 1.6% to ₺14.45 trillion ($346.60 billion), while foreign currency deposits increased by 0.6% to $203.95 billion.

The overall risk balance is tilted upward, meaning inflation could close the year higher than their forecast if food and energy prices continue to rise or if the currency comes under pressure, the economists added. They concluded that Türkiye’s central bank faces a difficult balance between sustaining economic activity and stabilizing prices, a challenge that will dominate policy debates in the months ahead.

The Turkish central bank’s next Monetary Policy Committee (MPC) meeting is scheduled for Oct. 23.