Turkish companies have raised ₺33.85 billion ($834.5 million) through 24 paid capital increases as of July 2025, surpassing the entire 2024 total of ₺30.54 billion ($752.6 million), according to the Capital Markets Board of Türkiye (CMB).

In dollar terms, this year’s amount has already exceeded $1 billion, compared to $918.4 million last year.

The sharp increase followed the domestic and global market downturn in March and April, triggered by a corruption probe targeting then-Istanbul Mayor Ekrem Imamoglu and the announcement of global tariffs by U.S. President Donald Trump.

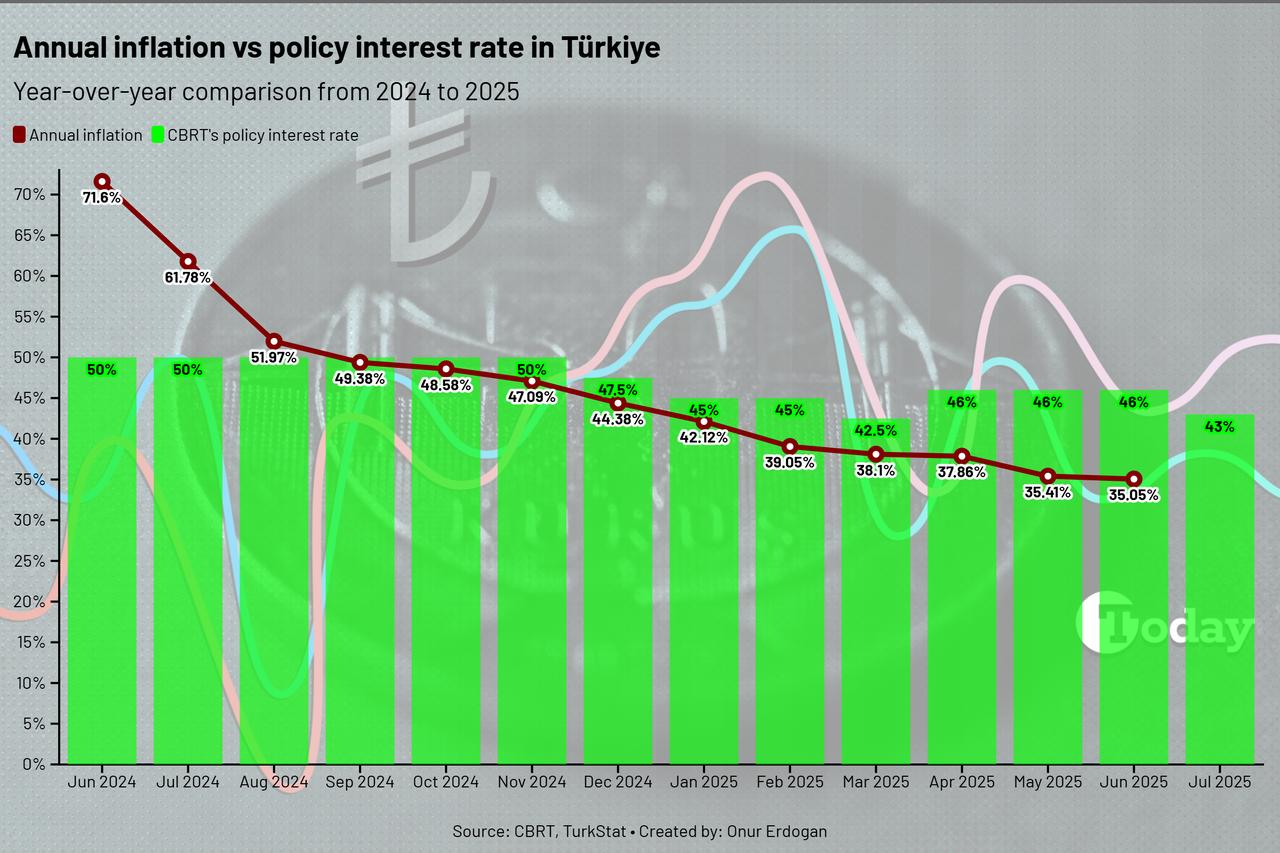

In response to the shock, the Turkish central bank suspended one-week repo auctions for a month and raised interest rates by 350 basis points to 46%, tightening liquidity conditions in an effort to stabilize the market. These developments prompted many firms to turn to equity markets to secure funding.

According to the data compiled by business-focused ekonomim.com, only three companies had completed paid capital increases by the end of March: Guler Yatirim Holding (₺240 million / $5.91 million), Türkiye Development and Investment Bank (₺4.5 billion / $110.9 million), and Bantash Bandirma (₺120.9 million / $2.98 million). However, 21 additional firms executed paid capital hikes in the months that followed.

Major transactions predominantly involve Türkiye’s largest sports clubs, including Besiktas with ₺4.8 billion ($118.3 million) in April, Fenerbahce with ₺1 billion ($24.7 million) in June, and Galatasaray with ₺8.1 billion ($199.6 million) in July. Dardanel, a seafood company, also raised ₺1.76 billion ($43.4 million) in May.

According to company statements disclosed on Türkiye’s Public Disclosure Platform (KAP), the overwhelming majority of capital raised has been used to repay existing debt. Several firms also cited operational financing needs, particularly to cover bank liabilities.

Twelve more companies have applied to the CMB for approval to launch paid-in capital increases, suggesting the trend is likely to continue.

Alongside paid-in capital hikes, many firms implemented bonus issues—capital increases funded from retained earnings. Some bonus increases reached nearly 600%, allowing companies to strengthen their equity base without new cash inflows.